There's no shortage of activity in the European VC landscape so close to summer break. In the space of a week, German entrepreneur Felix Petersen joined Faber Ventures as a partner, Berlin-based Point Nine Capital announced its new €55 million fund, and Harry Briggs revealed that he was leaving Balderton Capital to kickstart the £200 million Business Growth Fund in London.

And the news just keeps on coming. After roughly fifteen years at Advent Ventures Partners, France-born tech investor Frédéric Court is today announcing the next step in his (impressive) career.

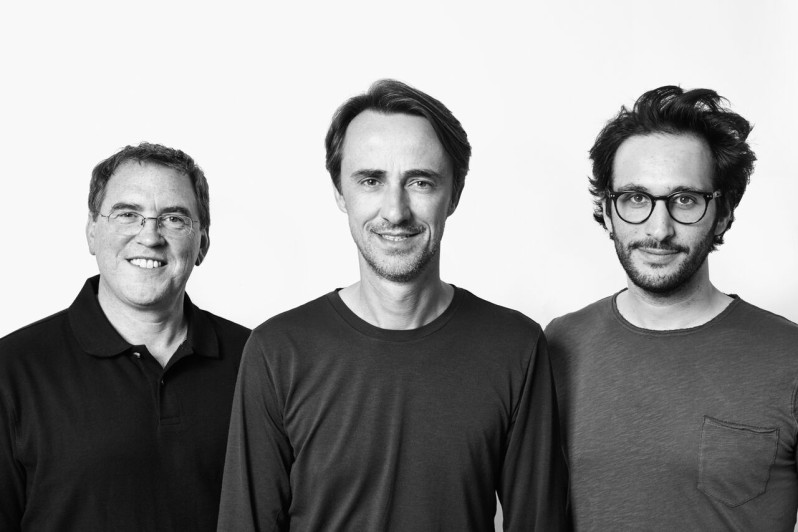

Court is launching Felix Capital, a new London-based venture capital firm that he says "operates at the intersection of technology and creativity". The fund's size is $120 million and is said to have been oversubscribed and closed in just months.

**Also read:** European private equity investment ballooned 14% to €41.5 billion in 2014: EVCA report

Frédéric Court has built up a track record in investing, particularly in companies like Farfetch, the online fashion marketplace currently valued at $1 billion, Dailymotion, Zong (sold to eBay for $240 million) and Vitrue (sold to Oracle), among others.

He's not striking out on his own, of course. Felix Capital's founding team includes Les Gabb (who worked with Court at Advent ) and Antoine Nussenbaum (previously AtlasGlobal and ABN Amro).

Court tells the Financial Times, which broke the news (actually the embargo), that he wants to invest in things like fashion, luxury and beauty, as well as content and music. From the press release:

_"Our conviction is that the Creative Class is a major driver of progress and change. The inevitable shift to more connected, digital lifestyles, favours new, disruptive and entrepreneur-led brands and services, especially in areas where Europe has a creative edge and global appeal._

_Our vision is to build a venture firm for this Creative Class, at the intersection of technology and creativity, in large markets such as digital commerce, digital media and connected life._

_Our mission is to be a partner of choice for entrepreneurs with big ideas, and help them build strong brands that stand out and move the world forward. We are building an entrepreneur-centric firm; everything we do is with them in mind."_

This is the first time I've personally heard a venture capital firm say they are entrepreneur-centric.

Just kidding, they all say that.

Either way, Felix Capital says it can theoretically invest anything from $100,000 to $10 million into rounds, but that its 'sweet spot' is $2-5 million.

Court says the firm initially set out to raise $80 million, but ultimately closed 50% higher at the fund's 'hard cap' of $120 million, with mostly European and US institutional investors chipping in. The backers include the typical LPs, such as pension funds, endowments, foundations, fund of funds, some family offices, and in this case also a couple of groups with large retail assets.

**Also read:**

- Chrys Chrysanthou departs Accel for Notion Capital after only a year

- Are Europe’s newest VCs its most promising?

- Google sets up European VC arm with initial $100 million fund

Would you like to write the first comment?

Login to post comments