Q3 2017 was a more or less average quarter for M&A transactions and IPOs in Europe, Israel, and Turkey.

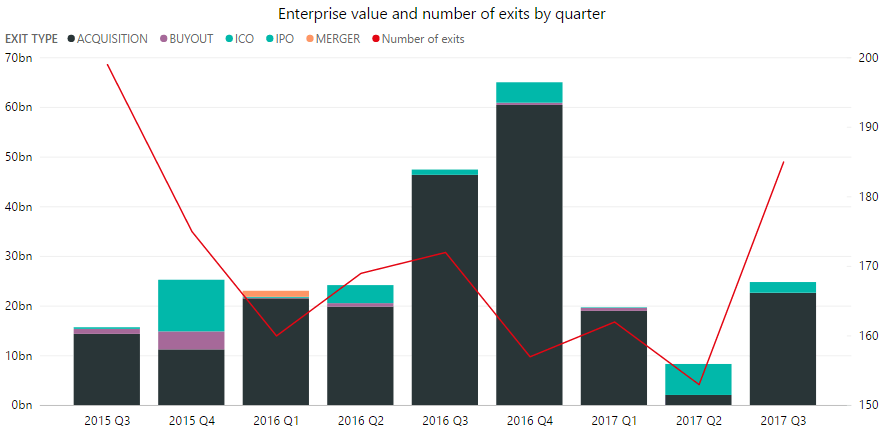

Though there were more deals than in most previous quarters, total exit volume decreased compared to standout quarters in Q3 2016 and Q4 2016, which had €47 billion and €65 billion in recorded transaction volume respectively, to just €25 billion in Q3 2017 - a 47% YoY decrease.

Last year’s exceptional Q3 was due to a €29 billion takeover of UK-based semiconductor and software company ARM by Softbank, while Q4 2016 saw a record acquisition of Dutch NXP Semiconductors by Qualcomm for $47 billion.

However, exit volume rose 200% QoQ from only €8.3 billion in Q2 2017 - €6.2 billion of which came from 19 IPOs. In contrast, there were only 4 IPOs tracked in Q3 2017, worth €2.15 billion. In Q3 2017 tech.eu also tracked 168 acquisitions and 7 mergers, for a total of 179 exits, up from 172 exit deals in Q3 2016, and just 154 in Q2 2017.

For what it’s worth, we also tracked 6 ICOs.

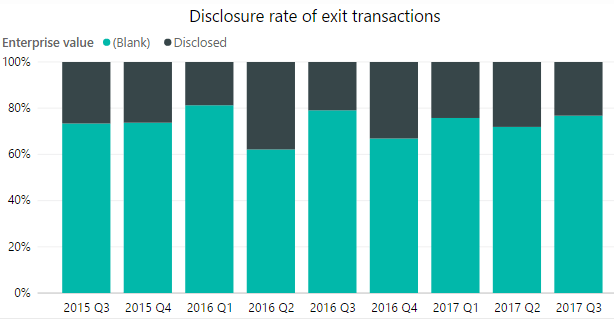

Of course, total exit volume for European transactions is always difficult to measure conclusively, as enterprise value is only disclosed in a fraction of acquisitions. The value of most deals remains undisclosed, with disclosure rates fluctuating between 19% and 38% in recent quarters. Enterprise value was only disclosed in 24% of deals - 43 out of 179 - in Q3 2017.

Top exits in Q3 2017 were for UK payments company WorldPay, which was acquired by the US company Vantiv for €9.5 billion, while German internet services company United Internet purchased the German telecom company Drillisch for €8.5 billion. Swedish fintech startup Bambora was bought by the French payments specialist Ingenico for €1.5 billion, and UK fashion retailer Matches Fashion was sold to US-based Apax Partners for €900 million. Polish Play, the country’s second largest mobile phone company, listed on the Warsaw stock exchange for €1.3 billion, and Finnish game developer Rovio Entertainment, creator of Angry Birds, finally went public in September, in a much anticipated IPO valuing the company at $1 billion.

Top exits in Q3 2017 were for UK payments company WorldPay, which was acquired by the US company Vantiv for €9.5 billion, while German internet services company United Internet purchased the German telecom company Drillisch for €8.5 billion. Swedish fintech startup Bambora was bought by the French payments specialist Ingenico for €1.5 billion, and UK fashion retailer Matches Fashion was sold to US-based Apax Partners for €900 million. Polish Play, the country’s second largest mobile phone company, listed on the Warsaw stock exchange for €1.3 billion, and Finnish game developer Rovio Entertainment, creator of Angry Birds, finally went public in September, in a much anticipated IPO valuing the company at $1 billion.

"We are extremely happy and proud of the great interest towards Rovio's IPO, both by Finnish and international investors,” said CEO Kati Levoranta.

“Rovio is a global games-first entertainment company that is today bigger and stronger than ever. The mobile gaming market is expected to grow fast and we are well positioned to take an advantage of this growth. The listing is an important step in developing Rovio into an even stronger games-first entertainment company."

Germany had a record breaking 41 exit deals in Q3, a 78% YoY increase, while the UK saw a decline with just 23 exits, compared to 37 in Q3 2016. Sweden also had 23 exits (a decline from Q1 and Q2 2017), Israel had 16, and France had 11 exit deals in Q3 2017.

The US continued to play a major role in acquiring European companies. There were 35 M&A transactions involving US-based companies this quarter, equal to the same period last year. The disclosed transactions by US-based companies were worth a total of €11 billion, compared to just €5.3 billion in Q3 2016, and €1.8 billion in Q2 2017. Following the US, German companies made the most acquisitions of European tech startups, 30, in Q3 2017 - 21 of which were acquisitions of other German companies.

To sum up, here is an overview of exit activity for European tech startups in Q3 2017:

- European and Israeli tech exit volume had an average quarter - down 47% YoY, but up 200% QoQ, with €25 billion tracked in disclosed deals.

- There were more exit transactions in Q3 2017 than in any quarter since Q3 2015, with 179, and an additional 6 ICOs.

- German companies saw the most exits, with 41, more than any other quarter on record. The UK and Sweden each had 23 exits in Q3 2017.

- The US was the most active acquirer of European tech startups, involved in 35 M&A transactions, with a disclosed transaction volume of €11 billion - a 108% YoY increase.

You can read our analysis of European tech funding deals for Q3 2017 here, and for more in-depth analysis, take a look at tech.eu’s selection of reports focusing on the European and Israeli tech startup scene. Become a tech.eu Insider for more data and analysis.

Would you like to write the first comment?

Login to post comments