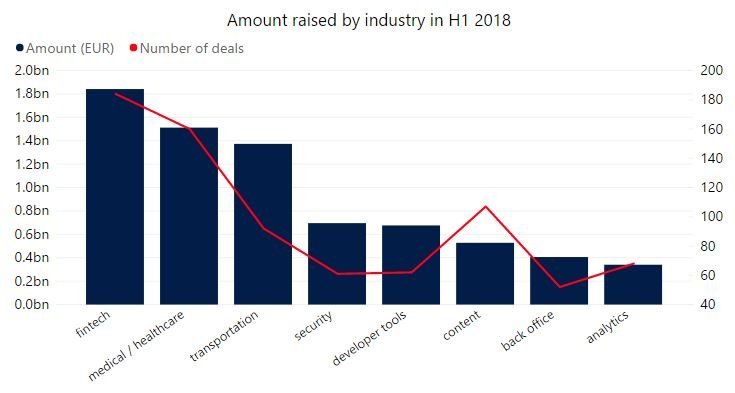

Fintech and medtech have long been the top verticals for European tech funding, attracting the most rounds and the largest ones. As finance and medicine are both industries with constant demand and innovation, it comes as no surprise that tech entrepreneurs keep bringing new solutions to the market, and that startups in these categories are attracting more investment every year.

One shift we’ve seen in 2018 is for the transportation vertical, a growing industry for tech investment, ranking third after fintech and medtech. Transportation has raised large sums in recent years, with big rounds for startups like ride-sharing apps and online car marketplaces.

Though food and fashion were strong verticals in 2016 and 2017, they’ve seen no major deals so far in 2018. Instead, security and developer tools have taken their place among the top five industries, with clear growth in the cybersecurity market

Fintech raised €1.8 billion in the first half of 2018 - the same as in H1 2017 - with several mega-rounds. The largest rounds in fintech for 2018 have been for the UK-based banking app Revolut, which raised €215 million, followed by the digital mortgage specialist Atom Bank with €167 million, and Berlin-based mobile bank N26, raising €146 million. UK-based eToro, a social trading and investment platform, and Starling Bank also raised €91,000 each.

As with fintech startups, many of the most successful medtech startups are based in the UK. The vertical has seen 160 deals so far this year, though less mega-rounds than fintech. Medtech startups have raised €1.5 billion in the first two quarters of 2018. Leading rounds were for Oxford Nanopore Technologies, which raised €112 million, and BenevolentAI, which raised €98 million. Oxford Nanopore develops micro-electronic systems for analysing molecules, and BenevolentAI uses artificial intelligence to facilitate drug development. The UK’s CMR Surgical, which develops robotic systems for surgery, also raised €83.5 million.

Transportation has raised an impressive €1.4 billion so far this year, rivalling medtech, and more than twice what was raised in H1 2017. While the UK dominates in fintech and medtech, we see transportation scale-ups appearing all over the map. The German used car marketplace Auto1 Group has seen the largest deal so far this year, raising €460 million from Softbank. Taxi apps including Estonia’s Taxify and Spain’s Cabify each raised rounds of about €150 million, and Israel’s Gett raised €70 million.

Aside from the mega-rounds of ride-hailing platforms, urban mobility startups are growing in popularity. Israeli Moovit, a transit app that allows trip planning with schedules and maps, raised $50 million, and French electric scooter rental platform CityScoot has raised €40 million so far in 2018.

While cybersecurity startups may not rival fintech in round size, in 2018 we’re seeing them take a bigger piece of the pie. Security startups have raised €700 million in H1 2018, doubling from €350 million in H1 2017. The main deal was for Paris-based Ledger, which provides security solutions for cryptocurrencies and blockchain apps, and raised $75 million.

Portuguese OutSystems led in the vertical of developer tools with a $360 million round for its low code platform for app development. In the content vertical, London’s Culture Trip raised $80 million, for its platform with exclusive cultural articles for world travellers.

Overall, 2018 has seen a boost in funding for transportation, which is now the third strongest industry next to fintech and medtech, which continue to see the most deals and attract the most investment. In previous years, food, fashion, and music have been among the top five industries, attracting large deals for successful startups in European tech, but they have disappeared from the stage in 2018, with none of these verticals even making the top ten in terms of funding. Instead, investment in cybersecurity has been rising consistently along with the global increase in data breaches and cyber threats to organisations. Investment in verticals that produce business development software, such as back office and analytics, are also growing, taking the place of consumibles like food, fashion, and music, which have perhaps already had their heyday.

![Report: Cabify holds acquisition talks with Lyft, looking for up to $3 billion [UPDATED]](https://cdn.tech.eu/uploads/assets/techeu-lazy-load.jpeg)

Would you like to write the first comment?

Login to post comments