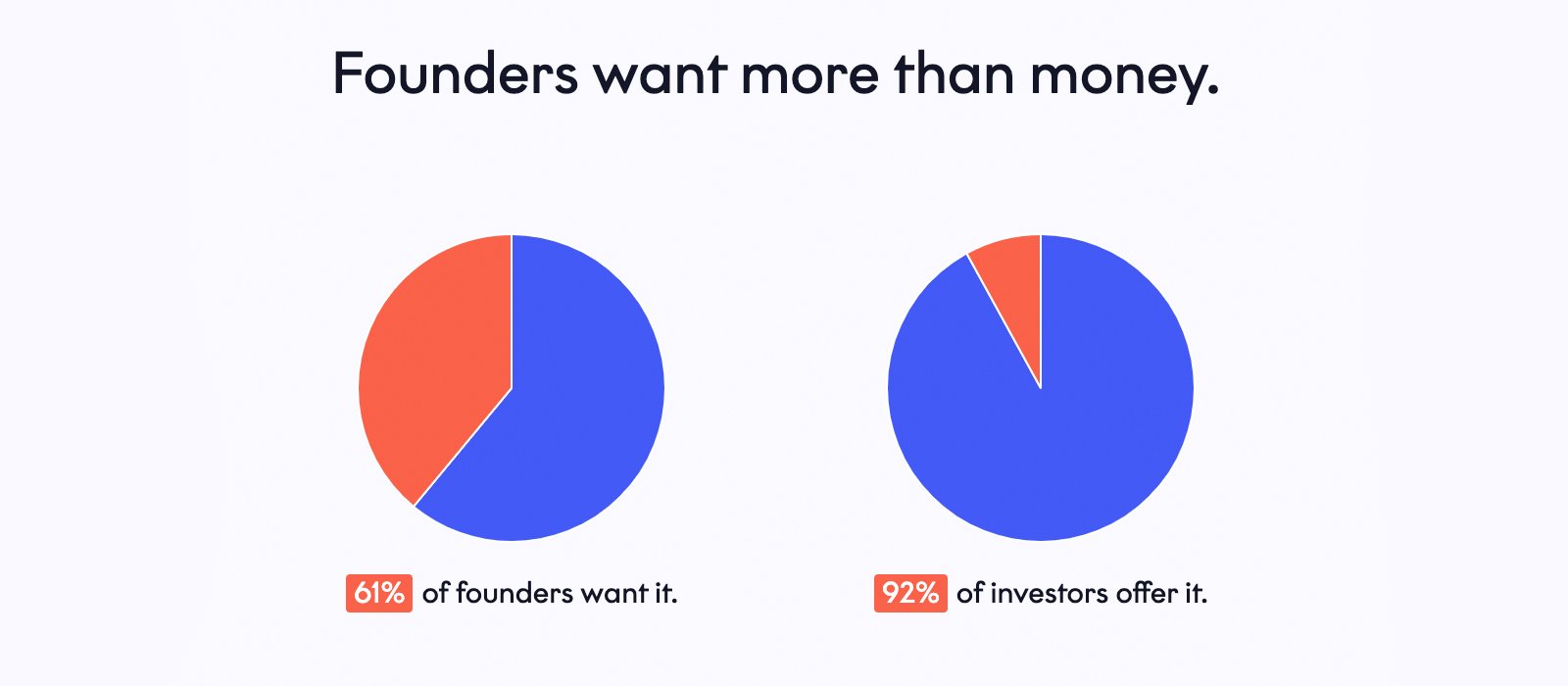

A new report published by Forward Partners and Landscape VC reveals that almost half (47%) of all founders consider value-add more important than a VC firm's brand and portfolio.

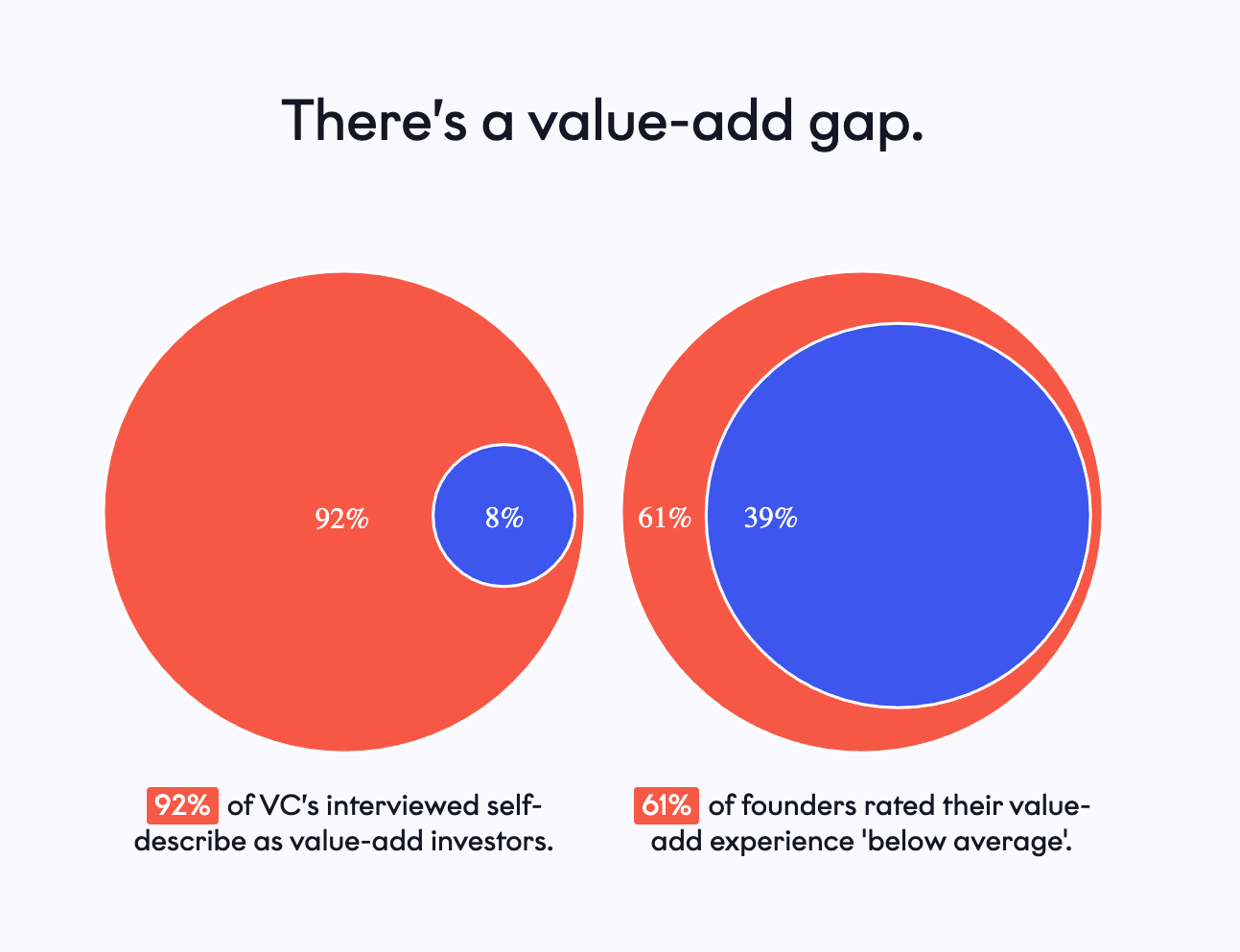

Of the 500+ pre-seed, seed, and series A founders surveyed across Europe, 65% of them gave the guidance and assistance provided by VC’s as “low value-add” and said they “tried, but failed” to provide any value beyond the capital, despite most firms promising to do so.

“Capital can almost be considered a secondary value if you get the right investors onboard and aligned with what you are trying to achieve, because the value they can add will be way beyond what you can do with capital alone,” says Jamie Akhtar of CyberSmart co-founder and CEO.

Revealing a huge gap in the venture capital world, 92% of VC firms surveyed, including Octopus Ventures, Blossom Capital, Local Globe and Kindred Capital claim to provide a value-add beyond the money they put up.

So what does provide value-add exactly? According to the report, 33% of founders point to access to an investor’s connections and network, and 30% saying that fundraising support contributed to the success of the business.

When broken down in B2C and B2B terms, 64% of B2C founders reported mentoring and emotional support as a significant factor in contributing to business success, whereas just 36% of B2B founders reporting the same.

“In our work with founders the issue of finding the right investor comes up every single time: What does a good one look like? How to win them? What can we expect beyond the money?” comments Head of Google Startups UK Marta Kripinska. “If three in five founders feel they’re not getting the right value from their investors, it means three in five startups could go further and faster; it means three in five investors could be doing a better job and getting better returns.”

The entire Forward Partners and Landscape VC report, including their 6 recommendations to improving the ecosystem can be viewed at forwardpartners.com/more-than-money/.

Would you like to write the first comment?

Login to post comments