Here's the bad news: there's new research that investigates the role gender plays in a startup founder's ability to raise private capital in Europe, and it turns out that if you're a woman, your chances of raising cash are extremely low.

The good news is ... actually there is no good news, it's all pretty terrible.

NGP Capital, the Finland-born global VC firm, is today releasing a new depressing report on the abysmal state of gender parity in the European tech startup and investment community.

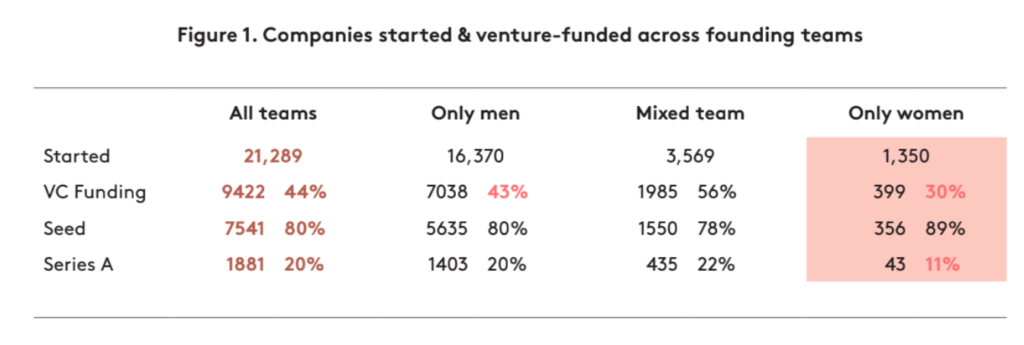

What the investment firm did was dive into data gleaned from Q, NGP Capital’s custom-built AI platform for startup and market discovery, to look at the raw numbers. All in all, NGP Capital selected an initial 21,289 companies, and then looked at 9,422 companies that raised venture capital from 2014 and 2019 to see how many of their founders were women.

NGP Capital teamed up with Catarina Cawén, a young researcher in Helsinki, to study the correlation between the gender of entrepreneurs and the probability that they will raise venture capital in Europe.

The results of the research are as unsurprising as they are frustrating (if you care about inclusion and diversity): 93% of the €3.2 billion of VC invested in the Nordic countries in 2019 went to male-only founding teams, 6% to mixed-gender teams, and only 1% to founding teams made up entirely of women.

These are statistics we've seen and lamented about before, but it's also important to note that - particularly 'thanks' to the coronavirus pandemic - the numbers are not getting any better. In fact, they're getting worse (NGP Capital will likely update the research in the coming months to include 2020, but don't hold your breath on progress).

So let's talk about the perceived 'supply issue' often brought up by critics. Women do tend to start fewer companies than men. But look at the chart below.

It shows the total number of European companies started between 2014 and 2018, and how many of them were allocated venture capital between 2015 and 2019, both in absolute terms and as a relative percentage within each founding team type.

44% of the startups in the sample of 21,289 received VC financing, and 20% made it to the 'early-growth stage' (Series A). But only 11% of female-only teams were granted venture capital during the early-growth stage, and of all the companies started by women in Europe, only 30% raised venture capital.

Of all the companies started by male-only teams, meanwhile, 43% secured VC funding. The mixed founding teams actually raised the most venture capital relatively, with 56% of all companies started by mixed-gender teams raising VC.

What the research also offers, to my knowledge for the first time, was insights on other areas such as the differences in European venture capital distribution by gender among industries, and the differences based on founder background factors, such as whether the entrepreneur had founded a company before or had a university degree.

Let's look at sectors first.

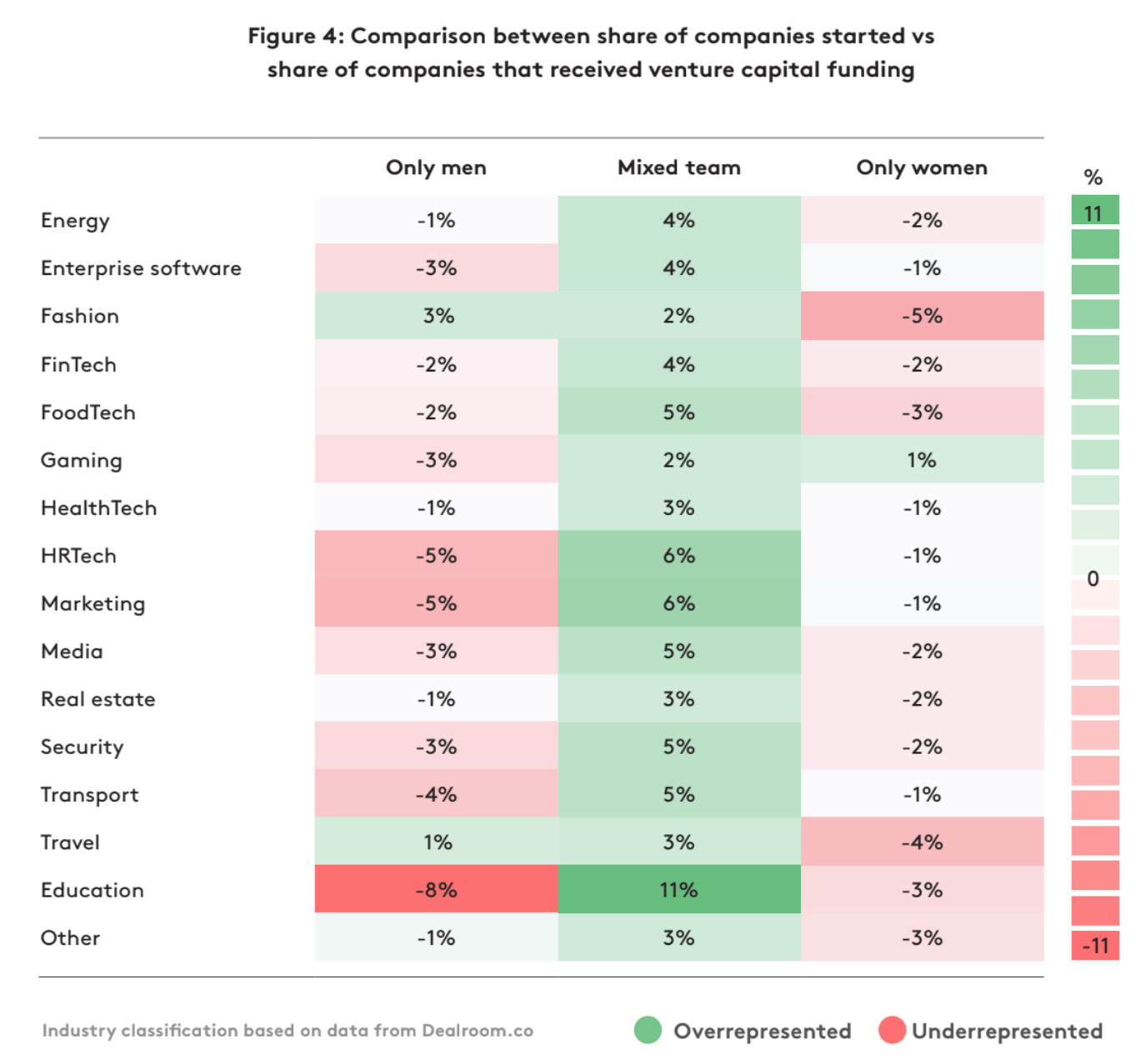

The chart below shows how VC financing has been distributed across different industries among the different types of founding teams. The percentages show the share of companies that raised VC funding, compared to the number of companies founded.

In Europe, the most companies were started in the fintech, healthtech, foodtech, enterprise software/SaaS, and marketing industries between 2014 and 2018.

The teams with only male entrepreneurs as well as those with mixed teams started more companies in the fintech (3,102) and healthtech (2,523) industries compared to other industries.

Female-only teams founded more companies in the healthtech (252) and foodtech (151) sectors than other areas. Female entrepreneurs were also comparatively more active in industries such as fashion, media, and education compared to male entrepreneurs, while male entrepreneurs were more active in industries such as enterprise software, transport and energy.

All-women teams received the lowest number of financing rounds in the fintech, security and travel sectors.

One key finding shown of the research is that mixed-gender teams raised the most capital in all industries except the gaming sector, which was the only sector where female-only teams were funded more often than male-only or mixed founding teams.

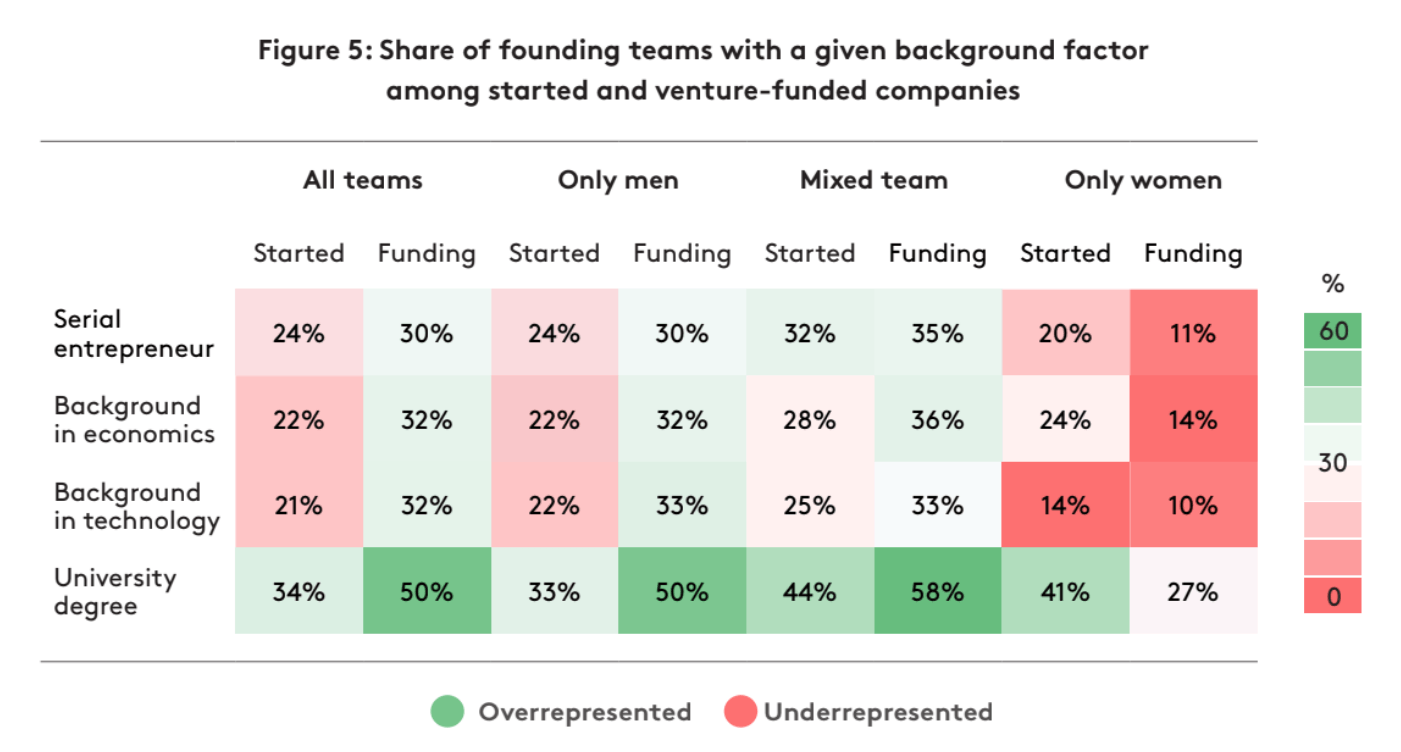

Background factors also affect the ability to raise VC, but gender seems to play an outsized role, as you can see in the chart below. It shows how venture capital is distributed based on background factors such as whether the entrepreneurs have founded a company before, have a background in economics or in technology, or have a university degree.

While only 34% of entrepreneurs who founded startups had university degrees, 50% of the entrepreneurs who raised venture capital had degrees. The same disparity holds true for other background factors.

However, the chart also shows that the gender of the founding teams plays an even more important role. 50% or more of both male-only and mixed-gender teams who received VC financing had university degrees. In contrast, less than 30% of female entrepreneurs who were granted venture capital had degrees.

This pattern is consistent across all of the other background factors as well. Apparently, these background factors do not have the same positive effect for female founders as they do for male-only and mixed founding teams.

I'll leave you with this: according to this research, based on a regression model, among all founders and all other factors being equal, being of the female gender alone reduced the probability of a founder being allocated venture capital by 17%.

Let that sink in. Of all the things that I think need fixing in the European startup and venture community, this one should be front and centre. Change my mind.

Last week, we recorded an interview with NGP Capital's Annika Sjöberg and Bo Ilsoe, and we'll run it asap to keep the conversation about this going - subscribe to our podcast to stay updated.

Update: the podcast interview is now live.

Featured image credit: Christina @ wocintechchat.com / Unsplash

Would you like to write the first comment?

Login to post comments