Just three months since the first announcement of their Series A raise at $21.5 million, the seemingly darling banking platform for e-commerce players, Juni has more than doubled the first portion of the raise to a hefty $73 million. This powerful pocket of pesos will be used up the headcount to over 120 and launch a fully integrated credit line product. In its seven months of operations, Juni has raked in a total of $76 million.

Like a number of other fintech players on the market today, Juni integrates with a wide range of banks and major payment providers and automates a number of routine functions, freeing up entrepreneurs’ time to focus on growing their business instead of managing ad spend and invoices. However, this author is hard-pressed to find another player in this field that’s received this amount of investment in so little an amount of time. Clearly, something is working quite well at the Juni HQ.

Between March and May of this year, Juni saw a total transaction volume increase of nearly 500% month-on-month, with a weekly average growth rate of 81%.

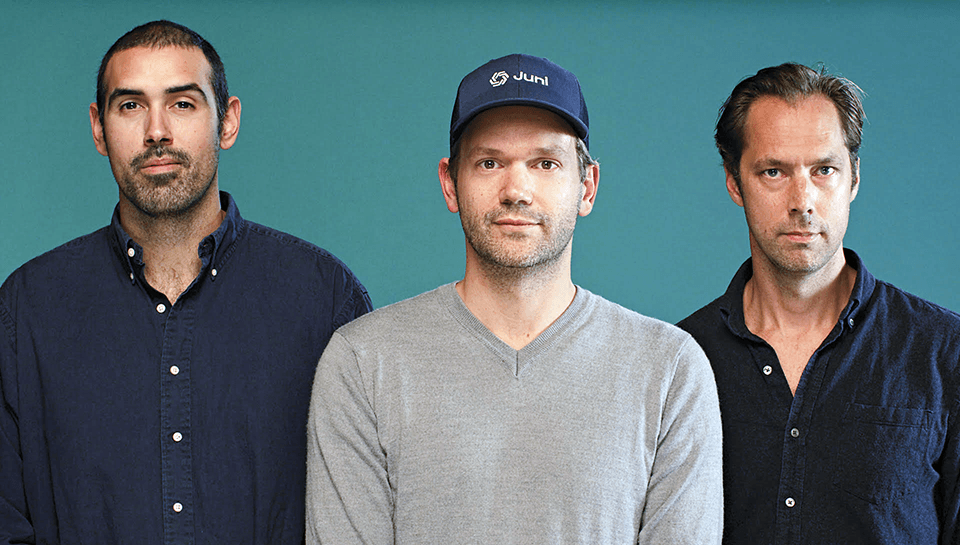

“We’re internet entrepreneurs too, after all, and before launching Juni, we were in the industry that we cater to today,” commented founder and CEO Samir El-Sabini. “We understand their pain points and business needs in a way that traditional banking can’t, which in turn means we’re able to offer them a credit product that actually makes sense for them.”

In the extension round, power player EQT Ventures didn’t want to miss out and stepped up to the plate with $52 million and joins existing investors Partners of DST Global, Felix Capital, and Cherry Ventures.

On the decision to got big on Juni, EQT Ventures Ted Persson comments, “Juni is the fastest-growing fintech we’ve ever seen, by a long stretch. The company has hit an impressive average weekly growth rate of 80% in just five months, and we're hearing great things from digitally native entrepreneurs. The fact that we've known Samir for a long time, and rate him highly made the investment decision easy. We’re excited to help Juni bring a new kind of credit product to the market, disrupting banking platforms for businesses even further.”

Would you like to write the first comment?

Login to post comments