Just in time, there's some excellent fresh reading material for the Christmas holidays to complement Atomico's recent 'State of European Tech' report: rival investment firm Lakestar - with a little help from its McKinsey friends - today published a new report highlighting what it deems the 'European Financing Gap'.

Lakestar, which made early investments bets on the likes of Airbnb, Spotify, Facebook, Revolut and Glovo, intends the use the first edition of its financing gap report to highlight the challenges Europe faces when it comes to properly funding growth companies, which in turn risks giving away its 'sovereignty' in crucial fields of innovation such as energy, mobility, fintech and biotech.

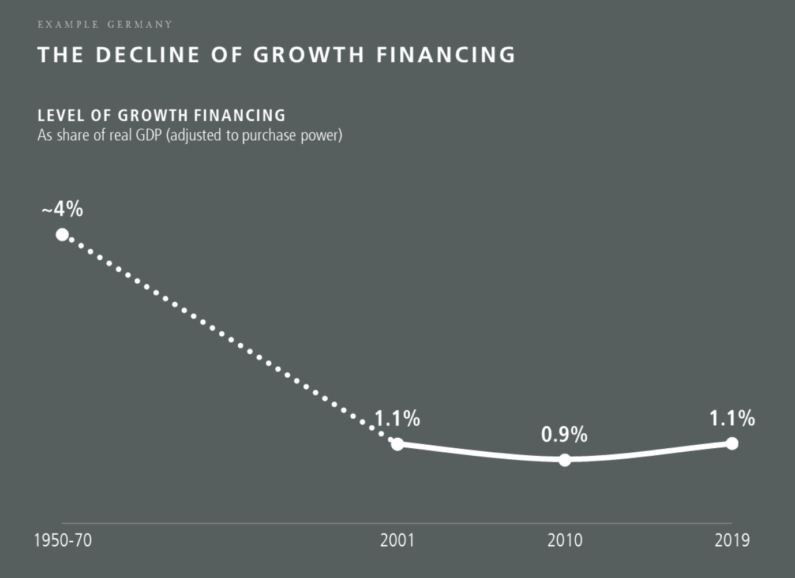

In a report zooming in on the situation in Germany, specifically, which is available for free here, Lakestar says that growth financing as a share of GDP has dropped significantly compared to the 1950s-1970s, when a lot of the country's subsequent drivers of economic growth and innovation were born.

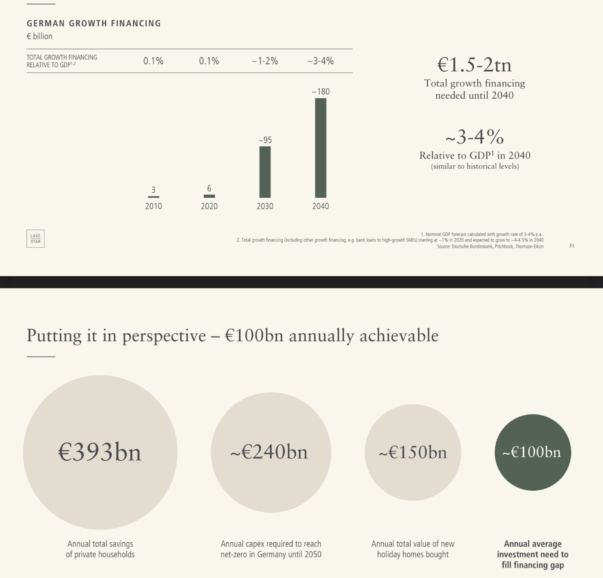

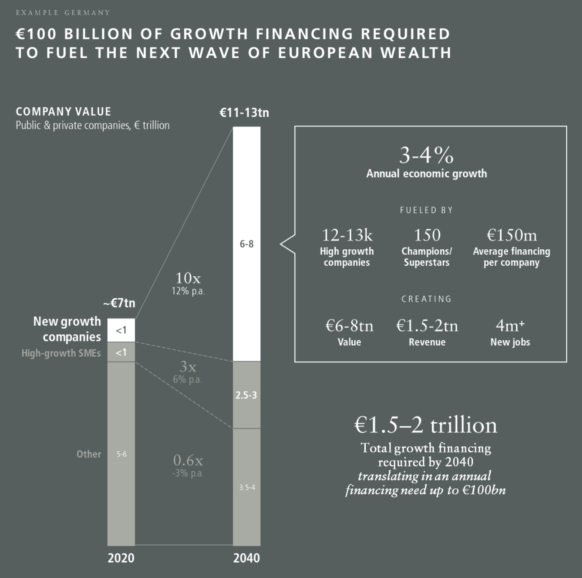

Making Germany into an example even more, the report says the country will grapple with a growth financing deficit of no less than €2 trillion by 2040, requiring an annual financing need of up to €100 billion every year.

Lakestar further claims up to 13.000 high-growth companies are needed by 2040 in order to fuel the next wave of European growth, requiring an average funding of €150 million apiece.

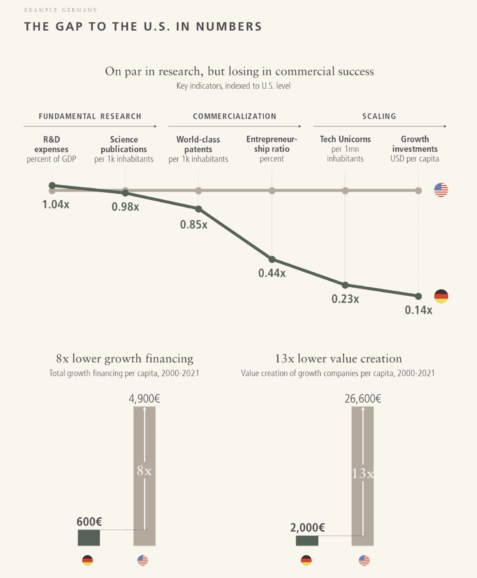

And, of course, it wouldn't be much of a report in Europe without putting it in comparison to the United States:

But a really nice report to peruse, and again, you can download the whole thing free of charge at the bottom of this dedicated website, which summarises the main findings for those with less time on their hands (and features a video with Lakestar founder and CEO Klaus Hommels).

Happy holidays!

Would you like to write the first comment?

Login to post comments