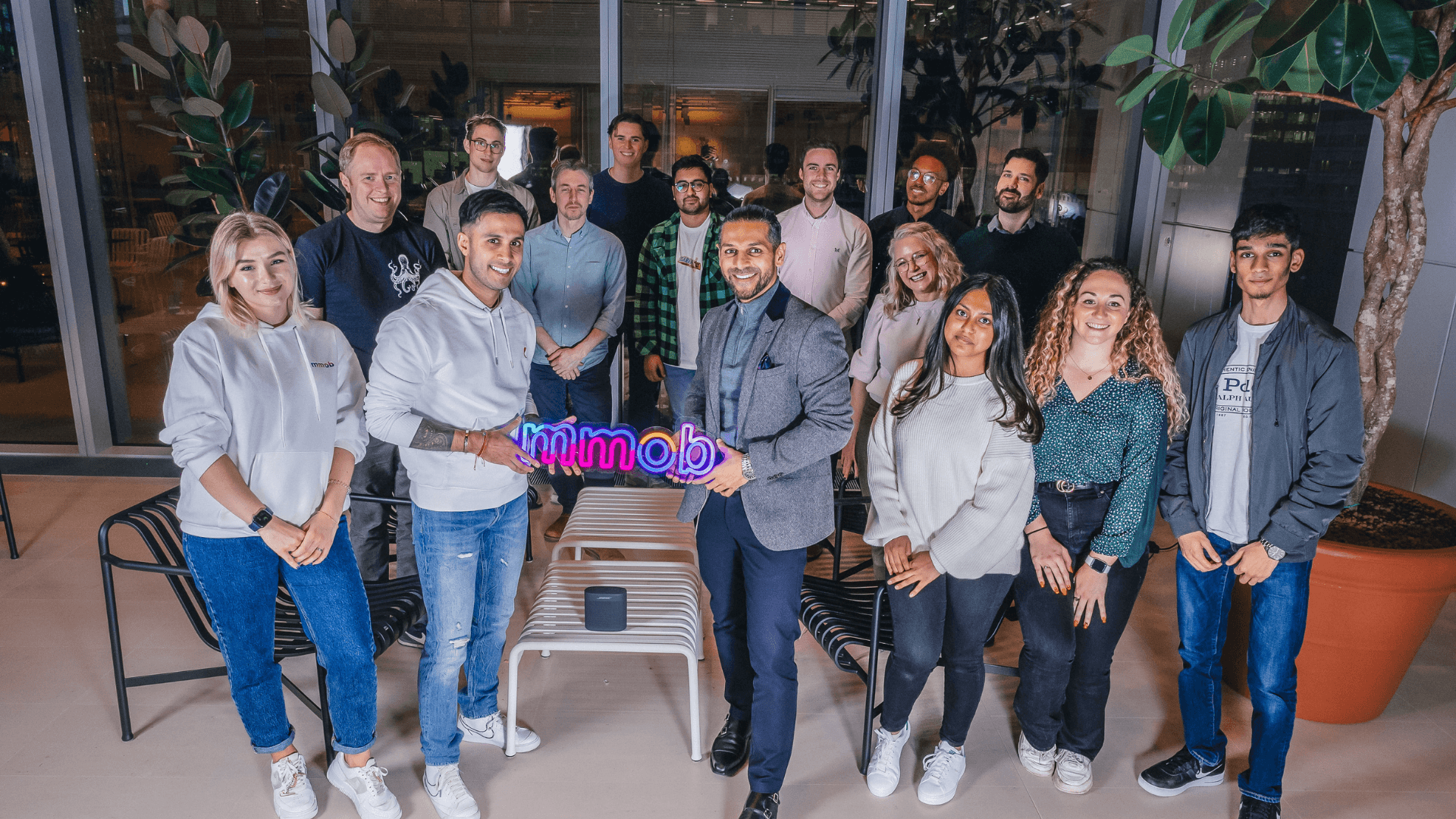

UK-based embedded finance network mmob has raised £5 million funding. The seed round was raised from a group of angel investors, including high net worth individuals and senior banking executives. The fintech company will use the investment to advance the development of its technology platform, enter new markets, including Malaysia, and improve its positioning within embedded finance.

Founded in 2020 by Irfan Khan, the startup is on a mission to deliver the onward journey of embedded finance, for both financial and non-financial brands. It is empowering consumer-facing fintechs to supercharge their growth through the rapid integration and delivery of relevant products and services that meet their customers’ financial needs.

Irfan Khan, founder and CEO, mmob said: “Due to advances in technology and the wealth of data available, brands can responsibly respond to consumer demand and offer personalised options and attractive pricing for financial services. However, ease of integration between providers is key to fuelling the sector’s growth. This funding will enable us to further expand our operations in the U.K. and Malaysia.”

The embedded financial services company is currently working with PensionBee, iwoca, Cuckoo, Superscript, So-Sure, Anorak, and Uinsure.

Would you like to write the first comment?

Login to post comments