As a Ukrainian living in the UK, I am inspired by the support demonstrated by the British people. As a VC I cannot say quite the same about my industry.

The prevailing attitude is the one where Ukrainian startups are admired for their tenacity but dismissed out of hand as a credible investment opportunity. The reflexive reaction of most VCs to the subject of Ukraine is to write a cheque to a charity, and not to a Ukrainian founder.

Biases in the investment industry are nothing new, but this one is particularly harmful at this critical time. A forever optimist, I’m hopeful that this bias is simply the result of some common misconceptions when it comes to Ukrainian startup investments and nothing more.

If you’ll indulge me, I’d like to dispel some of these falsehoods.

Close to home

At Blue Lake, our familiarity with the subject matter is not merely an academic one. Starting our life as a British – Ukrainian early-stage accelerator in 2019, we were based in Kyiv, supporting Ukrainian startups with both capital and intangible guidance and support. The outbreak of COVID forced a return to London, but we continued to support the Ukrainian ecosystem, if at a geographic distance.

VC And Ukrainian Startups

As some of you know, as a VC you get to pitch to investors almost as often as startups do. I honestly can no longer count how many of my investor presentations have included promotion and advocacy of and for the Ukrainian ecosystem and its startups. In the vast majority of cases I would be met with an eyes glazed over, if not dismissive look as soon as I would bring up the subject*.

*(Notable exceptions are some of the European accelerators who are very welcoming of teams from Ukraine)

Some of the most common Ukraine specific objections (outside of the usual VC reasons for rejecting a startup) included:

- Corruption

- Weak legal system

- Small local market

- War (as a reminder: started in 2014 with Crimea)

These ‘reasons’ mostly demonstrate a lack of understanding of the ecosystem. Why am I so confident about this? Because once the thin layer of this underinformed thinking is removed, the UK and indeed the world is hard-pressed to find anything more or less “wrong” with Ukraine’s tech ecosystem than any other in the world.

IT Outsourcing

Ukraine’s IT firms are trusted with the development and maintenance of some of the most complex and critical tech for Western startups and established firms alike. Looking only out my own window, I’m stumbling to think of an investment bank, food delivery service, blockchain, gaming, or any number of ancillary organisations or services that, when you dig deep enough, don’t have a direct or indirect connection to Lviv or Kyiv via Ukrainian dev teams delivering vital lines of code. Most probably, even at this very moment.

Later stage Investment

What’s more, later-stage investors love Ukrainian startups, seemingly ignoring any of the dangers that are supposedly awaiting them. A stable of Ukraine-founded unicorns (GitLab, Grammarly, People.AI, Bitfury) further cement the country’s status as an emerging tech superpower.

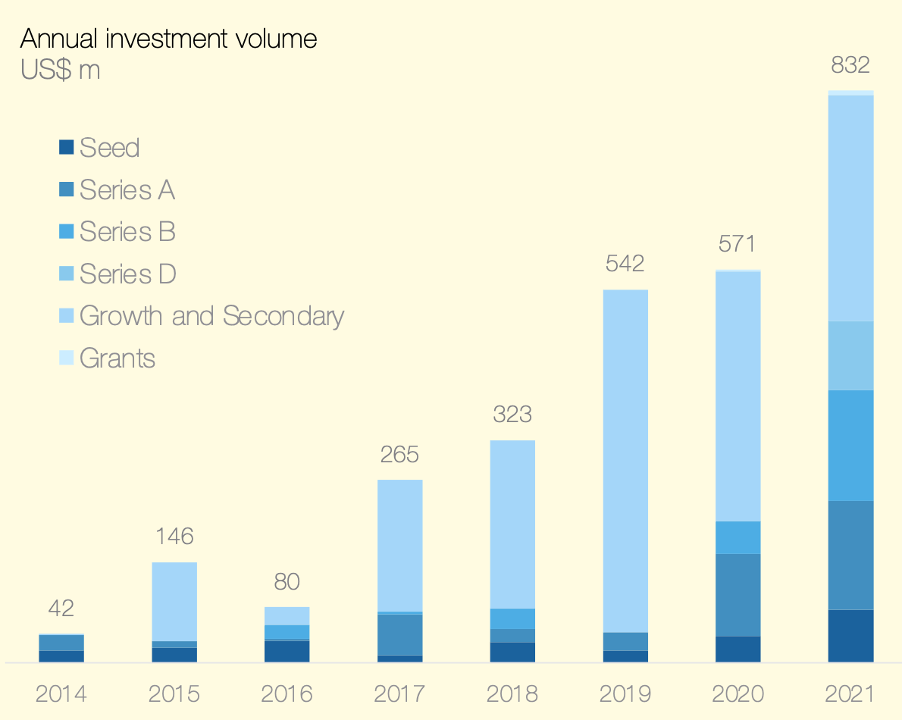

This success is reflected in the volumes of later-stage investments that have seen nothing but the hockey stick curve since 2016. Right in line with the rest of European funding trends, 2021 saw a record $832 million invested in Ukrainian startups.

What’s Going On?

At this point, you might think that I am arguing two opposing points in the same article. ‘Ukrainian startups are being ignored by VC’ and ‘Ukraine’s tech ecosystem has no problem attracting investments’.

High on talent, ambitions, and the ability to deliver top-notch tech products on international markets, Ukrainian entrepreneurs are digitally and legally speaking citizens of the world. Frequently overlooked when it comes to early investments, Ukrainian startups have to bootstrap, grow, and leave the country until they show up on the radar of the later-stage international VC community.

The increasing frequency and ticket sizes of later-stage investments, often dominated by international VCs, demonstrate a clear recognition of Ukraine's growth-stage startups. However, while this recognition is able to trickle down one layer, Ukraine’s early-stage scene is still lacking this level of acceptance.

This has to change. Now.

Could an argument be made that these early-stage startups present special risks and investors’ concerns are not unreasonable?

- Historically, Ukraine’s legal system hasn’t had the best of reputations (there have been some very significant developments just before the war).

- Сorruption is rife.

- The domestic market is small in almost every regard.

Now that we’ve put these common VC objections out on the table, let’s address them one by one.

Weak legal system and corruption

When it comes to legal registrations, 99.9% of Ukrainian startups neatly sidestep all of the issues that come along with it. The most popular jurisdictions are Poland, the US (Delaware), Estonia, and increasingly the UK. In doing so, Ukrainian startups significantly lower their risk from most of the legal, investment, and political gambles present in their home market.

Small local market

One of the striking differences between say UK-based and Ukraine-based startups is the treatment of their respective local markets. For many of the UK startups, their home market is their entire focus, at least for the short/medium term. In the case of Ukrainian startups, their home market is rarely more than a short-term focus, an alpha testing, that neatly provides a stepping stone toward large international markets.

Cultural aspects

The relative lack of early-stage investors in the Ukrainian space means that many founders can come across as unprepared and unpolished when it comes to raising funds to fuel their business. Be that as it may, this knowledge gap has been shrinking rapidly due to the wealth of increasingly available information, acceleration and education programmes available to Ukrainian founders. A fact that goes hand in hand with the maturation of the ecosystem.

War

When Russia invaded Ukraine on the 24th of February of this year, everything changed. For the country, for the ecosystem, and naturally, for the startups themselves.

There is no derisking of an artillery shell landing on top of you. I have met over 70 Ukrainian startups since the war started. While clearly being hit hard emotionally, the only founders who have suspended their work are those who have volunteered to defend their country. The others continue their work, some remaining in Ukraine, and others have left for the EU or the UK. If I had only one word to describe these individuals it would be this: determination.

The war has not destroyed the Ukrainian startup community. In many ways, this group was uniquely prepared to deal with these challenges long before they had to face them.

What does it all mean and what’s next?

The quick risk assessments, a heuristic that so many VCs pride themselves on being able to calculate with pinpoint accuracy, seems to go out the window when it comes to Ukrainian startups.

Are these startups risk-free? Can you name me one that is? Do these startups carry a unique set of risks? Yes, they do.

Hopefully, by sharing my thoughts and observations here today, VCs and angel investors can forego the low-hanging fruit, the “easy” win, and do their homework to understand what the real risks are and how they can be mitigated.

Investing in Ukrainian founders now is one of those rare and genuine opportunities the VC community so often speaks of: the chance to deliver impact, returns to LPs, and make a REAL difference in the world.

If that isn’t a win/win situation, I don’t know what is.

Would you like to write the first comment?

Login to post comments