The subject of ESG scoring hit the business headlines in late May, after Standard & Poor’s environmental, social and governance index (the S&P 500 ESG) dropped Tesla. The move provoked CEO Elon Musk's ire, who lashed out on Twitter saying, “ESG is a scam. It has been weaponized by phony social justice warriors."

Edouard Audi, the CEO and co-founder of SaaS company apiday, says that there is a lot of frustration around ESG, and one core misunderstanding is that it refers to the impact of your company on the world, rather, it looks at ESG risks to the company itself.

He directs us to his post explaining ESG in greater detail, entitled "Elon Musk thinks my startup is bullshit".

"People think ESG is, 'I'm building an electric car, I'm helping transition the world from petrol to a green future, so that's going to be a good ESG company.' Actually, ESG doesn't measure that, that’s sustainability," Audi told Tech.eu.

However, Audi says that Musk is right about the fact that ESG rating requires a crazy amount of information that is time-consuming to gather and immaterial to the business most of the time.

And that is where apiday comes in: their AI-driven software has been developed as a tool to help companies smoothly collect, manage and improve everything to do with ESG certification and reporting.

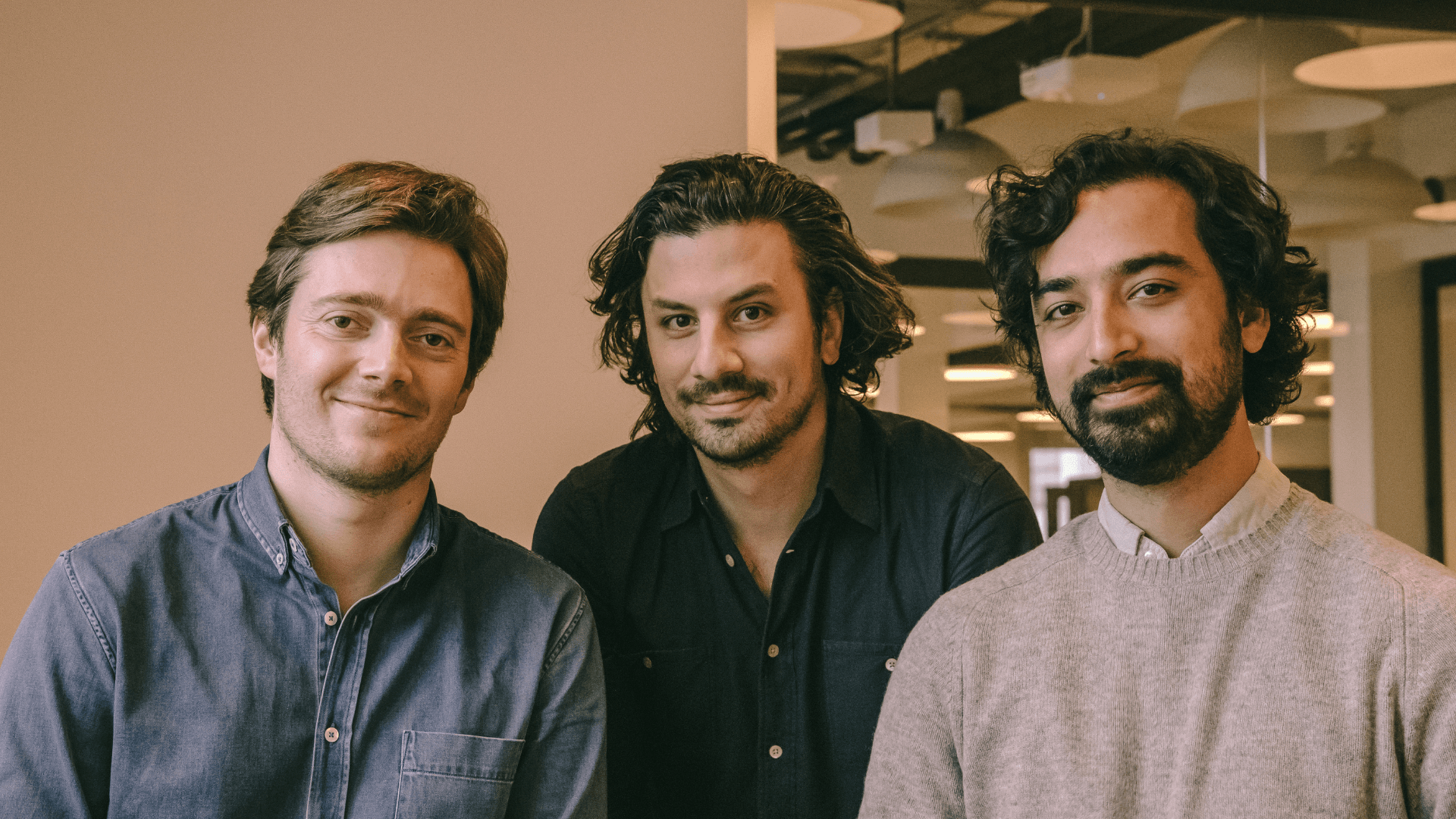

Co-founded by Audi together with COO Charles Moury (left in the photo) and CDO Erol Hoke (right) in 2021, apiday recently received €3.2 million in a seed round led by Speedinvest and Revent. That money has been earmarked for the new investor product and international expansion to Australia, China, and India.

"Companies who want to stay competitive in this new world need to collect, analyse and improve their ESG data, but that's a big problem because they usually don't have the expertise or the resources internally to manage that kind of data,” Audi told Tech.eu.

“The main problem with ESG is the fact that all the data is actually inside companies, but they don't have the tools to report that data, so today they either do it themselves, but it's error-prone, time consuming, and very mentally draining...or the other option is to take a consultant, and they do a very good job but it's expensive."

Having launched their first tool for companies in March, apiday is now following up with a new product designed for private equity, VCs and ESG consultants, who are under pressure to get their ESG house in order, as the European Sustainable Finance Disclosure Regulation is going to kick in soon.

Audi says their automated data management tool will “help institutional investors to finally access raw sustainability data directly from their portfolio companies and fast track their compliance with new regulatory requirements.”

Would you like to write the first comment?

Login to post comments