Extreme and volatile weather changes brought about by climate change are increasing in both frequency and severity, with global economic losses from natural catastrophes reaching $190 billion in 2020, out of which $101 billion were uninsured. Climate change has become a systemic risk and, together with socio-economic developments, this type of uninsured losses continue to rise.

Traditional insurance alone cannot cover losses brought on by climate change-induced extreme weather changes. Parametric insurance is often used by big companies to protect their businesses against natural disasters and severe weather events. However, these have so far not been an option for SMEs, and distribution strategies have been poor.

Enter London-based insurtech startup BirdsEyeView, which has raised an undisclosed amount of funding, led by SFC Capital, with the funds matched by the European Space Agency (ESA).

The platform uses satellite data to structure insurance solutions for severe weather. The funding will be used to grow the team and further develop its technology.

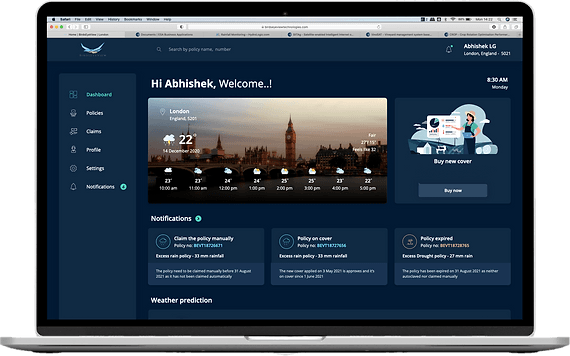

The company structures weather-based events insurance products using its proprietary algorithmic underwriting engine, RAPTOR to provide SMEs access to weather-based events insurance products. It uses meteorological data gathered by the likes of European Space Agency, NASA, which is then processed to structure parametric products.

James Rendell, CEO and co-founder of BirdsEyeView said: “We aim to develop our RAPTOR technology, which is going to help both insurers and policy holders get better and more accurate insurance services.”

Ed Stevenson, investment manager at SFC Capital added: “The insurance industry is changing and adapting to the world as it evolves. Climate change is a challenge for many industries and innovative technologies like BirdsEyeView will help the industry to move forward.”

Would you like to write the first comment?

Login to post comments