London-based Growth Intelligence has brought in £1.5 million from alternative investment fund manager Shard Credit Partners through its U.K. technology-focused venture debt fund. The new cash will be used by the startup for its product development and expansion in new markets.

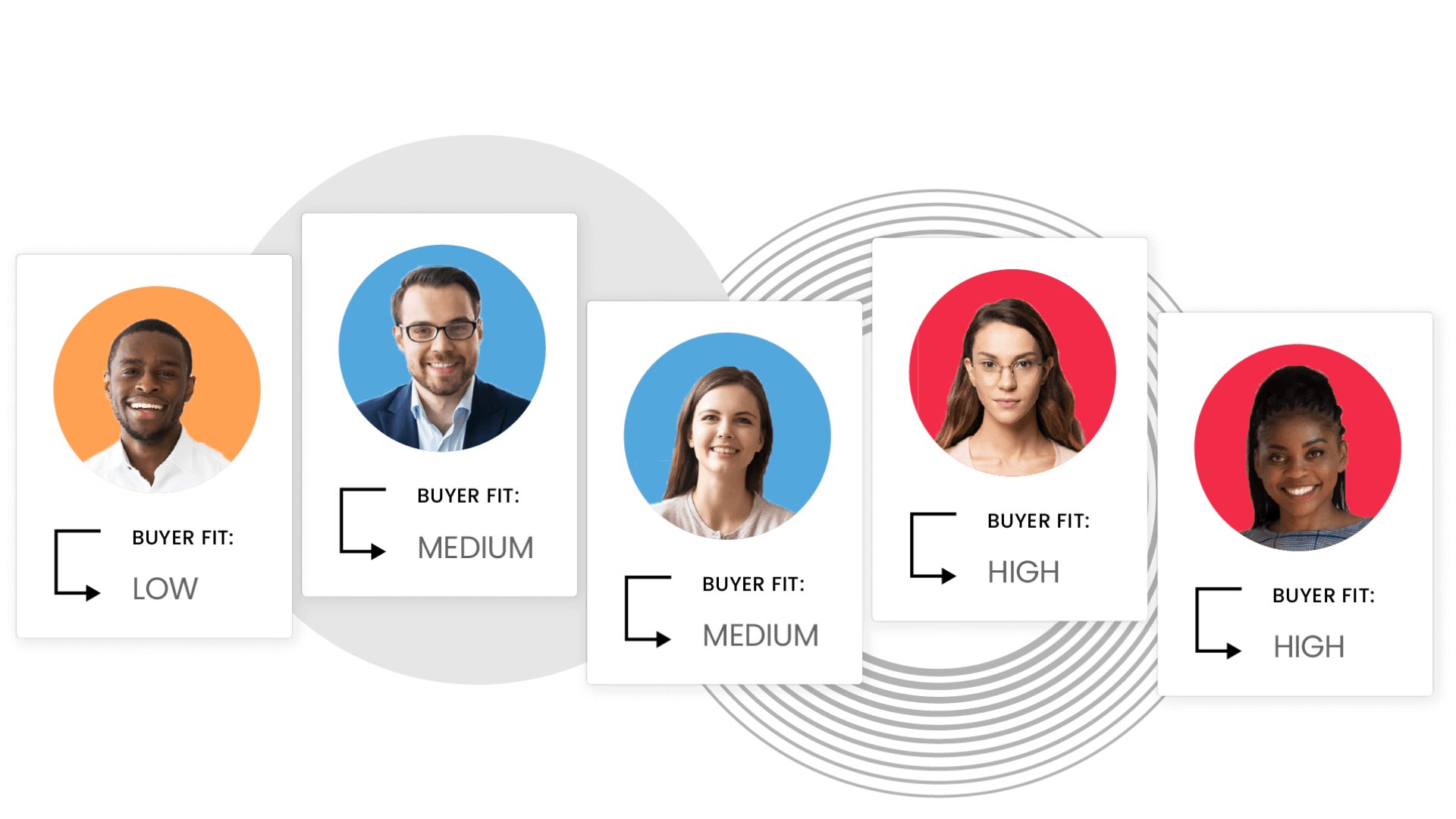

The UK-based company empowers SMEs to run account-based marketing (ABM) at scale for the first time. It helps B2B marketers, who have struggled to define their audiences, run efficient and creative digital-first campaigns. The startup’s current portfolio includes clients such as American Express and Vodafone.

Tom Gatten, CEO of Growth Intelligence said: “Our platform offers ABM marketing at scale -- across the U.S. and the U.K. The opportunity for businesses to acquire new customers digitally is growing post-covid. Yet most marketing leaders struggle to confidently define their ICP and total addressable market, which leads to high digital ad spending, slow growth, and low conversions. We’re here to solve this problem and transform B2B marketing by enabling large enterprises and mid-sized companies to build, scale and launch ABM at scale.”

Alastair Brown, CEO of Shard Credit Partners, added: “Our investment marks the third investment from our new venture debt strategy. The investment team has a strong pipeline of opportunities and we expect the pace of deployment to continue through the summer months, supporting positive fundraising momentum as we approach subsequent fund closes through the remainder of 2022.”

Would you like to write the first comment?

Login to post comments