London-based fintech startup 9fin has raised $23 million in a Series A+ funding round. The company’s AI-powered data and analytics platform provide financial services clients with a host of business intelligence information, all aimed at helping them win business, outperform their peers, and save time. The fresh capital has been amassed primarily in order to support a 9fin’s sustained push into North American markets. Since 2017, the startup has raised a total of $37.2 million.

9fin’s $23 million Series A+ round was led by new investor Spark Capital with participation from existing investors Redalpine, AI Seed, Seedcamp, 500 Startups, and Ilavska Vuillermoz Capital.

Despite debt markets being the largest asset class in the world, a great number of market participants rely on outdated technology for analysis. According to Burton Taylor, in 2021, annual spend on financial data increased to $36 billion, with Refinitiv noting that annual fees for advising on debt transactions reached $75 billion. To put these figures into perspective, theyrepresent roughly twice the size of fees earned on M&A transactions and IPOs.

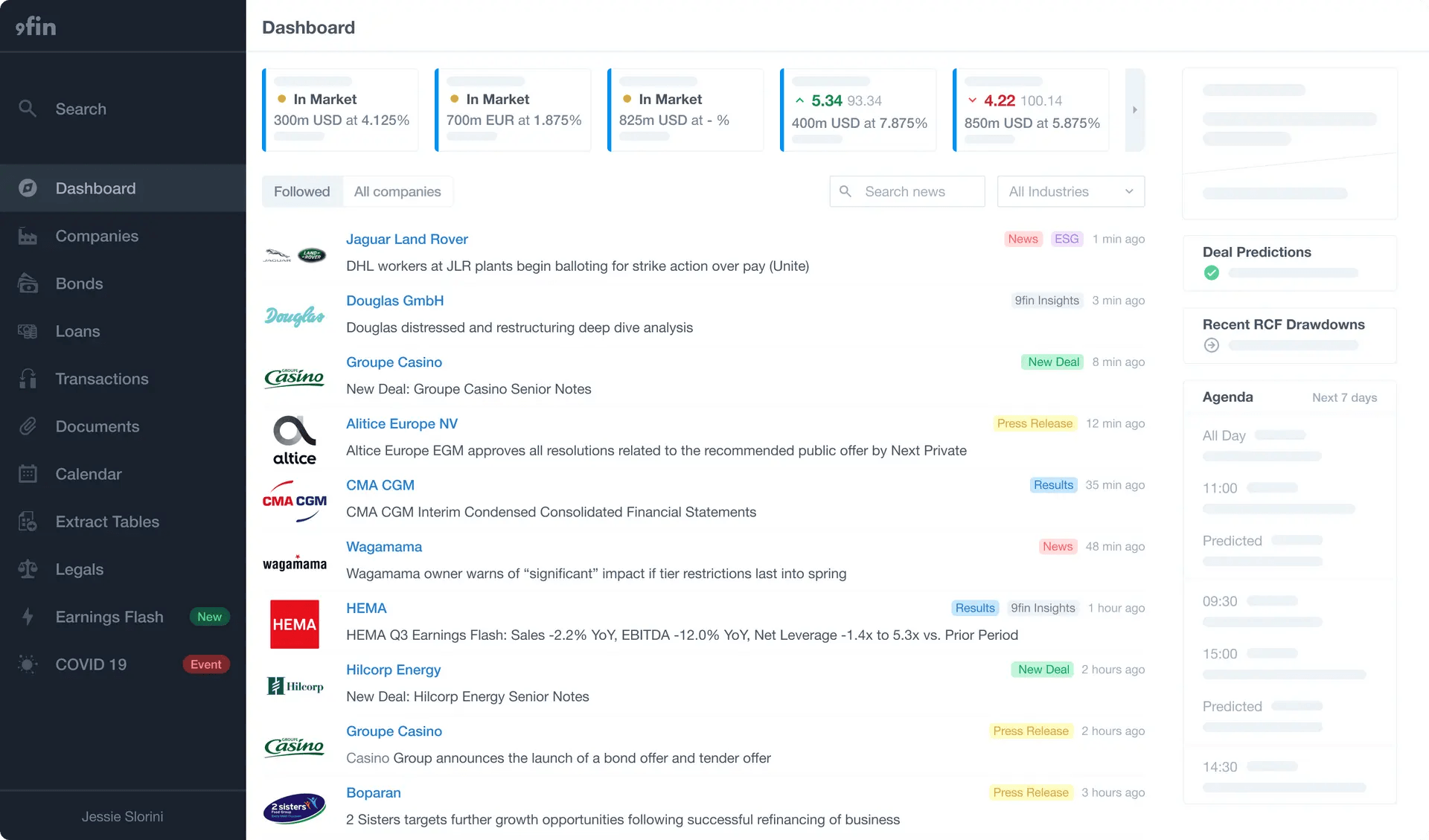

9fin’s platform is not only an update to outdated methods, but offers an AI-driven solution, one that can far outperform even the most well-oiled team(s) of analysts. The company currently supports over 60 customers including nine of the top 10 investment banks, four of the top five debt advisors, 80% of European HY Sales & Trading desks, and four of the top six law firms in debt capital markets.

“We didn’t set out to fundraise, but when we spoke with Alex and the team at Spark, they were incredibly enthusiastic about the business, and their culture and operating experience are a great fit for us. So we decided to raise opportunistically and accelerate our US GTM timing,” commented 9fin CEO and co-founder, Steven Hunter. “We’ve seen incredible success with our platform in Europe and are thrilled to expand in the US. With this round, we will grow our US team to more than 70 people with new hires planned across credit, legal, and sales.”

Would you like to write the first comment?

Login to post comments