Advanced Commerce, a UK-based platform that optimises merchandising at online retailers, has received just short of £1.5 million in funds.

Leading the round is UK investment management service Wealth Club, investing through its Enterprise Investment Scheme to the tune of £1.3 million. The round also includes funding from clients of the Lincolnshire-based VC Haatch Ventures, which first backed Advanced Commerce in 2021. Haatch Ventures also put in £70,000 directly.

Advanced Commerce's GrapheneHC platform lets e-commerce companies match the tender care that brick-and-mortar stores usually give to merchandising.

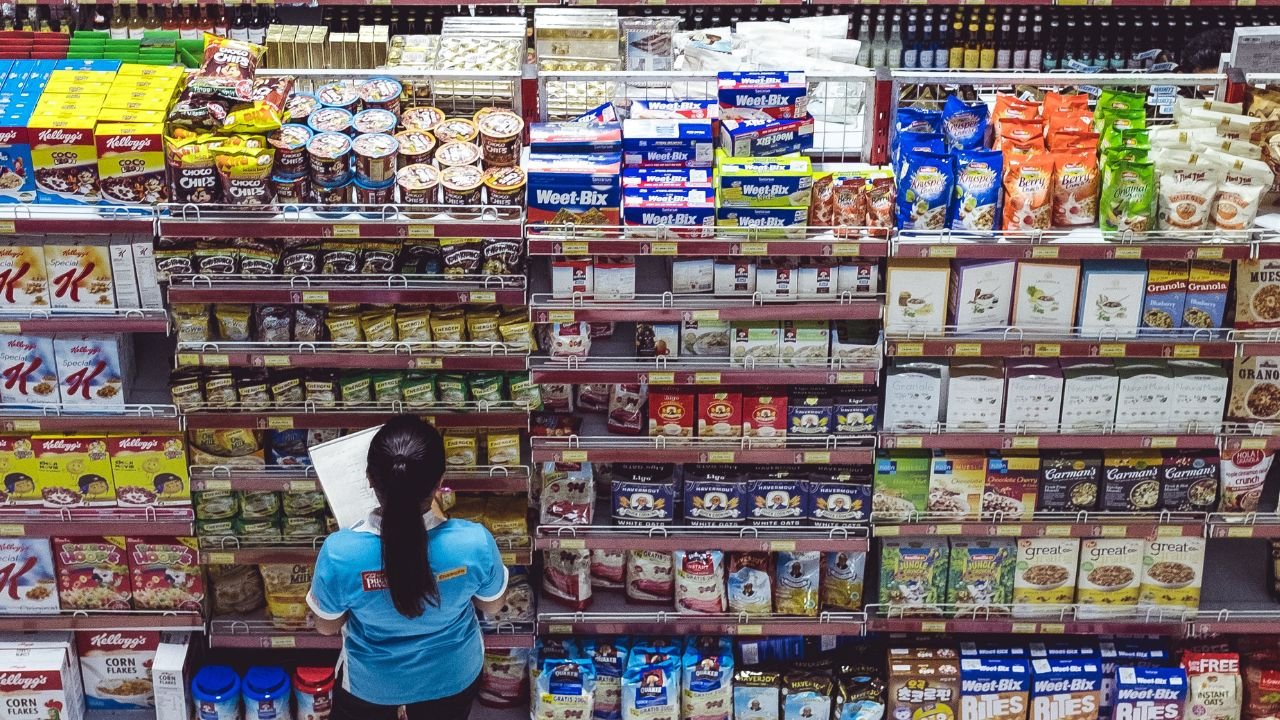

In retail stores, the product selection staring back at you didn't happen by accident. Retailers assign goods to specific merchandising plans designed to catch the customer's eye with trendy or prevailing products. Technicoloured store shelves are akin to retail's final advertising billboard, and GrapheneHC aims to do a similar thing online.

Key features include an intelligent search engine to pull up the right goods to match the customer's query straight away, sparing them a reproach with the website controls and then deciding to look elsewhere.

Beyond the intelligent search, retailers can dive deeper to create what's known as merchandising blends, allowing them to display a group of related product lines based on key attributes, like trends, pricing and popularity.

An earlier funding round for Advanced Commerce raised £1.6 million. Wealth Club and Haatch Ventures invested £1.3 million and £300,000 respectively.

Wealth Club's founder and CEO Alex Davies sounds convinced Advanced Commerce has hit on a crucial pain point in the UK e-commerce sector, which he says is estimated to be worth above £150 million in the wake of increased online spends due to the COVID-19 pandemic.

Davies added: "Many retailers struggle to keep up with users’ expectations, for instance, up to 70% of baskets are abandoned – and that alone can cost e-retailers £millions in lost sales.

"Advanced Commerce is helping solve this. Its platform is the digital equivalent of a good shopkeeper, arranging products on shelfs to maximise sales. And the results speak for themselves: increasing average values orders by 12-15% and the volume of orders by 5-10%.

"An opportunity to invest in a start-up where the founder is a sector expert and on top of that has a proven track record with a similar business, is hugely attractive. Our clients recognise a good opportunity when it presents itself and were quick to invest.”"

Would you like to write the first comment?

Login to post comments