Lodz-founded/London-HQ’d Cryptiony has raised €500,000 in a pre-seed funding round. The startup offers a crypto tax automation platform for individuals, traders, and tax professionals, and with the pre-seed money is targeting a market expansion into Europe’s largest crypto market with over 4.2 million users, the United Kingdom.

Alongside the market expansion, Cryptiony plans to expand its development team, introducing new features, and new exchange and blockchain integrations.

Cryptiony’s pre-seed round was led by New York-based ff Venture Capital with Pointer.Capital and web3-focused angel investor Marcin Wenus participating.

Crypto and taxes. If you’ve ever purchased, traded, or hodld, you’re legally obligated to report and pay tax on those 1’s and 0’s. And yet, while crypto traders might be ahead of the curve (in some respects, we’ll leave FTX out of this discussion. For now.) technically speaking, the accountants they/we/you engage are oft to be slightly less behind when it comes to the requirements of reporting these losses/earnings(?).

And with both the IRS in the US and HMRC in the UK starting to put pressure on crypto asset holders, an increasing number individuals are becoming aware of the need to file crypto gains, losses, and staking (a notoriously difficult calculation due to the fact that payments are often made daily, creating hundreds of data points for each asset) payments as part of annual tax reporting.

And with both the IRS in the US and HMRC in the UK starting to put pressure on crypto asset holders, an increasing number individuals are becoming aware of the need to file crypto gains, losses, and staking (a notoriously difficult calculation due to the fact that payments are often made daily, creating hundreds of data points for each asset) payments as part of annual tax reporting.

In the UK, for example, exchanges are legally required to notify HMRC when an individual’s total holdings reach a relatively modest £3,000, and even exchanging one type of crypto asset for another or for goods incurs tax liabilities.

As for residents of the EU, don’t think you’re out of the woods, as the European Union proposed new rules that will require all digital asset service providers to report transactions involving customers residing in the bloc.

Right now, reporting can work to taxpayers’ advantage. With most crypto assets heavily down in value since the end of 2021, it is likely that many purchasers have losses that, if recognised and reported, could offset future capital gains tax.

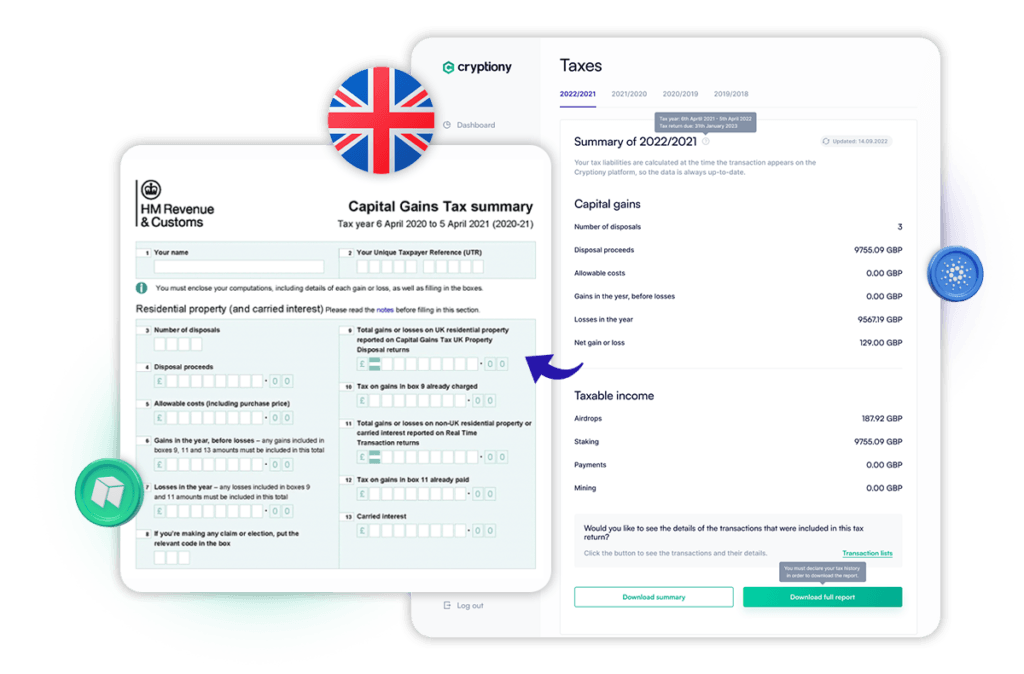

Stepping in and aiding in keeping everything above board is Cryptiony. By providing a cryptocurrency tax calculation that’s reportedly easy, fast, and affordable for beginners, but also scales upwards to support professional traders and accountants.

In linking directly to exchanges via APIs and extracting relevant data, the platform can automatically create a full tax liability report compliant with complex tax laws, such as the UK’s share pooling rules.

“If crypto ever was part of a separate universe, it isn’t now. Tax authorities are treating trading profits just like any other capital gain and taxpayers are waking up to the risks of non-compliance,” commented co-founder and CEO Bartosz Milczarek. “It’s a big market already and, as web3 becomes mainstream, is going to get even bigger. The UK is our most important opportunity right now and the new pre-seed funding enables us to grab that opening with a pricing model that is going to be hard to ignore.”

Lead image: Anna Mizerska

Would you like to write the first comment?

Login to post comments