Madrid-based Twinco Capital has raised $12 million in an equity ($9 million) and debt ($3 million) funding round. Focusing on the fashion and retail industry, the female-founded startup offers working capital, particularly in the realm of supply chain financing, covering everything from the production cycle from purchase orders to final invoice payments. Since mid-2019, Twinco Capital has raised approximately $18 million in debt and equity funding.

The $9 million equity portion of the round was led by Quona Capital and saw the participation from Working Capital, as well as existing investors Mundi Ventures and Finch Capital. The $3 million debt portion was provided by Zubi Capital. According to company representatives, this round serves as a precursor to an additional $100 million in debt funding Twinco Capital is aiming to secure later this quarter.

All in all, the $12 million is aimed at helping the company ramp up expansion plans within major sourcing countries and strengthen its technology and data capabilities, in particular in relation to ESG.

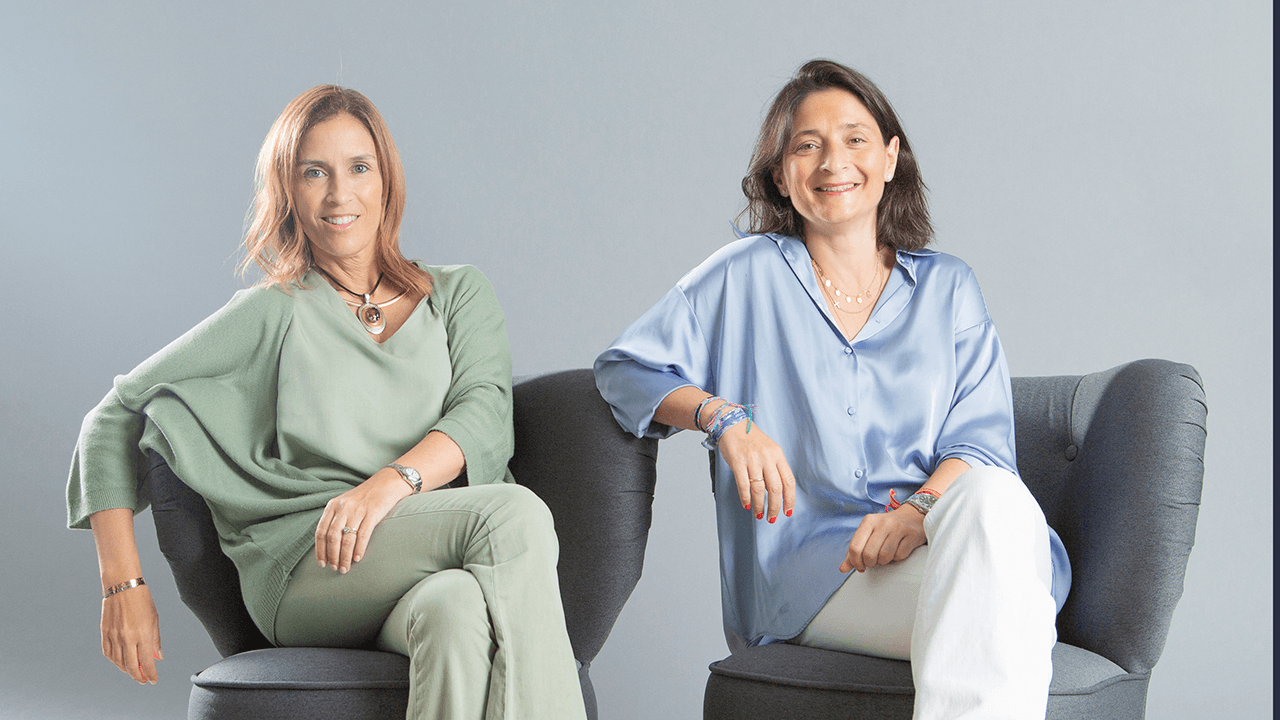

Founded in 2019 by banker and trade finance specialist Sandra Nolasco (CEO) and equity investing and project finance executive Carmen Marín (COO), Twinco Captial primarily services European and LatAm retailers who are buying more than $10 billion per year in manufactured products, mostly from SMEs in emerging markets.

According to the company, they’ve onboarded more than 100 suppliers, located in 12 different countries including Bangladesh, China, Pakistan, South Korea, Turkey, Thailand, Vietnam, Indonesia, and Spain, providing them with access to affordable liquidity, allowing them to spin up production when they most need it most, upon receipt of an order.

Twinco will provide these suppliers with up to 60% of a purchase order value upfront with the remainder due upon delivery.

“If we are to have competitive and socially responsible supply chains on a global scale, suppliers need access to affordable financing from the very beginning of production, starting with the purchase order,” said CEO Sandra Nolasco. “Extraordinary events, such as those experienced these past years, have revealed the fragility of supply chains, which are historically unable to adapt to the complexity of global production networks. At Twinco, we propose a radical change in how to use finance as a tool to proactively transform global supply chains, foster the participation of SMEs, improve efficiency and ensure responsible sourcing practices.”

Would you like to write the first comment?

Login to post comments