The global insurance market was valued at $5.45 billion in 2022 and is expected to grow at an annual rate of 52.7% between 2023 and 2030. In regions such as Europe, Asia, and the Middle East, this growth has been significant.

Europe's insurtech industry added more than 100 companies in the past year. Despite the funding crunch and looming recession on the horizon, the progress of these companies didn’t slow down.

The increase in connected devices is also setting Europe apart from the rest of the world and creating unique opportunities for insurers. Countries like the United Kingdom (UK) and France are coming out on top as key markets for insurtech in Europe, growing faster than North American and MEA regions.

However, the question remains: what does this year hold for the European insurtech market? Let’s take a look at some of the current challenges and opportunities.

Impact of the volatile geopolitical environment

The Russia-Ukraine conflict has created volatility in the region with rising energy costs, supply chain disruptions, and similar challenges. The supply chain disruptions resulted in commodity shortages and increased costs for automobile manufacturers due to a lack of raw materials.

Information Services Group (ISG) survey shows that three-quarters of European insurance industry executives plan to accelerate their digital transformation programs in response to geopolitical tensions.

With persistently high inflation, recession threat, and other economic and environmental risks, the insurance sector must adapt its business models to remain competitive. This means that we will see more insurers focus on digital transformation strategies to reduce costs and increase operational efficiency.

Rise in claims inflation and subsequent costs

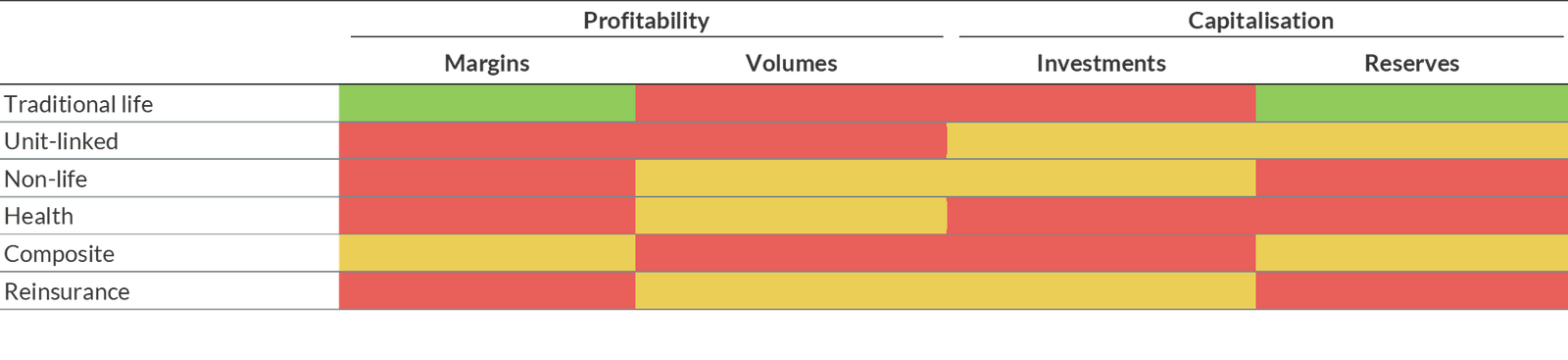

Rising inflation and increasing interest rates are already impacting the European insurance industry. It presents a unique and complex set of challenges for insurance companies, particularly vulnerable to these economic pressures.

The primary concern is that high inflation can cause reserve deficiencies due to higher-than-anticipated claims inflation. It can result in margin pressure for short-term business as insurers struggle with the delicate balance between competition and pricing power.

Plus, non-life insurance companies with weak reserve levels or limited pricing power are likely to suffer the most from the adverse impact of increased claims on their capital. To cope with this situation, insurers must address structural weaknesses to remain competitive in an increasingly challenging market.

Increased competition despite funding constraints

The market is becoming increasingly crowded and saturated with more companies offering insurance products. This has led to more aggressive pricing strategies and fewer profitable deals for each company. Rising costs due to inflation are also making it harder for insurers to remain competitive in terms of pricing.

Moreover, with the current economic climate being what it is, many companies are cutting back to survive. As such, fewer resources are available for innovation or large investments into new technologies that could help make operations more efficient or provide customers with better service.

Implications of the potential EU AI Act

As the European Commission introduces its draft for an EU AI Act, the insurance industry must grapple with a unique technical challenge. The legislation will impact any company operating within the EU and in any industry if they're using artificial intelligence (AI) technologies.

With existing regulatory frameworks already covering the uses of AI, insurance companies and insurtech startups now need to consider how applications that may be regarded as "high risk" by the Act will fit into their offerings.

This is especially true if they are using AI to perform activities related to credit and insurance policy decisions. Europe's insurers may face new challenges in implementing AI-powered digital transformation initiatives under this new legislation.

Insurtech trends that will thrive in 2023

Despite the current challenges in the industry, there are some key areas of insurtech to watch in 2023:

Continued use of artificial intelligence to automate internal processes

McKinsey predicted that by 2030, 25% of the insurance industry would be automated— leading to significant cost savings. Insurance providers will continue using AI to automate more internal processes and create efficient customer-centric systems. We’ll see more insurers streamlining processes like underwriting, fraud detection, claims processing, and more.

By utilizing AI technology, these processes can be completed faster and with higher accuracy than manual efforts. For instance, visual intelligence can be used to quickly analyze and identify causes of damage in claims submitted remotely at the time of the incident. Automating this important step in the claims process allows insurers to reduce their exposure to financial losses, minimize fraudulent activity, and ensure that customers receive the correct coverage promptly.

Solutions that improve the entire customer experience

We expect to see more insurance providers deploy solutions like embedded insurance and parametric insurance to provide a more comprehensive, streamlined, and intuitive customer experience.

As embedded insurance leverages existing relationships between customers and brands they already trust, more companies are looking to invest in it. They can maintain relevance with the next generation by making minor modifications to their business model and focusing on their distribution channels.

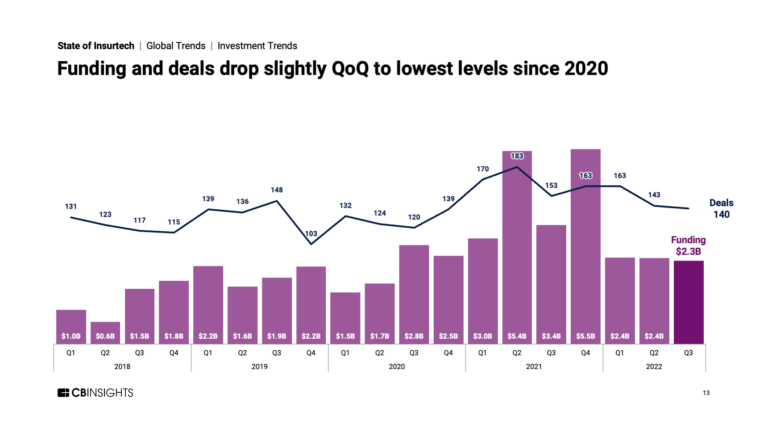

The increase in insurtech funding, which began in 2021, has also impacted the demand for these solutions. The European embedded insurance market is due to increase from $10+ billion in 2022 to $28+ billion in 2029.

More attention on climate change solutions

In 2018 and 2019, Europe suffered its worst consecutive droughts compared to the last 250 years. The rise in floods in the UK added to the catastrophe leading to millions of dollars in losses. However, a Swiss Re study found that in Europe, only 34% of flood losses are insured, even though the flooding that happened that year (2021) was the costliest natural disaster in that region.

For the first time, sustainability is now one of the top five priorities in the insurance industry. However, only 8% of insurers are preparing adequately. To build climate resilience, we may see more insurance providers in Europe offering parametric insurance options for adverse weather-related events. This type of insurance protects businesses and individuals against losses due to extreme weather conditions like fire due to droughts, floods, and high winds.

It works by setting predetermined parameters of a potential loss, rather than traditional policies based on the value of the item or assets being insured. The premiums paid for coverage are based on the likelihood of certain conditions occurring, such as wind speed, tide level, temperature range, or precipitation levels over a certain period.

This type of insurance is easy to understand and purchase, giving customers quick access to protection even when traditional policies are not applicable. It allows policyholders to access funds immediately following a damaging event instead of waiting for conventional claims processes and negotiations with insurers, which can take far longer.

Telematics-based insurance for accurate claims processing

We’ll also see more vehicle insurance providers using telematics technology for usage-based insurance products. With a telematics device, insurers can build a complete record of a customer's driving habits, including speed, acceleration, and braking patterns, allowing them to provide a more accurate and individualized premium rate. Insurers can use the data to identify potentially dangerous behaviors and suggest ways that policyholders can improve their driving habits to lower their premiums. It can incentivize motorists to make safer decisions when behind the wheel, improving road safety for all users.

A recent survey found that more than half (55%) of all drivers in six of the largest European motor insurance markets are interested in telematics policies. Countries with the most interest include Italy and Spain, where nearly 70% of drivers stated they were interested.

Looking ahead

The European insurance industry faces several challenges ahead in the new year. However, insurers will lean into partnerships with insurtech companies that can help them streamline operations, reduce operating costs, and improve the overall digital experience for customers.

Would you like to write the first comment?

Login to post comments