With close to half of 2023 in the books, and keeping in mind the European private equity (PE) and venture capital (VC) predictions made at the end of 2022, PitchBook has published "2023 European Private Capital Outlook: H1 Follow-up“. The report provides an overview of how the outlooks are faring and what has changed in European venture capital (VC) and private equity (PE) in 2023.

The overview concentrates on 6 topics, as follows:

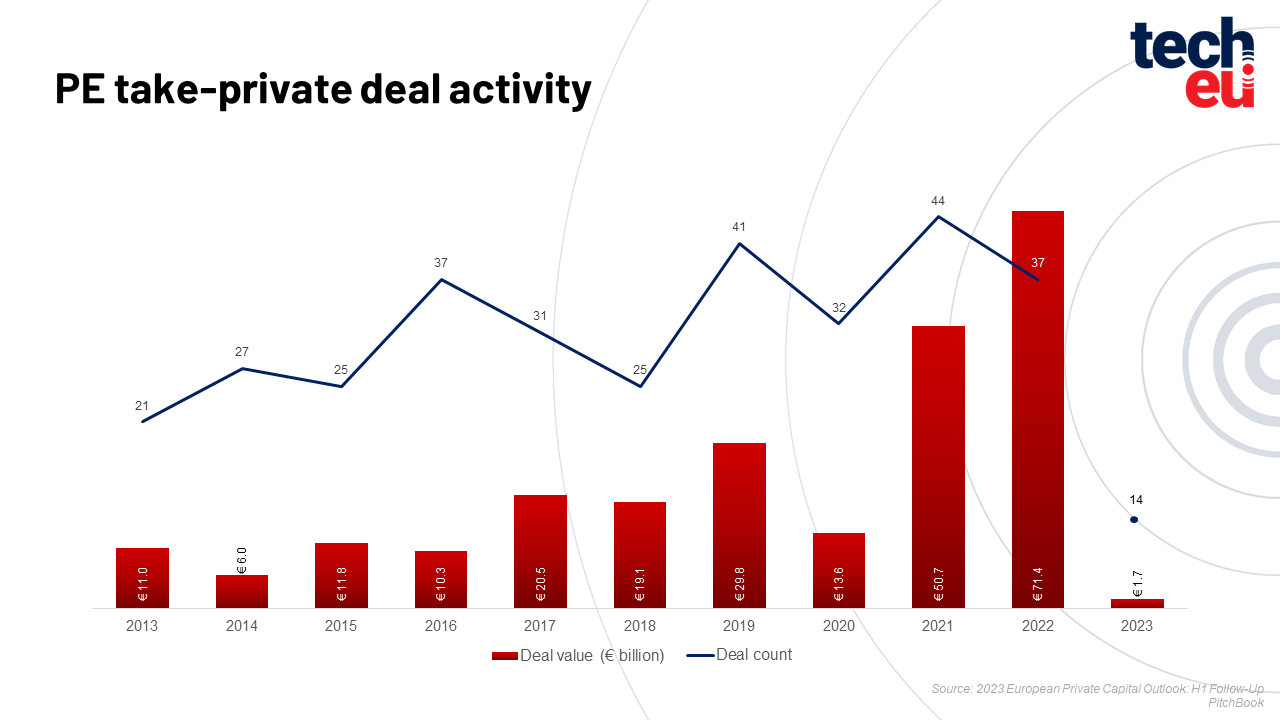

1. Take-private deal value will reach €30 billion

As of May 2023, the take-private deal value reached just €1.7 billion, across 14 deals. If this trend continues, it is expected that by the end of the year, it fall short of €30 billion. There are identified different factors that influenced this situation, like growing interest rates that reduced the readiness to use the financial incentives, which led to fewer activities and potential take-private targets in the space.

On the other side, inflation rates are easing and interest rates could slow. This situation is ultimately leading to a clearer macroeconomic picture and pro-growth policies, which could help public company share prices.

At this moment, the issues that could have an impact on take-private appetite are management priorities, shareholder demands, as well as top- and bottom-line performance.

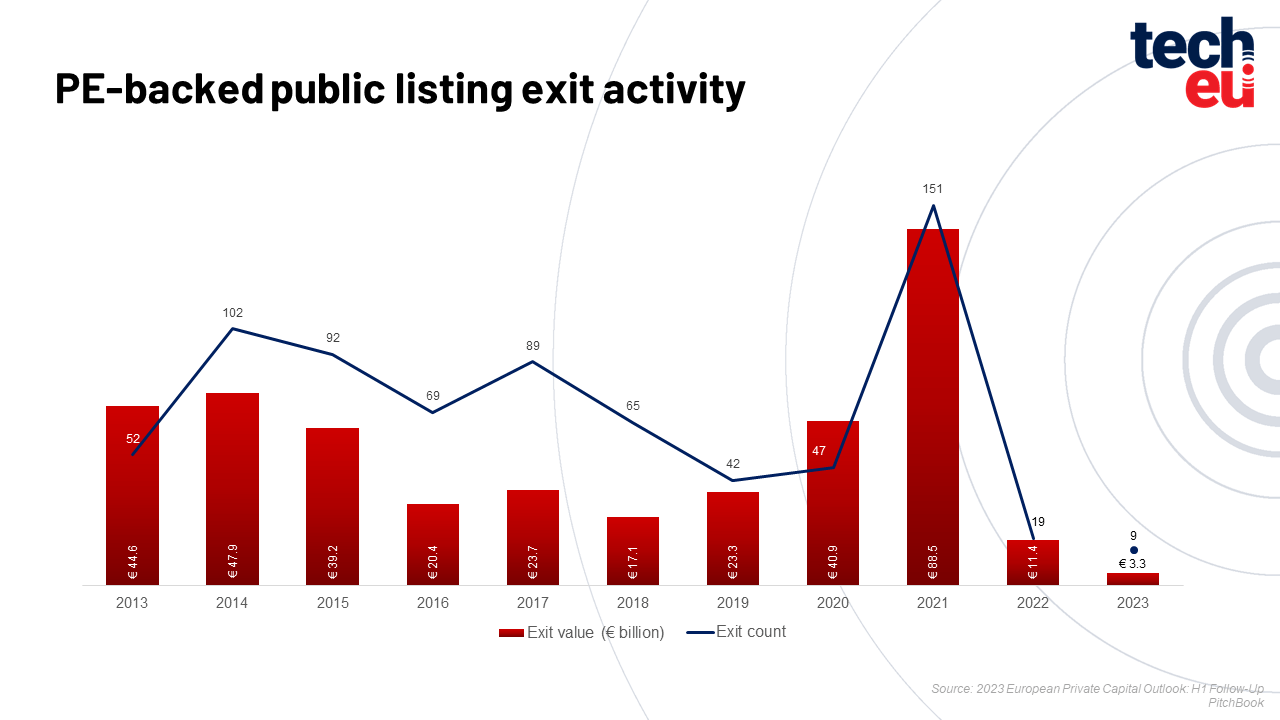

2. Fewer than 40 PE-backed public listings will take place

For the period covered by this report, only nine PE-backed public listings have taken place, with the yearly total on pace to fall below 40.

Public listings are still rare and are characterized by volatility and low share prices on the stock exchanges. All this had the effect of reducing enthusiasm for the debut.

It is not surprising that companies have decided against listing on the stock exchange, given that listed companies are floundering.

3. PE carveout deal value will account for more than 15% of aggregate PE deal value

Carveouts have represented 10.3% of deal value, and it shows that the overall activity slowed across the continent. As companies focused on costs and operational efficiencies in the first quarter, participating in a potentially lengthy and complex carveout or any form of the deal may not be attractive in the current environment.

This period is also characterized by deals that are taking longer, as well as a greater emphasis on due diligence. That's why PE investment professionals can focus on buying fewer but larger companies, rather than spreading resources across multiple smaller carveouts.

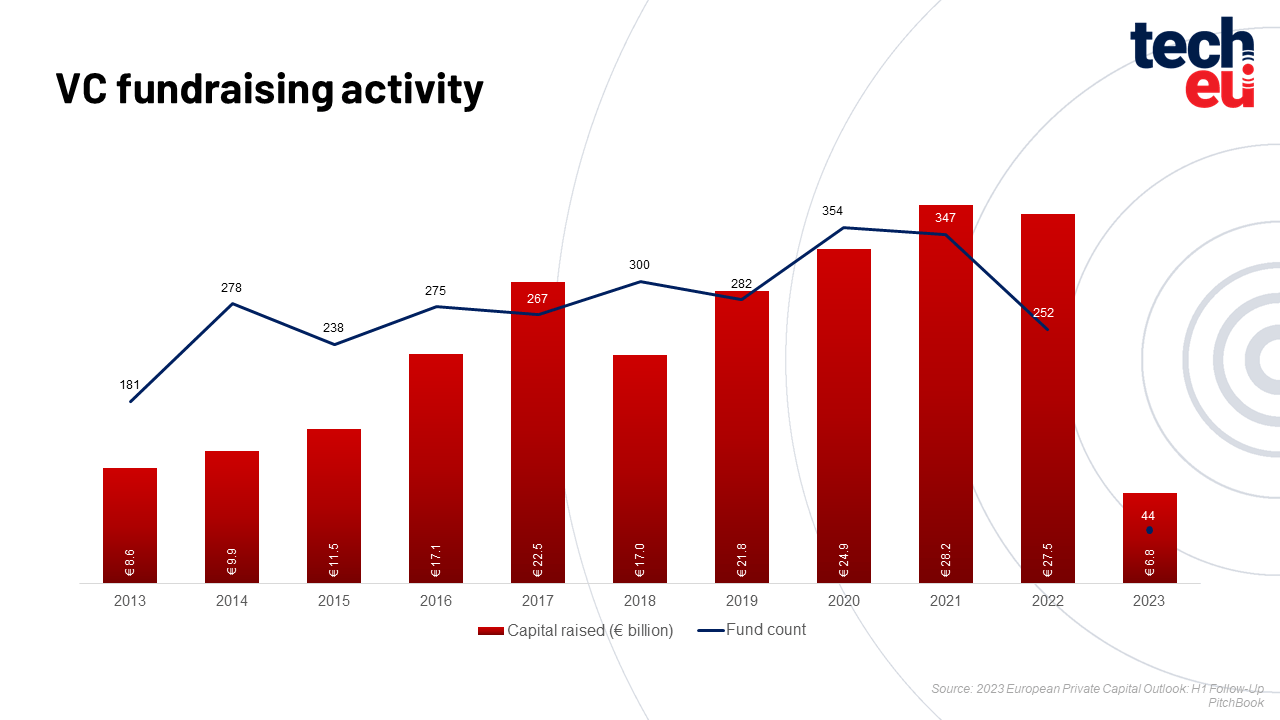

4. 2023 will see a record €45 billion of dry powder in the European VC ecosystem

Fundraising in this almost half of the year gives the hope that by the end of the year, it can be strong as in the previous three years. It is expected that in the second half of the year to be even higher, especially if the cycle of tightening monetary policy comes to an end.

In parallel, it can be seen more caution in capital deployment with VC deal value falling 32.1% QoQ in Q1. It is not expected that record amounts of dry powder to be deployed rapidly, but rather a venture capitalists to be more cautious and more diligent in their investment approach

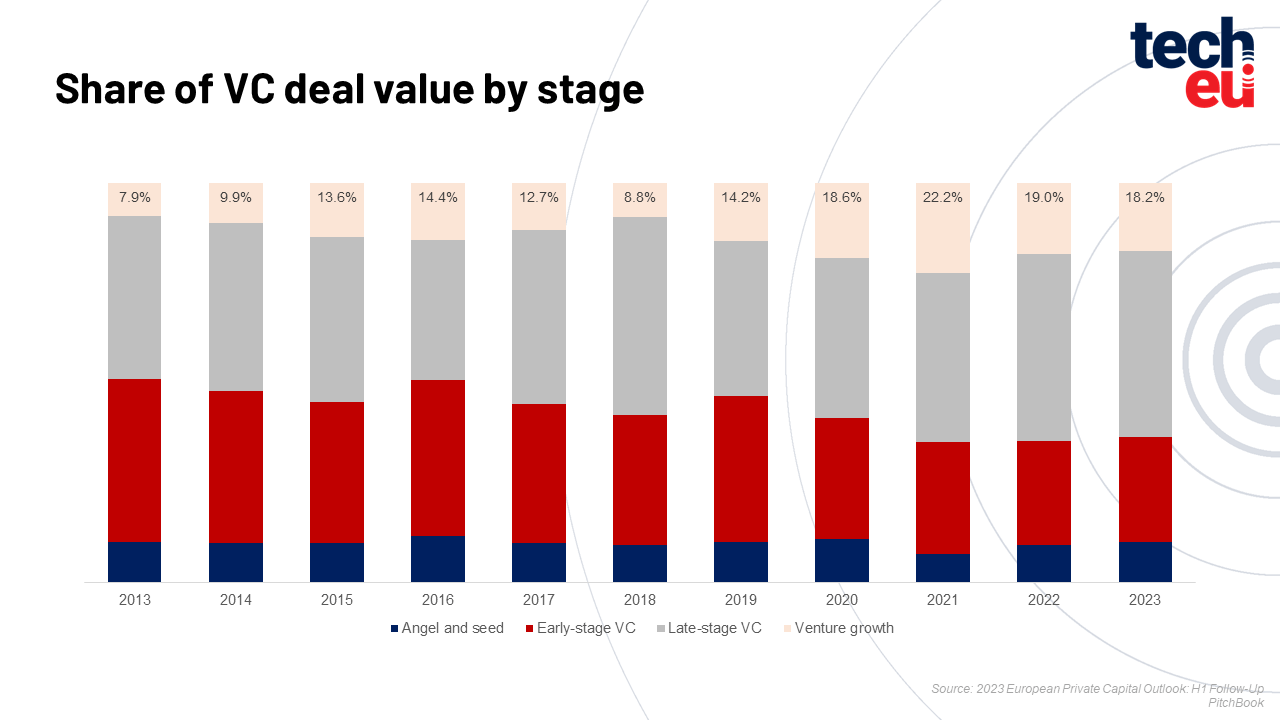

5. The venture-growth stage will represent over 25% of all deal value in Europe

The venture-growth stage has shown a slight drop from 2022 and is still a few percentage points away from expectations.

There are a couple of factors and arguments against the prediction that will point toward deals becoming smaller like:

- the venture-growth deal value has lost some ground to early-stage deal value,

- venture growth went down in Q1 2023 compared to Q3 2022, while the early stage went the opposite direction, increasing over the same time frame

- only five new unicorns arise in 2023 so far, compared with 48 in 2022 (and unicorns make up the bulk of venture-growth deal activity)

- the pullback from nontraditional investors as in Q1 2023, their share of deal value significantly dropped (77.3% YoY)

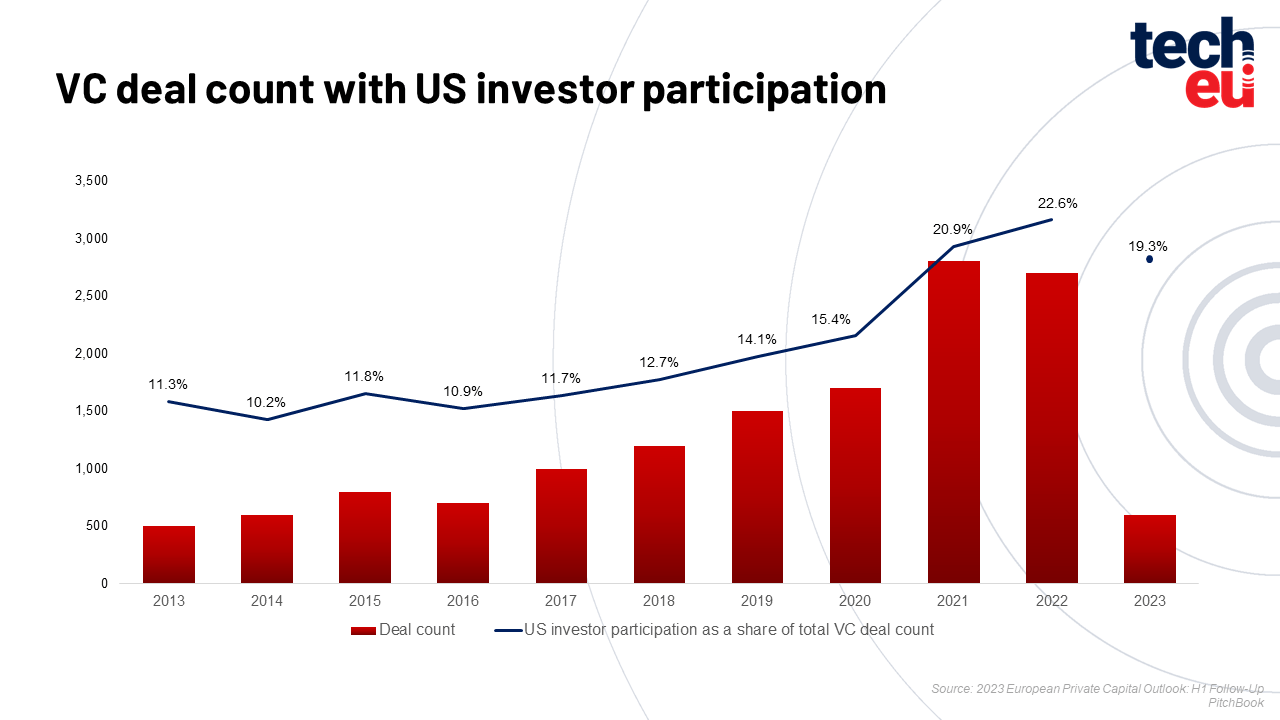

6. European VC activity with US participation will represent over 25% of the deal count

The collapse that happened with Silicone Value Bank, which supposedly banked half the VC industry in the US, created a lack of confidence in the global banking sector and dried up liquidity. Because of that, it is expected that US investors will refocus their energy on their domestic market rather than venture internationally given current conditions and the denominator effect.

On the other side, recessions in most European economies are no longer expected, so it can give a boost to investments. For some countries, venture capital investment is the top priority in their political agendas. Also, as diversification remains the prime reason for US investors to participate in European VC deals, it can be expected that this will continue to attract substantial capital.

The report can be downloaded here.

Would you like to write the first comment?

Login to post comments