"What are you currently excited about in insurtech?" That's a question I often receive from incumbents and investors in the market. It's understandable, given the current quiet state of the VC market across industries.

The insurtech space has also experienced a decline. Every six months, we take the opportunity to provide an overview of the industry, leveraging astorya.vc's market intelligence tool, which tracks every announced deal in insurtech Europe.

There is much to be learned from what is still thriving in this ecosystem and what is being built for the future of insurance innovation.

An overall drop in insurtech investments

Let's begin by examining several key performance indicators (KPIs) related to investment activity. During the first half of the year, insurtech startups raised over €370m. However, this represents a significant decline of 48% compared to the previous year.

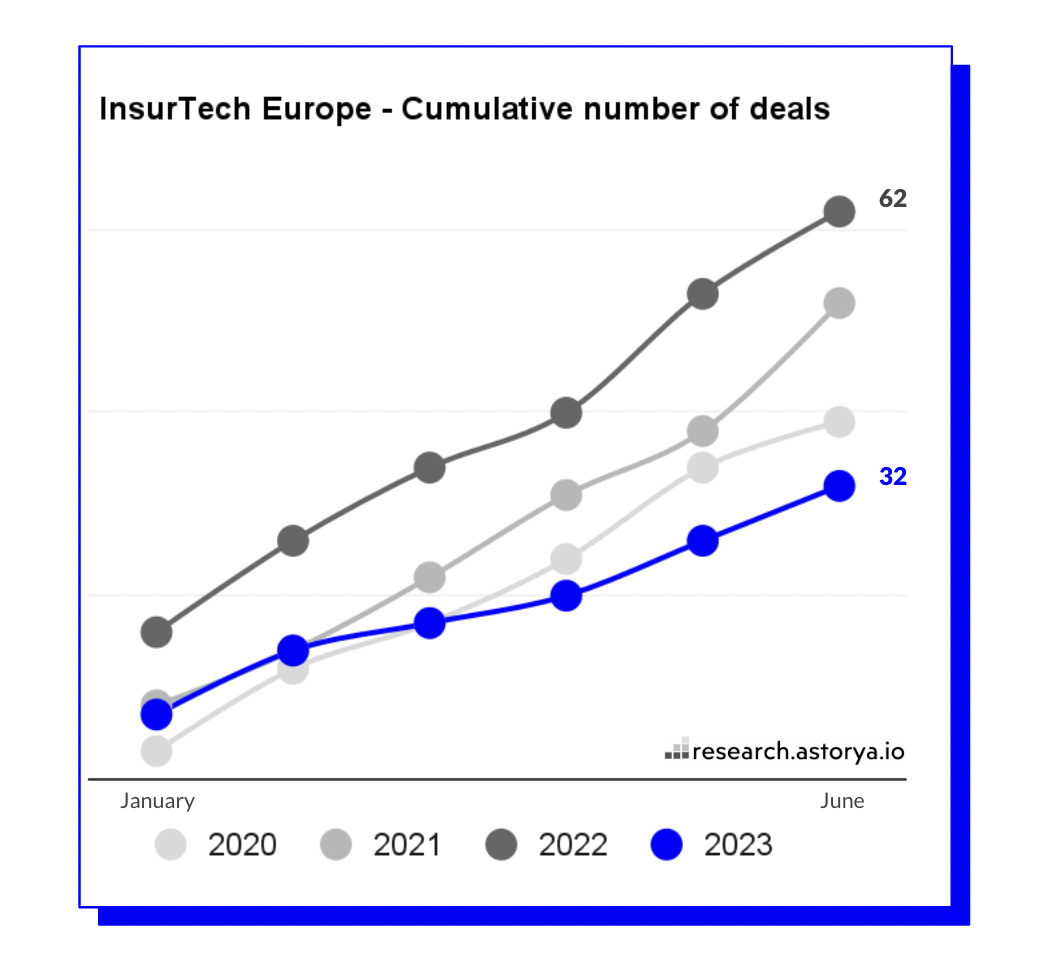

It is important to note that the number of deals announced, which amounted to 32 over the six-month period, also experienced a similar drop. When we consider the investment levels from a slightly earlier timeframe, it appears that we have returned to levels comparable to those seen in 2019-2020.

Let's examine if the activity remains subdued in the second half of the year, considering the two patterns currently observed in the market. On one side, startups have been postponing fundraising rounds for some time. Many have downsized their teams in order to save costs and buy time. On average, these teams have decreased by 15% from their peak for startups that announced a funding round in 2021.

However, they cannot indefinitely delay their funding needs, and some of them will soon require additional capital. It's worth noting that this situation could potentially contribute to an increase in mergers and acquisitions (M&A) activity. In cases where startups are unable to secure a new funding round or choose not to do so, being acquired might be an appealing option to sustain their operations.

On the other hand, several investors have announced new funds in the past 18 months but have not made substantial investments thus far. These investors will need to initiate deals in the near future to deploy their capital effectively.

But the future of insurance innovation is under construction

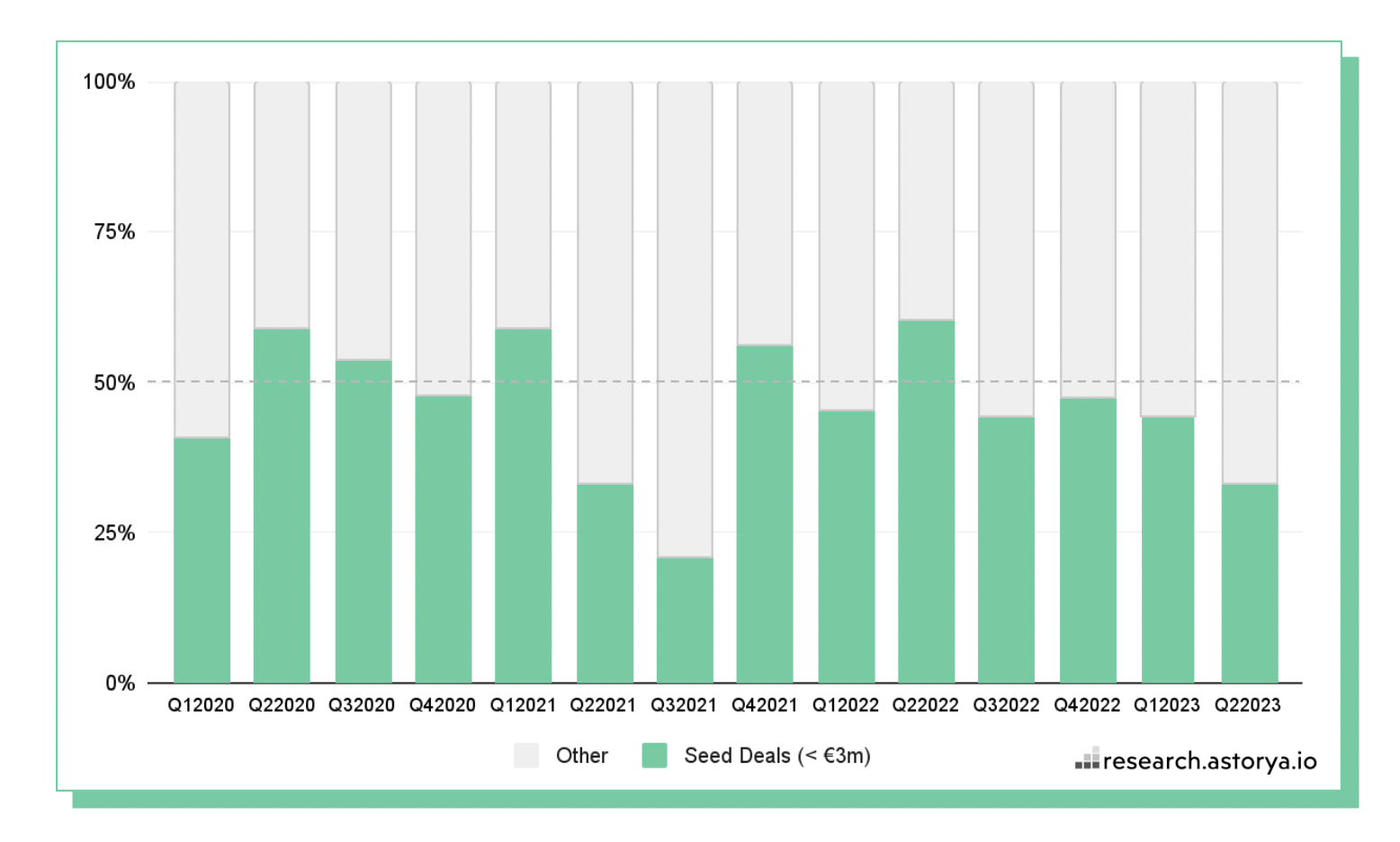

Taking a closer look at the maturity of the deals announced, it is notable that Seed deals, which typically involve funding amounts below €3m, have remained highly active. In fact, they accounted for 45% of all deals announced in the first half of the year. This indicates that the market is actively supporting and nurturing the future of insurance innovation by providing early-stage funding to promising startups.

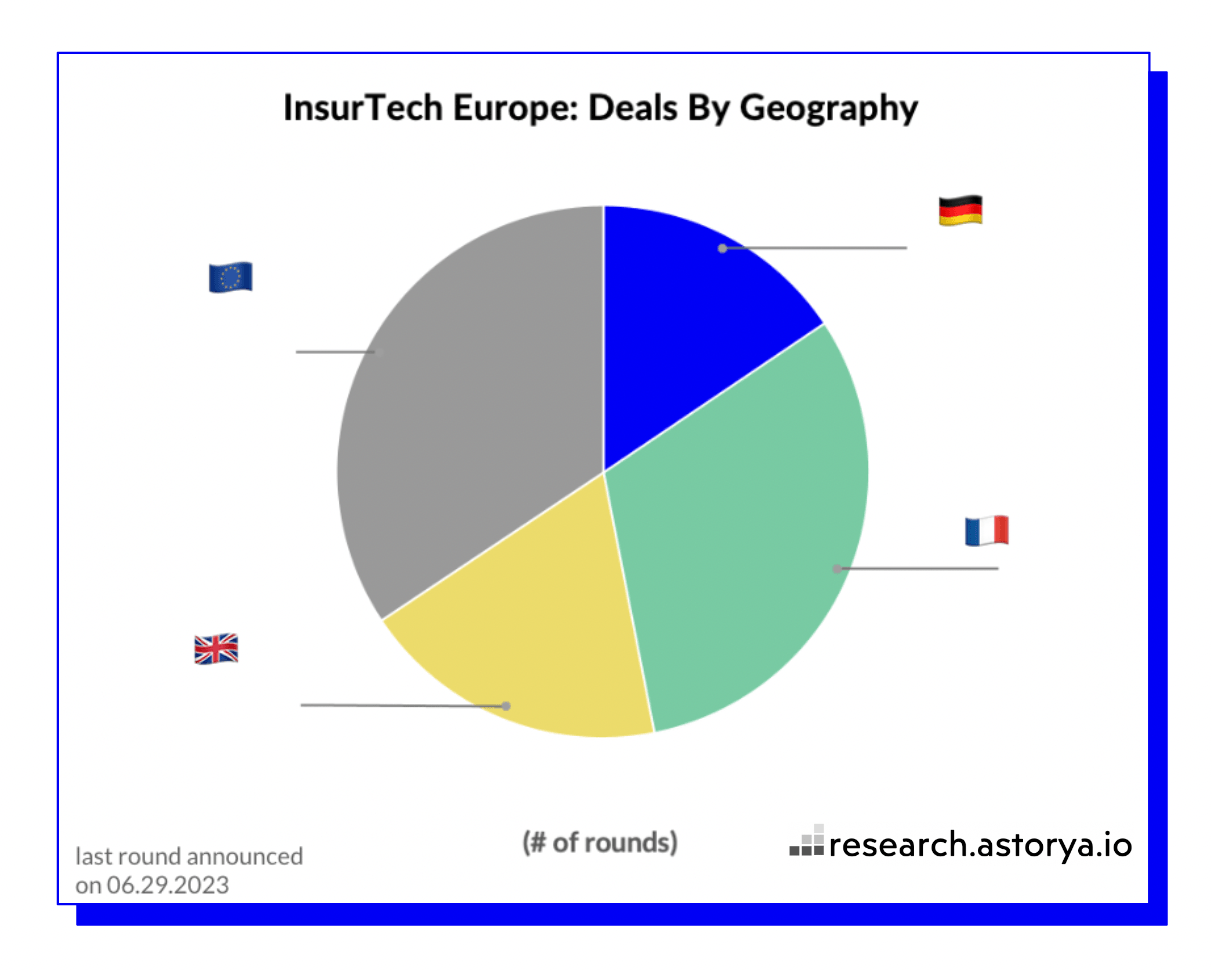

It's interesting to analyze the local dynamics of the European insurtech scene. France stands out as it accounted for 31% of every deal announced in the first half of the year, which is slightly higher than usual. On the other hand, the UK had a challenging second quarter and landed at 19% of every deal, below its typical level of activity (which is usually between 25% and 33% of insurtech activity in Europe). Germany maintains its third place with 16% of rounds, aligning with its long-term trend. Beyond these three major startup scenes, the "rest of Europe" remains vibrant, contributing to one-third of all deals announced.

This trend confirms that insurance innovation is spreading across various local ecosystems in Europe, showcasing the growing influence and presence of insurtech startups across the continent.

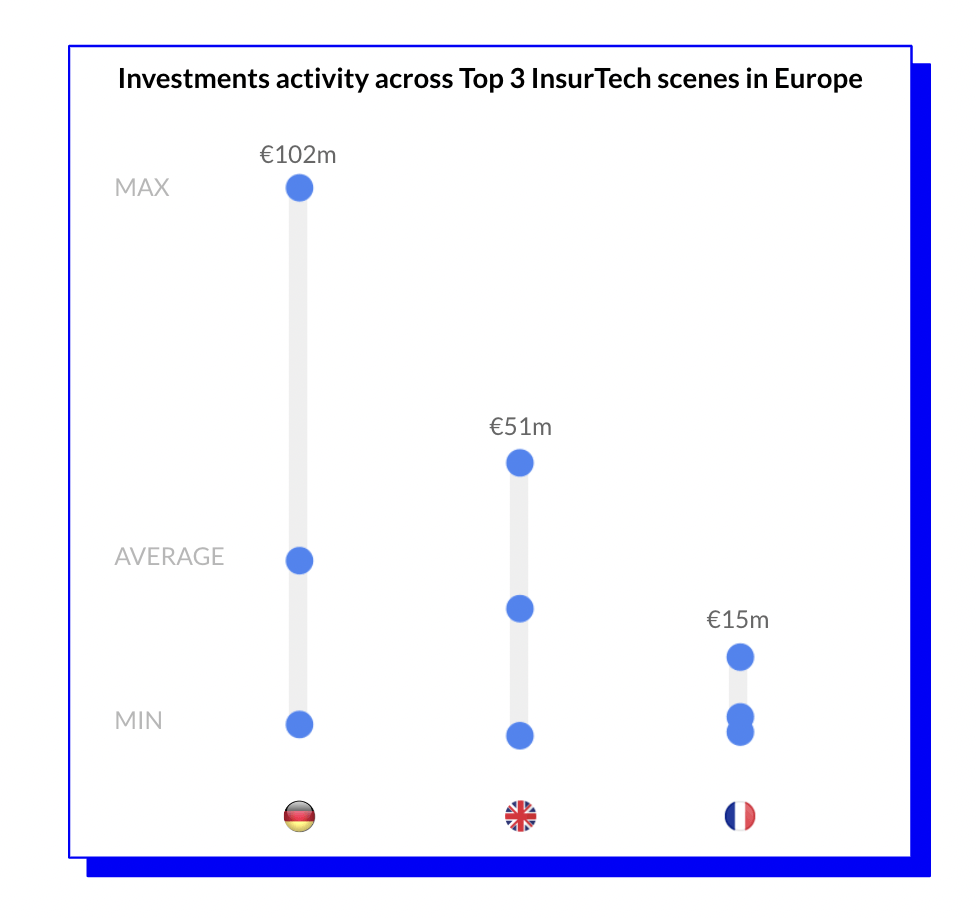

When examining the amount of money raised in each local ecosystem, the ranking differs slightly. Germany takes the lead, primarily driven by Wefox's significant €102m funding round in the second quarter, which accounted for 78% of all investments in German insurtech during that period. The UK follows as the second-largest market, with only three major deals contributing to 96% of the total investments in the market.

In contrast, France had a relatively smaller share, with €30m invested in local insurtech players. These variations in funding highlight the specific dynamics and major players within each market.

Overall, this indicates that while a number of startups in the UK and Germany were successful in raising larger funding rounds, the French market was primarily focused on nurturing and supporting new ventures. The distribution of investments suggests that the French ecosystem may have been more active in terms of fostering early-stage startups and promoting the emergence of new players in the insurtech space.

And no market vertical is immune to insurance innovation

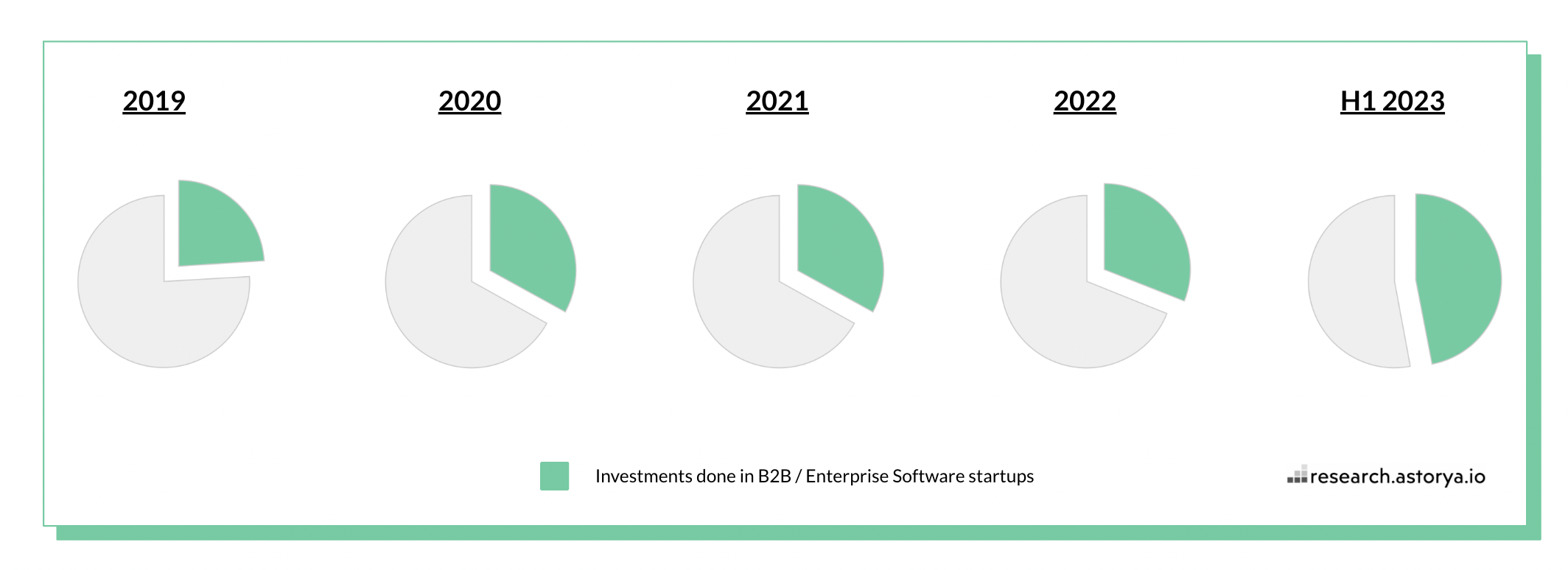

Beyond the distinctions in maturity and geography, there is another prominent trend shaping the insurtech market: the increasing presence of business-to-business (B2B) players. Nearly half of all funding rounds announced in the first half of the year were for startups that are focused on developing technologies for incumbent insurance companies, such as Software as a Service (SaaS) and enterprise software solutions.

This trend is not unique to the insurtech sector, as we see a similar shift towards B2B players in other industries, including fintech. While this trend may not come as a surprise, the data clearly demonstrates the significant growth and importance of B2B startups in the InsurTech space, particularly from 2019 onwards.

It aligns with the concept of "the innovator's dilemma," which suggests that internal innovation can be challenging in any industry. The "make or buy" dilemma also reveals a clear pattern of incumbents initially attempting to develop solutions internally before turning to the market for off-the-shelf solutions. Furthermore, in the realm of data and artificial intelligence, larger companies have the advantage of generating more accurate insights.

Consequently, corporations can achieve better results by collaborating with insurtech startups that also work with their competitors, rather than pursuing internal development. This counterintuitive approach is becoming increasingly recognized, with venture capitalists actively supporting such collaborative solutions.

Startups that adopt a direct-to-consumer approach witnessed rounds of funding announced in various business lines during the first half of the year, including property and casualty (P&C) insurance, health insurance, life insurance, and commercial insurance.

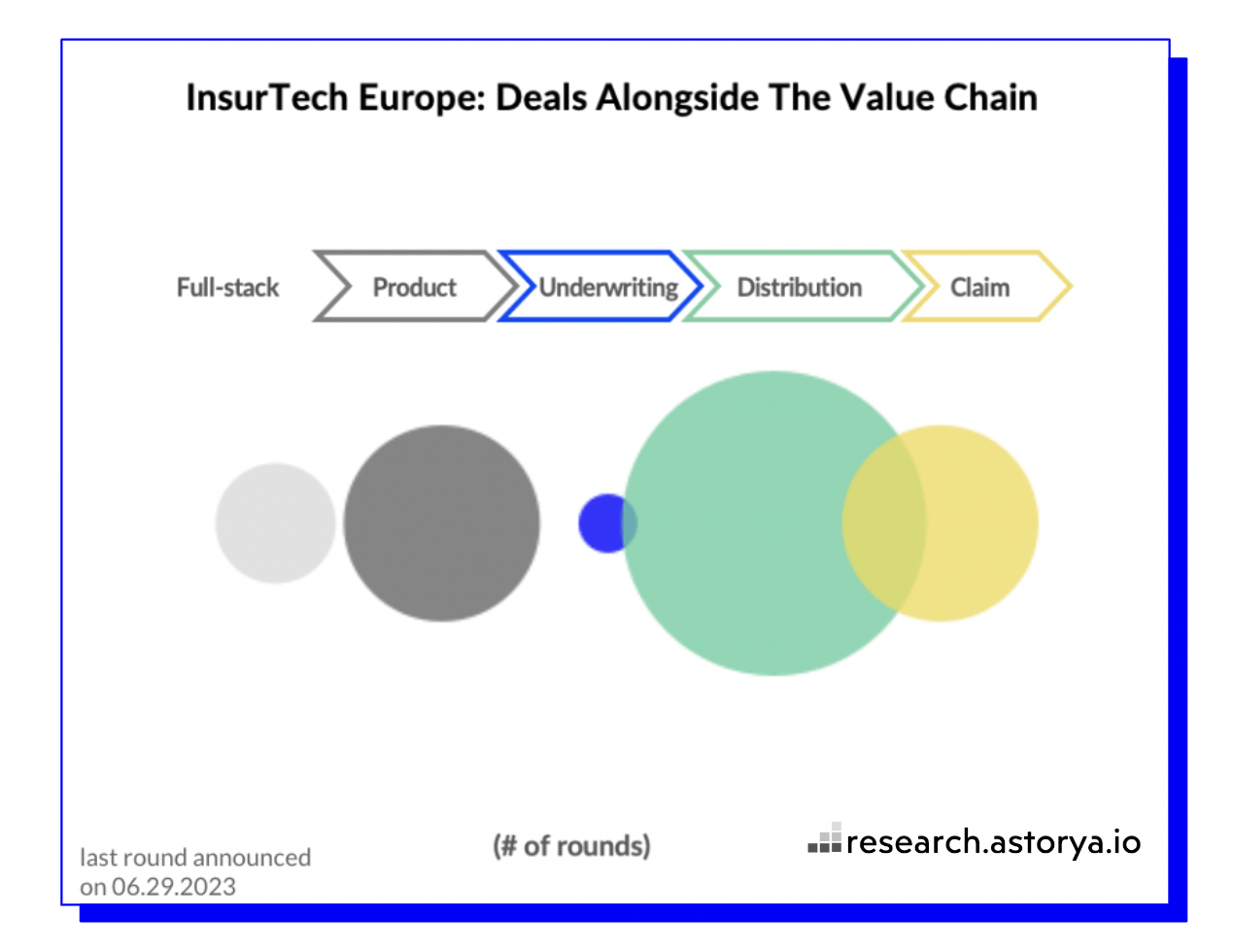

The value chain of the insurance industry was comprehensively covered by the deals announced in the first half of 2023. As expected, the "distribution" segment continued to dominate, representing more than half of all deals, a trend that has persisted since the inception of insurtech. However, what stands out is the increased activity in the "product" category, which encompasses new technologies addressing existing business lines, such as telematics in car insurance, as well as the emergence of "new risks."

The first half of the year saw significant investment in Cyber insurtech, followed by startups focusing on climate-related risks, and Coincover, which raised funds to address risks associated with digital assets.

There is still room for applying technology and innovation to the insurance industry

These new risks present a clear opportunity for insurtech players, as they are still unstandardized and often lack historical data. This necessitates the identification and access of new data sets, the utilization of algorithms to make sense of the data, and ultimately allows (re)insurers to assume these risks by understanding and pricing them accurately.

In addition to the collaboration between startups and incumbents, there is still ample room for digitisation within the insurance industry.

While the first wave of insurtech, which primarily focused on distribution and employed a direct-to-consumer strategy, is facing a critical juncture, the insurance industry as a whole lags behind its peers, such as banks and other industries, in terms of digital transformation.

The emerging trend of embedded insurance might be part of the solution to address this digitization need, although it is still in its early stages.

Furthermore, the influence of AI cannot be overlooked, particularly generative AI, which is pervasive in the market. The insurance industry is often recognized as one of the sectors most likely to be profoundly impacted by these technologies.

This is linked to the industry's pursuit of operational efficiency, with technologies serving as tools to empower employees at every level of the value chain. Generative AI is just one example of such technology. Moreover, AI-based insurtech startups are already delivering benefits to incumbents across Europe.

Would you like to write the first comment?

Login to post comments