It's no secret that inflation, skyrocketing interest rates, a practically non-existent IPO exit window, and harsh fundraising conditions have taken their toll this year. Digging into how these trends impact the tech ecosystem, PitchBook’s “Q2 2023 European Venture Report” provides a quarterly overview of deals, nontraditional investors, exits and fundraising for the region.

According to the report, European VC dealmaking dropped off a cliff in the first half of 2023, with deal value down 60.8% compared with H1 2022 and 34.2% lower than H2 2022. Exit activity isn't faring much better, according to Pitchbook, slowing to decade lows. When it comes to fundraising, LPs are playing a much more conservative game, favouring funds with longer track records. Adding some bittersweet icing to the cake, Pitchbook reports a decline in US investor participation in European VC deal value in 2023.

VC deals activity

As mentioned, VC deal activity recorded a significant drop in the first six months of 2023. With the 'growth at all costs' mentality' done and dusted, Pitchbook's report highlights the fact that VCs are working closely with their portfolio companies to help them restructure operations to prioritise cost management and extend runways. Ultimately, this has led to layoffs and hiring freezes across the entire startup ecosystem.

The report also shows that while there may be fewer deals, the financial figures attached to them are increasing, often in the form of follow-on VC investments providing additional runway to their startups.

Thus, €10 million to €25 million deals in Q2 are down 39.1% YoY in deal count, while €500,000 to €1 million and deals under €500,000 are down 65.9% and 64.0% YoY, respectively.

VC exit activity

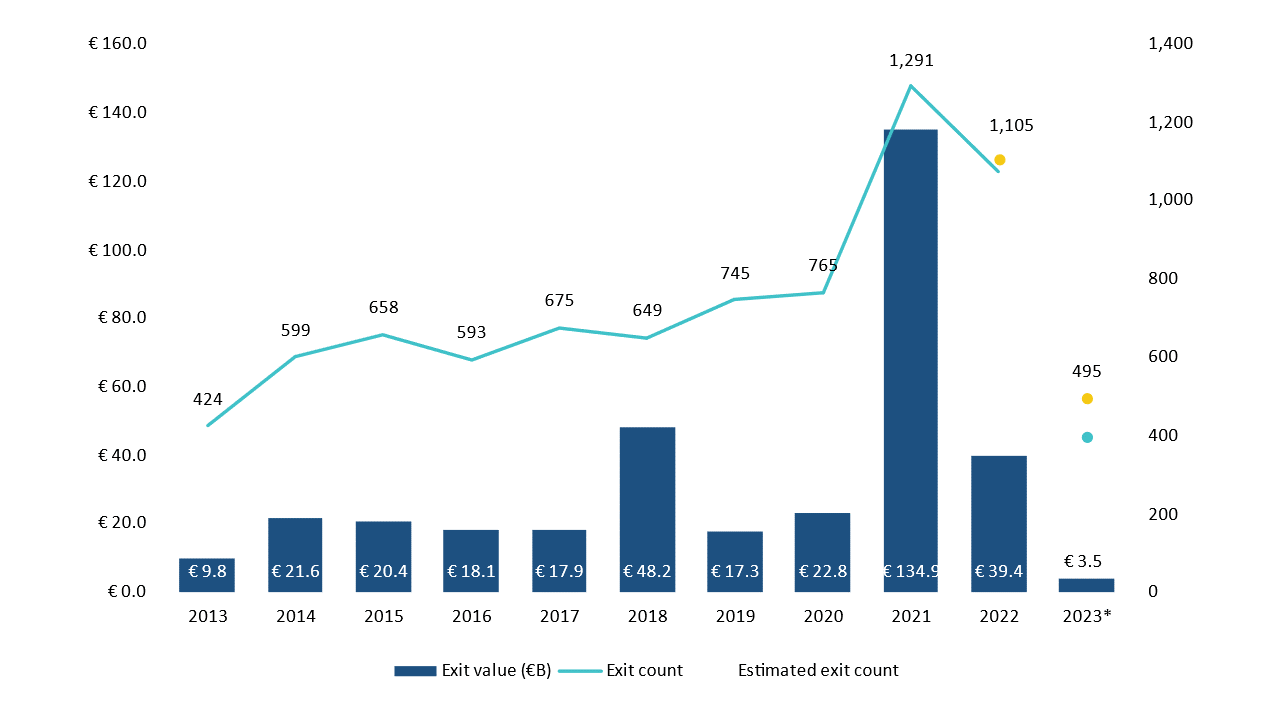

Exit values have declined, while asset prices remained depressed regardless of strategy. In H1 2023 exit value amounted to €3.5 billion. This run rate implies that 2023 will mark a drop of 82.2% compared to 2022’s total exit value. Similarly, exit count is pacing 10.4% below 2022.

While common deduction points to companies and investors being more cautious in 2023, Pitchbook's report provides the undisputable truth in the data.

Analysing exit activities by sectors, the report highlights that IT hardware shows the most resilience in exit valuations, energy shows the least resilience, and cleantech continues to be a prevalent vertical in demand.

VC fundraising activity

As for VCs raising capital, H1 2023 saw 60 vehicles in Europe raise €8.9 billion. This rate implies that the full year of 2023 is on track to pace 36.7% below 2022 levels if H2 shakes out in a similar manner to H1.

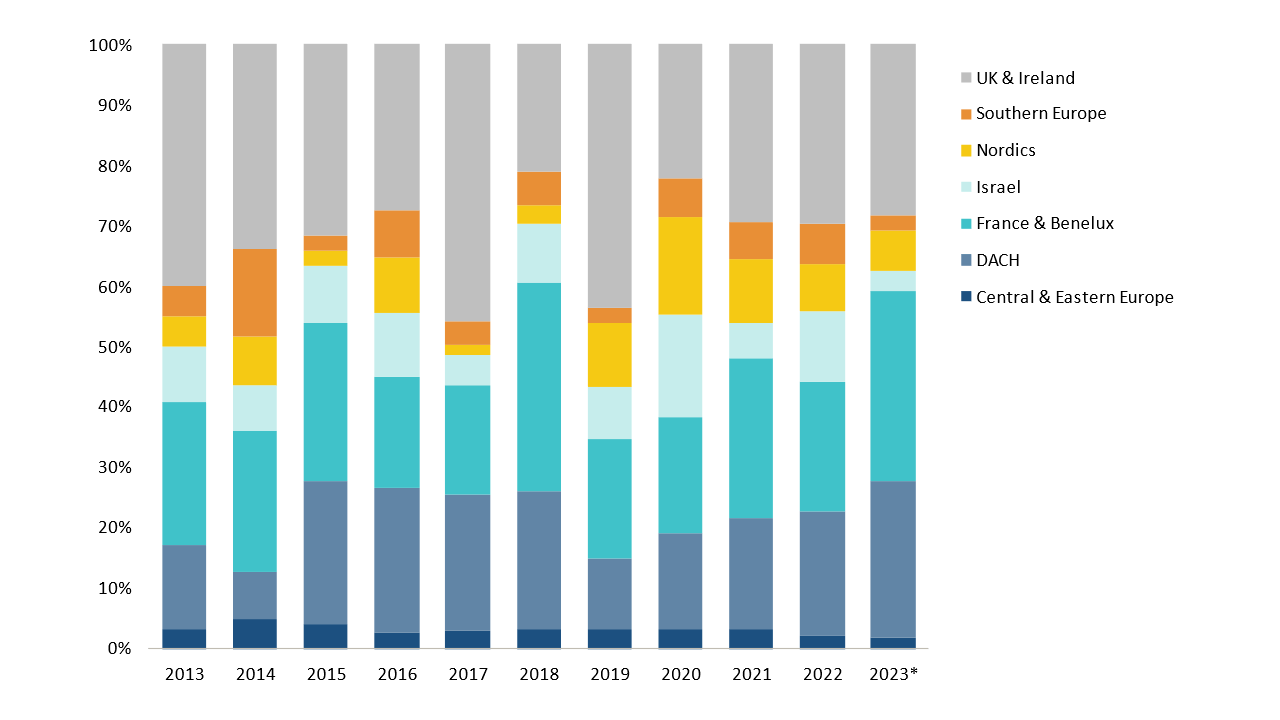

Regionally, UK and Ireland have recorded the most fund closings, followed by a tie between the Germany, Austria, and Switzerland (DACH) region and France and Benelux, representing 26.7%, 21.7%, and 21.7% of total fund count, respectively. Also, these three regions showed more resilience in H1 2023.

What's clear from Pitchbook's data, the shift in the macroeconomic environment is influencing the European tech ecosystem. The ecosystem is clearly adapting to these fluctuations and preparing as best as possible for the future with varied nuances.

While some might see 2023 H1 numbers and H2 predictions as doom and gloom, we'd all be well off to remember that industry titans are rarely born in times of prosperity and that the cycles of business are most often cyclical. Perhaps overused by now, but the phrase 'Keep Calm and Carry On' is, at the moment, most appropriate.

View PitchBook's Q2 2023 European Venture Report in full here.

Would you like to write the first comment?

Login to post comments