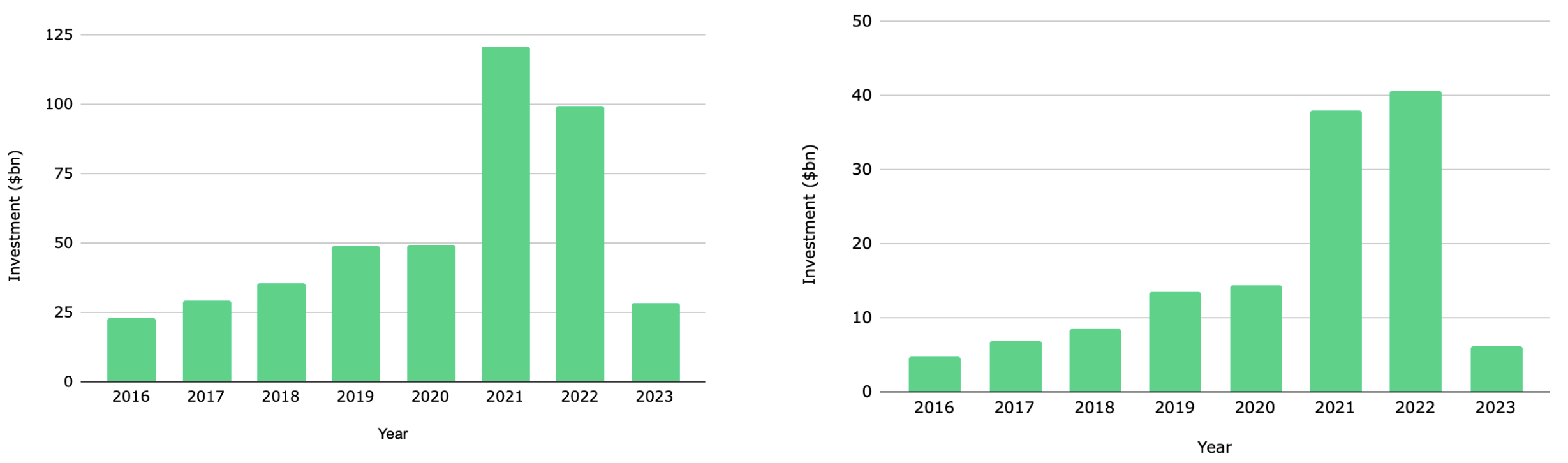

Business software firms have proven their resilience in the face of economic challenges, experiencing a remarkable 7.4% year-on-year surge in investment during 2022, even as the wider technology industry faced a downturn. Notably, the European technology sector as a whole encountered a nearly 19% decline over the same period.

These significant findings stem from a comprehensive analysis conducted by Notion Capital on the dynamic European business software ecosystem. The venture capital firm's research indicates that startups and scale-ups within the business software domain have exhibited exceptional performance, propelling their collective value from $712 billion in 2021 to an impressive $1.2 trillion in 2022.

Dr. George Windsor, Director of Research and Intelligence at Notion Capital and lead author of the report commented,

"There has been a clear downturn-busting trend, and the business software sector has performed very well compared to the rest of European tech. This signals how these companies are maturing and coming into their own, taking a more important place in the wider European tech sector"

The business software sector has rapidly evolved from its origins in B2BSaaS, now encompassing startups and scale-ups focusing on technologies including the omnipresent artificial intelligence, quantum computing, and blockchain. These technologies find applications across diverse industries. The research conducted by Notion Capital leverages data from both their resources and Dealroom, offering a pioneering examination of the business software category across Europe.

Business software companies are increasingly claiming a larger share of the European technology sector value, 30% of the total market value in 2022, or, $1.1 trillion out of the overall tech sector value of $3.7 trillion. This leap represents a notable increase from their 18% share of the total value in the preceding year. In tandem, Notion's findings indicate that Business Software startup valuations lept from $712 billion in 2021 to $1.2 trillion in 2022. In comparison, across the Atlantic, US Business Software startups valuation dropped by 12% from $4.2 trillion to $3.7 trillion, before regaining that lost value in 2023

Additionally, the study highlighted that European business software companies have maintained consistent employment levels, with a steady workforce of 2.8 million individuals from 2022 to 2023. This follows a substantial 27% employment surge in 2021.

The research further indicates that European business software entities are increasingly attracting foreign investment, with American and Asian investors playing a growing role. Notably, more than 40% of total investments in these firms during 2021 originated from US-based investors, who typically engage in later-stage investment deals.

To access the full report, "European Business Software Ecosystem Update" visit Notion Capital.

Would you like to write the first comment?

Login to post comments