A London-headquartered fintech backed by Spain’s second-biggest bank which has pivoted from providing financial assistance to freelancers to offering credit builder services is gearing up to raise as much as £8 million in a Series A funding round.

Wollit, founded in 2019, has reinvented itself as a credit-building fintech, a service which its founder says could be a launch pad for offering other financial services like lending and savings in the future.

Wollit previously provided a financial top-up service for freelancers and gig workers, aiming to improve their financial welfare by regulating the incomes of those not in full-time work.

Wollit previously provided a financial top-up service for freelancers and gig workers, aiming to improve their financial welfare by regulating the incomes of those not in full-time work.

However, Wollit pivoted away from this service during COVID, its founder Liad Shababo said, citing rising interest rates which, on the customer side, would likely lead to rising debts and defaults.

To date, Wollit has raised £3.5 million, via investors including Spanish banking giant BBVA and London-based fintech-focused VC Anthemis.

It is now looking to raise between £6 million and £8 million in a Q2 Series A funding round, with the capital to be used to scale the Wollit operation, including beefing up its sub-10 strong team and investment in marketing and development.

Shababo has spoken to existing investors about participating in the new round.

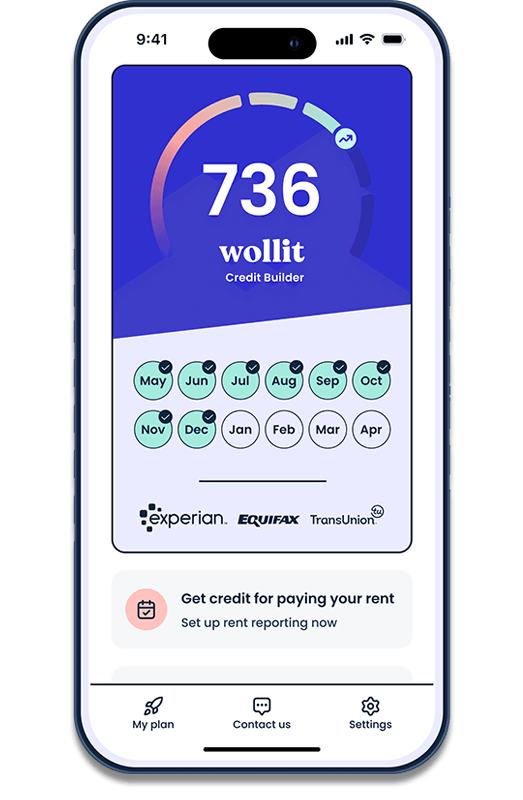

Wollit’s main product is called Wollit Credit Builder and is squarely designed to help improve an individual's credit score.

Wollit’s credit building plans were initially a side product to the startups' top-up service but “high demand” meant it supplanted it, says Shababo.

The plans are 12-month credit-building instruments, costing £9 a month, that users pay off in 12 monthly payments.

Wollit reports these as loan repayments, which make up a significant part of a user’s credit score, to major credit agencies like Experian and TransUnion.

Due to the loan structure, it means there is no risk of the borrower defaulting.

Shababo says the reason it is structured as a loan is because “essentially the only real way to build credit is to take credit and pay it back on time and that’s what provides the creditworthiness the agencies look at”.

It also has other credit-building type products, such as a Rent Reporting product and an Affordability Risk Monitor product.

Shababo says Wollit now has around 10,000 monthly subscribers.

He further comments:

“We saw about 600 percent revenue growth last year. Obviously, the gross margins are high because it’s kind of really a software product. There is no risk, there are no credit defaults there.”

Wollit has a consumer credit licence, which Shababo says it is likely to use in the future to launch new products.

On potential future products, Shababo says:

“We unlock credit scores, we can unlock savings, we can unlock lending and other products.”

As well as becoming increasingly popular with consumers, credit building is becoming an increasingly competitive area, with the likes of Loqbox and Monese offering similar type services.

Lead image via Wollit.

Would you like to write the first comment?

Login to post comments