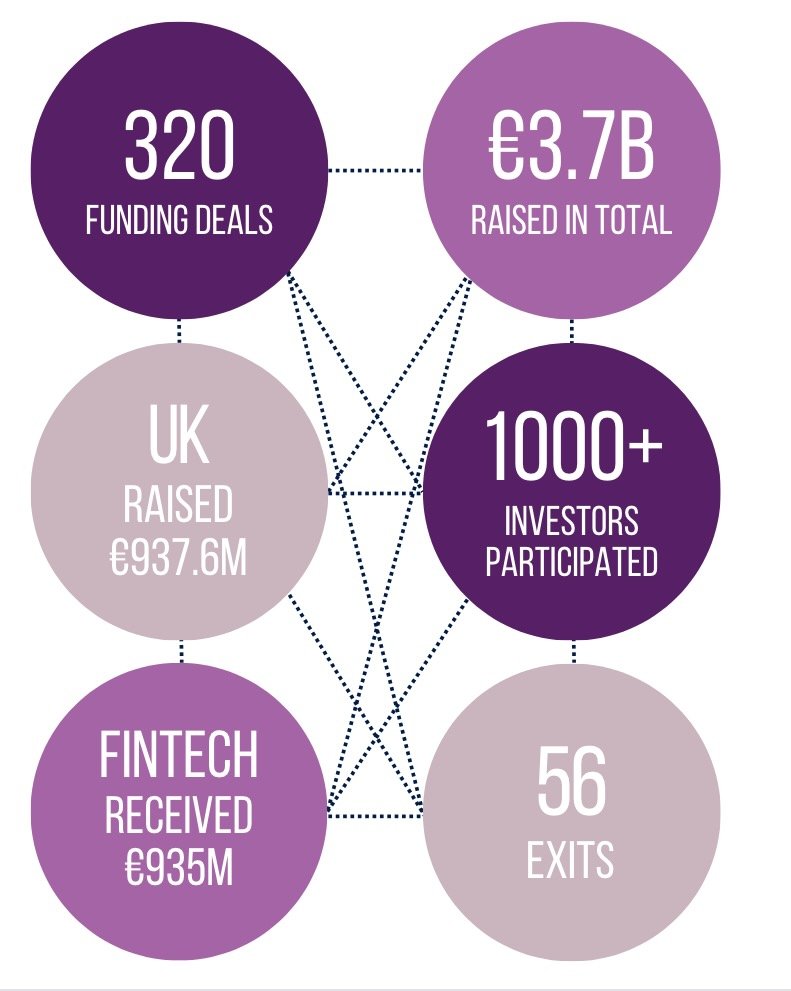

According to the Tech.eu database, European tech companies raised €3.7 billion over the course of April 2024 in some 320 deals.

This figure represents a decrease of around 15 per cent compared to the previous month (March 2024 saw an investment volume of €4.4 billion) and also a decrease of around 5 per cent compared to the same month a year before (investment volume in April 2023 was €3.9 billion).

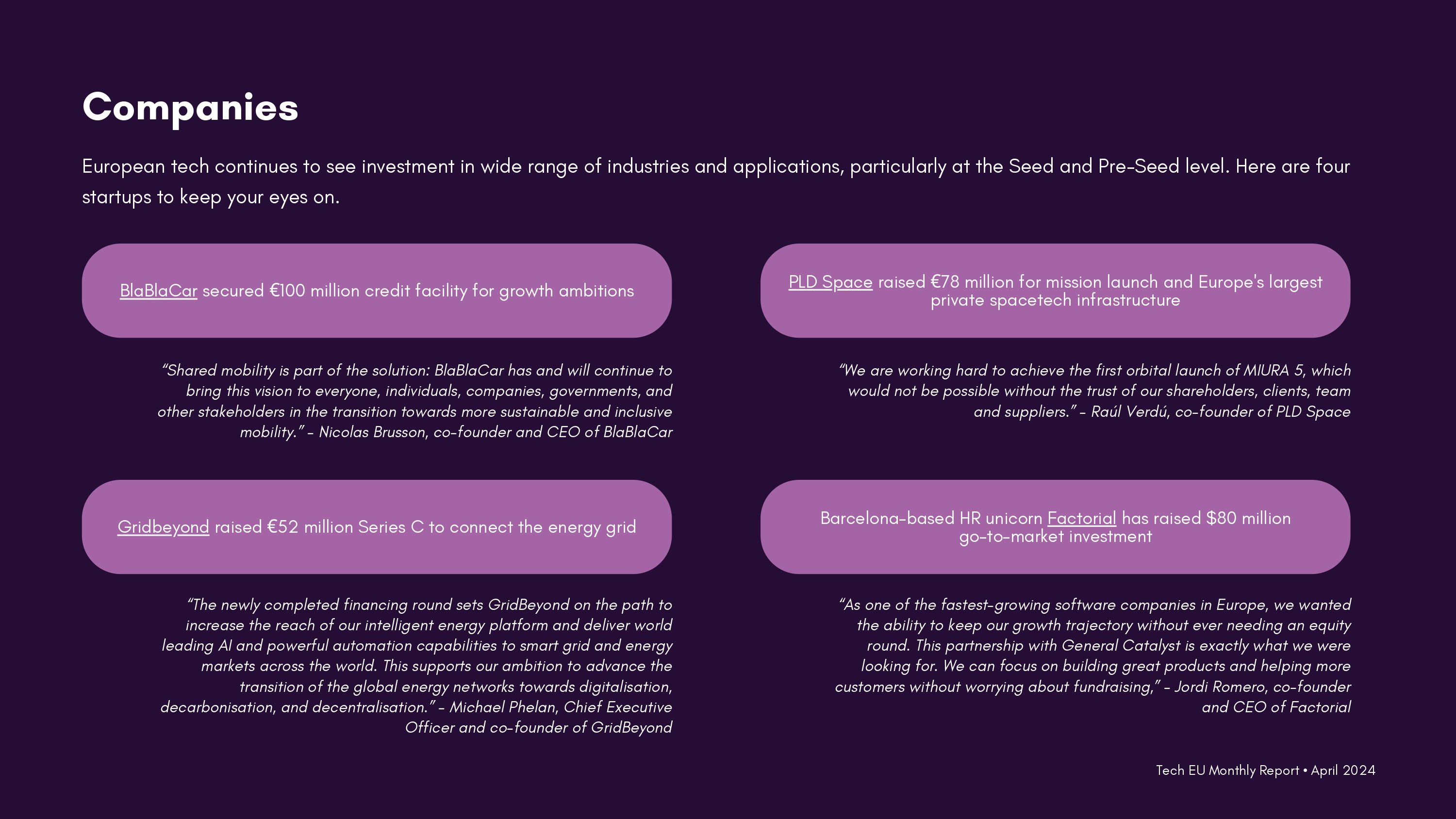

While overall figures have decreased, several large funding rounds demonstrate the ability of scaleups to secure the funds necessary to build their customer base, further develop their product offerings, and extend their reach internationally.

Companies

Out of 320 deals in April (a decrease of approximately 5 per cent year over year), 10 companies raised €100 million or more (each) while 43 were undisclosed deals.

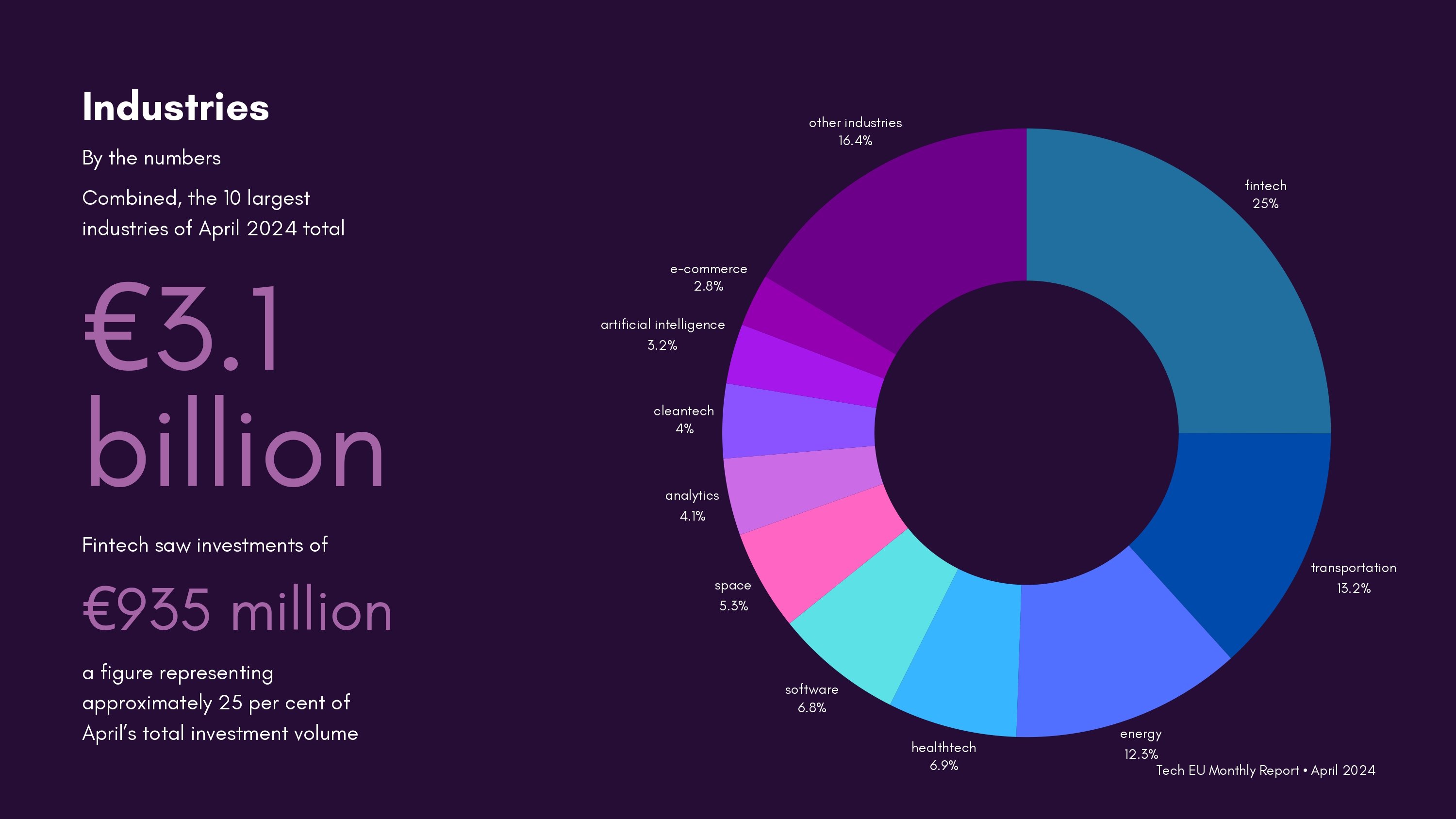

Industries

By funding amount

April 2024 sees Fintech take the top slot by far in terms of investment volume in European tech startups, garnering nearly 25 per cent of the monthly total at €3.7 billion.

By deal flow

IIn terms of deals, fintech received the highest support with 43 deals. The healthtech sector saw 33 deals, followed by software with 30 deals, energy and transportation with 14 deals (each).

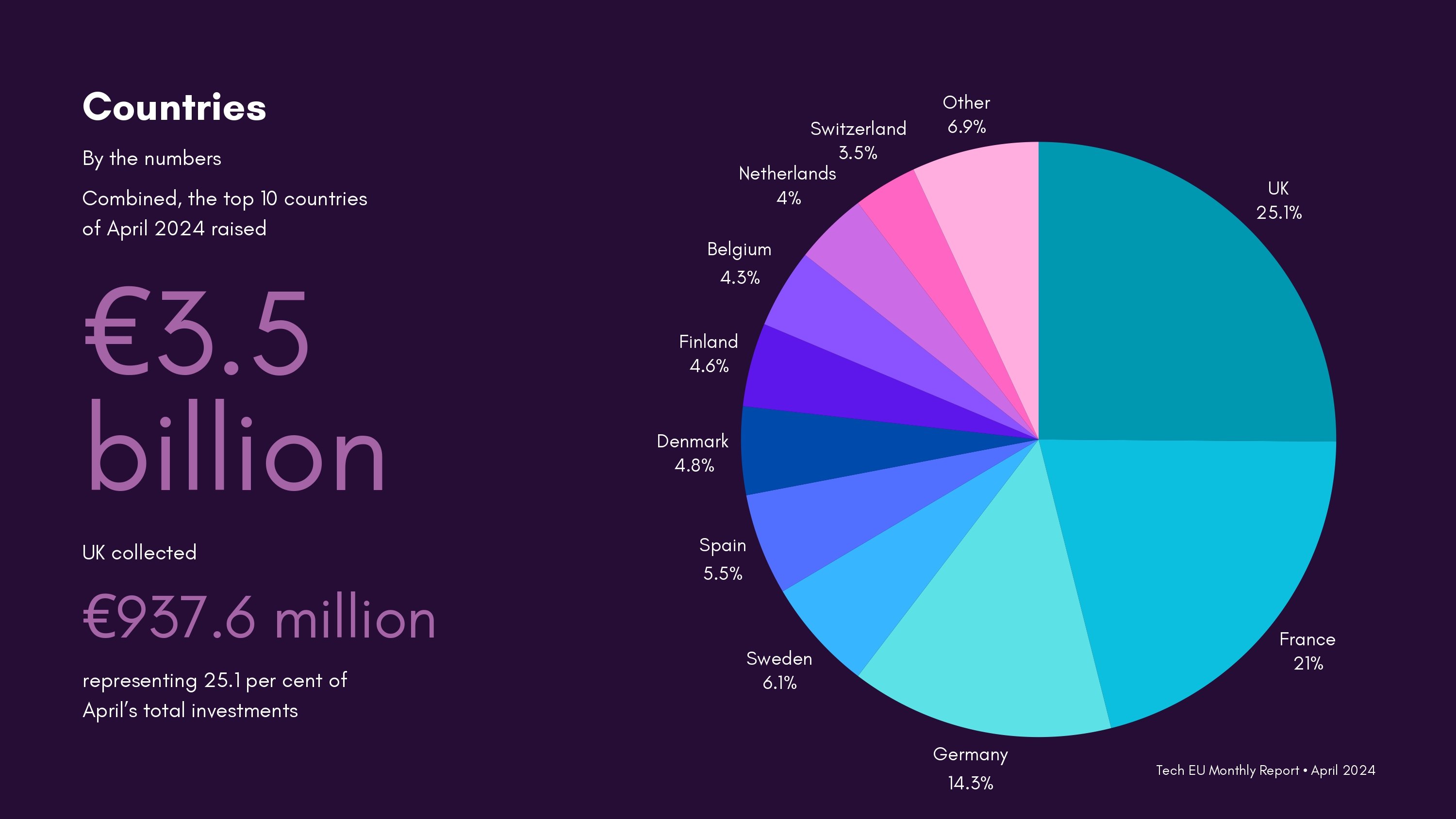

Countries

This month, pole position goes to the UK, with approximately €937.6 million raised across 68 deals. In 2023, UK companies raised €24.7 billion over the course of the entire year.

Rounding out the podium, France took second position with €782.8 million raised over 30 deals, followed by Germany with €534.1 million raised over 37 deals.

Beyond the traditionally well-funded countries, April 2024 marked the appearance of Denmark, Türkiye, Poland and Latvia.

Exits

In April, 52 exits were recorded, out of which 49 were, as to be expected, undisclosed, and 3 were valued at €3.8 billion.

The biggest exit was for the UK’s Audiotonix which was acquired by France's PAI Partners for £2 billion.

Additional notable exits include:

- Supply chain SaaS Nalanda acquired by Once For All

- Teylor acquired creditshelf in a quest to dominate European lending

- Agritech xFarm Technologies merged with Greenfield and Spacesense to hone its Geospatial AI

- Luxury assets platform Konvi acquired Diversified and Fractible

Grab the PDF version of this report for even more insights, including a special foreword from Sam Nasrolahi, Principal, InMotion Ventures.

Would you like to write the first comment?

Login to post comments