According to the Tech.eu database, European tech companies raised €10.6 billion over the course of May 2024 in some 311 deals.

This figure is almost three times bigger compared to the previous month (in April 2024 European tech companies collected €3.7 billion). The two biggest deals (closed by Imec and SumUp), worth over a billion (each) together secured more than all companies in the previous month.

When it comes to a number of deals, May was almost on the same level as the month before. The difference was in less than 10 deals closed in May compared to April.

Companies

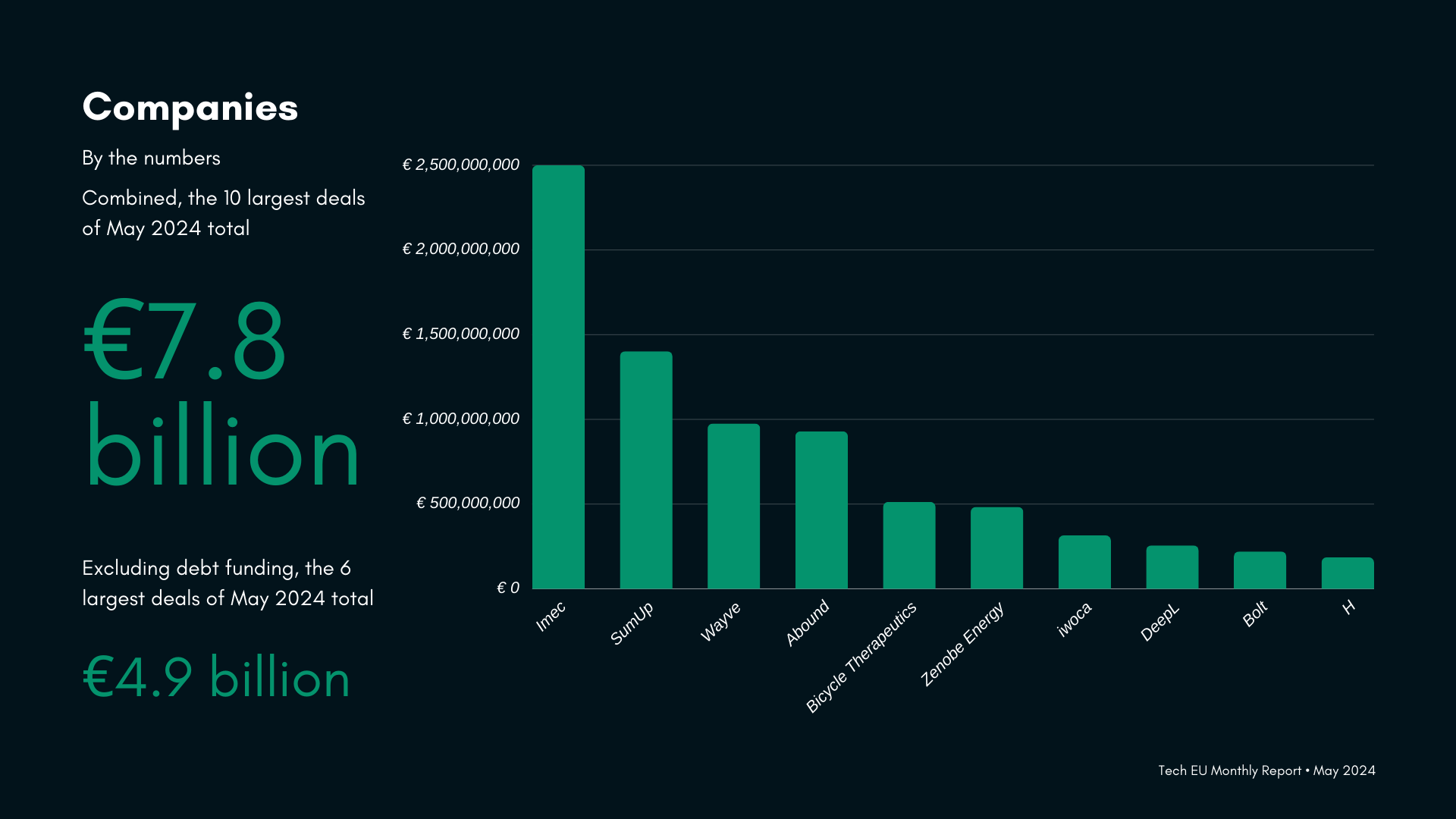

Out of 311 deals in May (a decrease of approximately 15 per cent year over year), 2 companies raised more than €1 billion (each), 15 companies raised more than €100 million (each) while the value of 34 remain undisclosed.

Industries

By funding amount

May 2024 sees Fintech take again the top slot in terms of investment volume in European tech startups, garnering 31 per cent of the monthly total at:

By deal flow

In terms of deals, fintech received the highest support with 51 deals. The software sector saw 37 deals, followed by healthtech with 36 deals, energy with 26 deals.

Countries

This month, pole position goes to the UK, with approximately €5.4 billion raised across 84 deals. In 2023, UK companies raised €24.7 billion over the course of the entire year.

Rounding out the podium, Belgium took second position with €2.5 billion raised over 9 deals, followed by Germany with €829.5 million raised over 38 deals.

Beyond the traditionally well-funded countries, May 2024 marked the appearance of Greece, Croatia, Lithuania and Hungary.

Exits

In April, 49 exits were recorded, out of which 46 were, as to be expected, undisclosed, and 3 were valued at €305 million.

The biggest exit was for the UK’s Glassbox which was acquired by UK’s by Alicorn Venture Partners for $150 million.

-

Additional notable exits include:

- Summa equity acquired majority stake in Fast LTA

- Access Legal acquired inCase to transform client communication and boost productivity

- Intelligence provider FE fundinfo acquired fintech Dericon

- Freepik acquired Spanish AI image upscaler Magnific

- Visma made third acquisition of 2024 with MyCompanyFiles

Grab the PDF version of this report for even more insights, including a special foreword from Martin Sokk, CEO and co-founder of Lightyear.

Would you like to write the first comment?

Login to post comments