Today, the launch of The Swiss Deep Tech Report 2025 spotlights how Switzerland has quietly become one of the world’s most advanced and efficient deeptech ecosystems.

Curated in close collaboration with Dealroom.co, Startupticker and venture capital firms Founderful and Kickfund, the report is the first of its kind to map the full scope of Switzerland’s deeptech performance - from research institutions and patents to venture activity and late-stage outcomes.

With over 1500 Swiss deeptech startups analysed and data spanning more than five years, the report positions Switzerland not just as a centre of academic excellence, but as a global-scale producer of science-based innovation and venture outcomes.

Notable points from the report:

Swiss deeptech companies have created more than $100 billion in combined enterprise value.

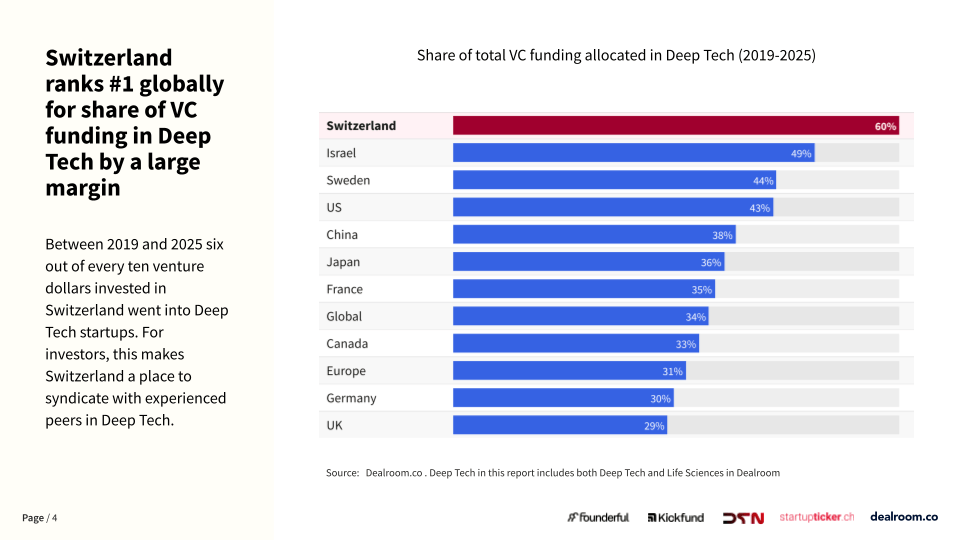

- From 2019 to 2025, Switzerland allocated 60 per cent of its total venture capital into deeptech — more than any other country globally.

- Over the same period, Switzerland ranked first in Europe and third worldwide for deeptech VC funding per capita, backed by both a strong domestic research base and increasing levels of international capital.

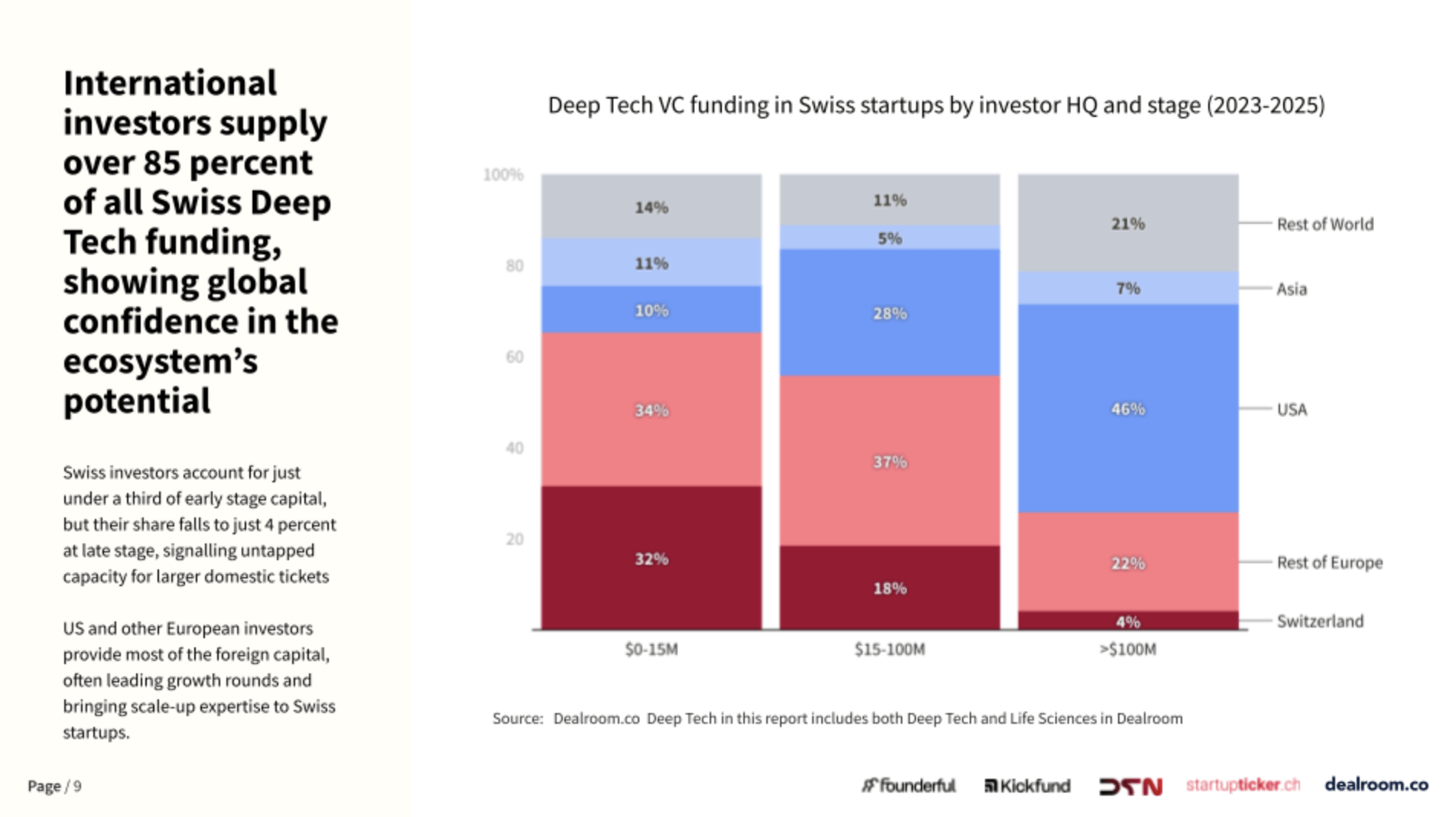

- Nearly 96 per cent of late-stage Deep Tech rounds in Switzerland were led by global investors, with US and EU firms now accounting for the majority of capital inflow.

- Behind Oxford and Cambridge, 2 of the top 4 universities creating deeptech spin-offs in Europe are Swiss: ETH Zurich and EPFL.

"Switzerland has long excelled in fundamental research, but we believe the next decade belongs to the scientists and engineers who turn that research into global companies," said Alex Stöckl, Founding Partner at Founderful.

"This report is about making that transformation visible - about telling the story of Swiss deeptech in hard data and positioning it clearly on the world stage. Founderful is proud to lead that effort."

The report also highlights a new generation of Swiss startups driving that shift.

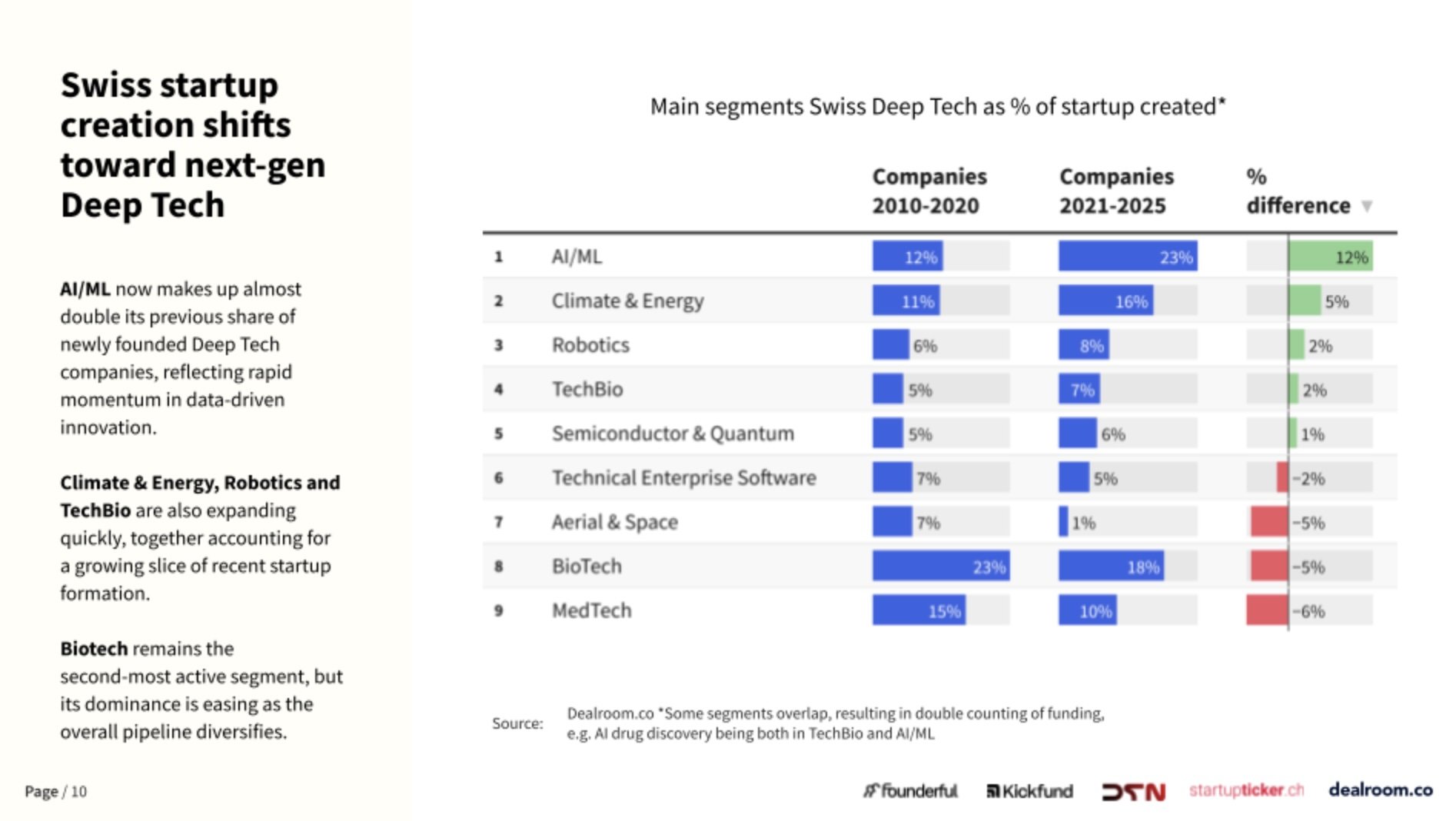

AI/ML already accounts for 23 per cent of companies founded since 2021, almost double its previous share. Climate & Energy, Robotics, and TechBio have each expanded at speed..

Further, despite making up only 1.3 per cent of Europe’s population, Switzerland holds 4.8 per cent of its core AI talent.

The strength of this cohort reflects a deeper pipeline forming at the intersection of academic excellence, local entrepreneurial talent, and increasing support from sector-focused investors.

According to Andy Yen, Founder and CEO of Proton:

“Switzerland has Europe’s most entrepreneurship-friendly employment laws and ample private capital, enabling the risk-taking necessary to innovate.”

Nicolas Autret of Walden Catalyst Ventures, shared:

“Switzerland has become a deeptech powerhouse on the global stage… Swiss success stories like ANYbotics, Scandit, and Climeworks are due to the convergence of academic excellence, a strong IP culture, and industrial collaboration.”

The international visibility of these startups is growing rapidly, but local capital, particularly at the later stages, remains limited, creating both a challenge and an investment opportunity.

According to Geraldine Naja, Director for Commercialisation, Industry and Competitiveness at the European Space Agency, the launch of the European Space Deep Tech Innovation Centre in Villigen, Switzerland is proving how precision science, agile industry and open collaboration can propel space technologies from lab to orbit.

"This new hub is more than a facility — it’s a testbed where European autonomy meets global opportunity. At ESA, we see Switzerland’s deeptech strengths as a catalyst for advancing Europe’s technological sovereignty, commercial competitiveness and innovation resilience.’’

Investors are reallocating capital toward the next wave of AI-powered verticals. In 2024 almost one-third of all Swiss deeptech funding went to AI-first startups, from generative protein design and industrial autonomy to foundation-model safety, tripling the share recorded in 2020.

Looking for more data-driven insights on Switzerland? Check out our analysis earlier this month.

Lead image: Pixabay.

Would you like to write the first comment?

Login to post comments