In the first half of 2025, European robotics financing totalled €618.7 million across 33 deals, roughly 1.8 per cent of all European tech capital (€33.7 billion) and 1.7 per cent of deal volume (1,941 deals).

While robotics remains a focused slice of the market, the period’s largest financings highlight a broadening scope: aerial systems for defence and geospatial intelligence, collaborative and humanoid platforms, medical exoskeletons, and drone solutions for renewable-energy maintenance and industrial inspection.

Logistics and manufacturing stayed busy with warehouse piece-picking, outdoor mobile robots for inspection and site logistics, modular automation cells, and software layers that power robot vision, autonomous picking, programming/orchestration, and systems integration. Long-range BVLOS platforms and marketplaces rounded out activity.

Together, these themes point to a sector shifting from pilots to scaled, mission-critical deployments across defence, healthcare, energy, and supply chains.

The following are the ten largest funding rounds in the European robotics industry during the first half of 2025.

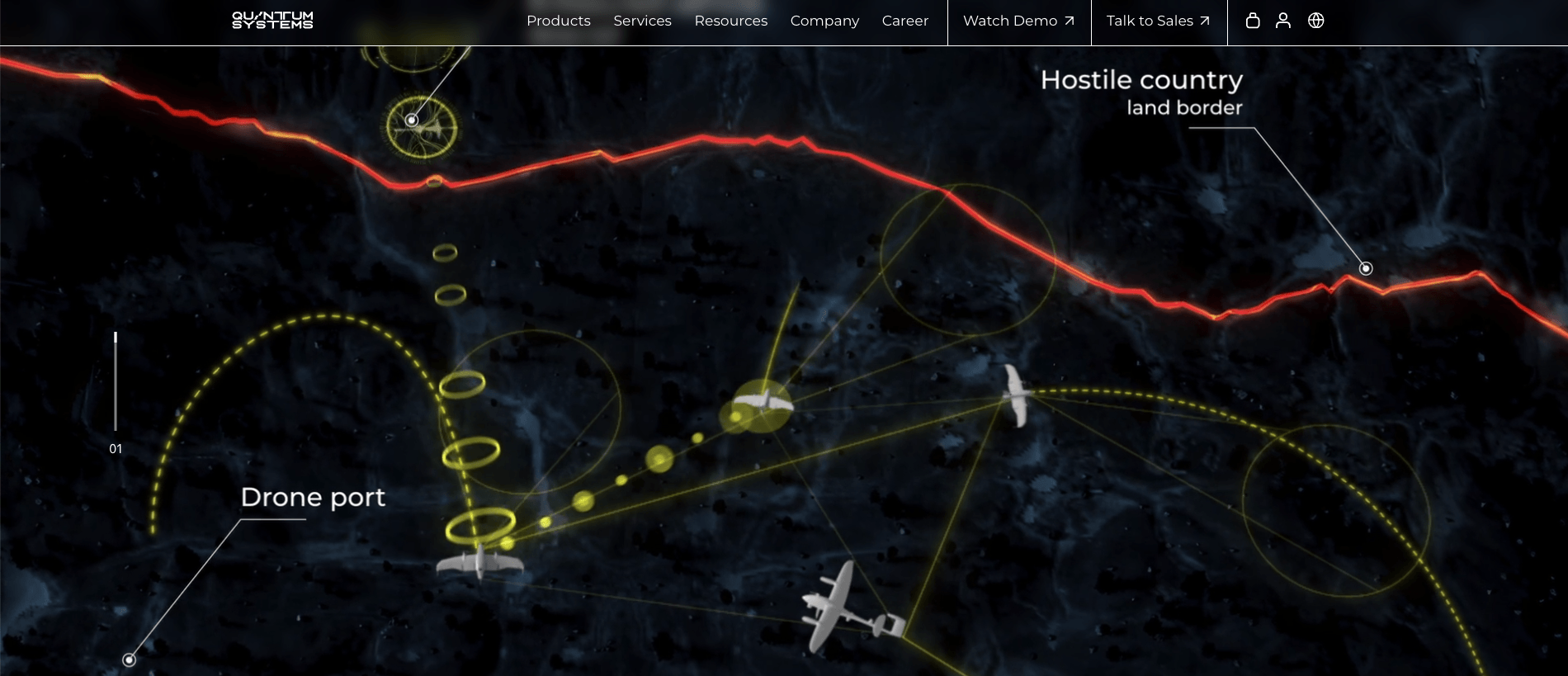

Quantum Systems (Germany)

Amount raised in H1 2025: €160M

Quantum Systems develops advanced aerial intelligence systems that integrate vertical-take-off-and-landing (VTOL) drones with high-performance sensors and mapping software.

Its product line, including the Trinity Pro, provides long-range drones and turnkey systems for defence, security, and geospatial applications. With a mission of “Aerial intelligence when it matters,” Quantum Systems enables critical operations in infrastructure inspection, ISR and remote sensing.

In May, Quantum Systems secured €160 million to scale its AI-powered aerial intelligence platform.

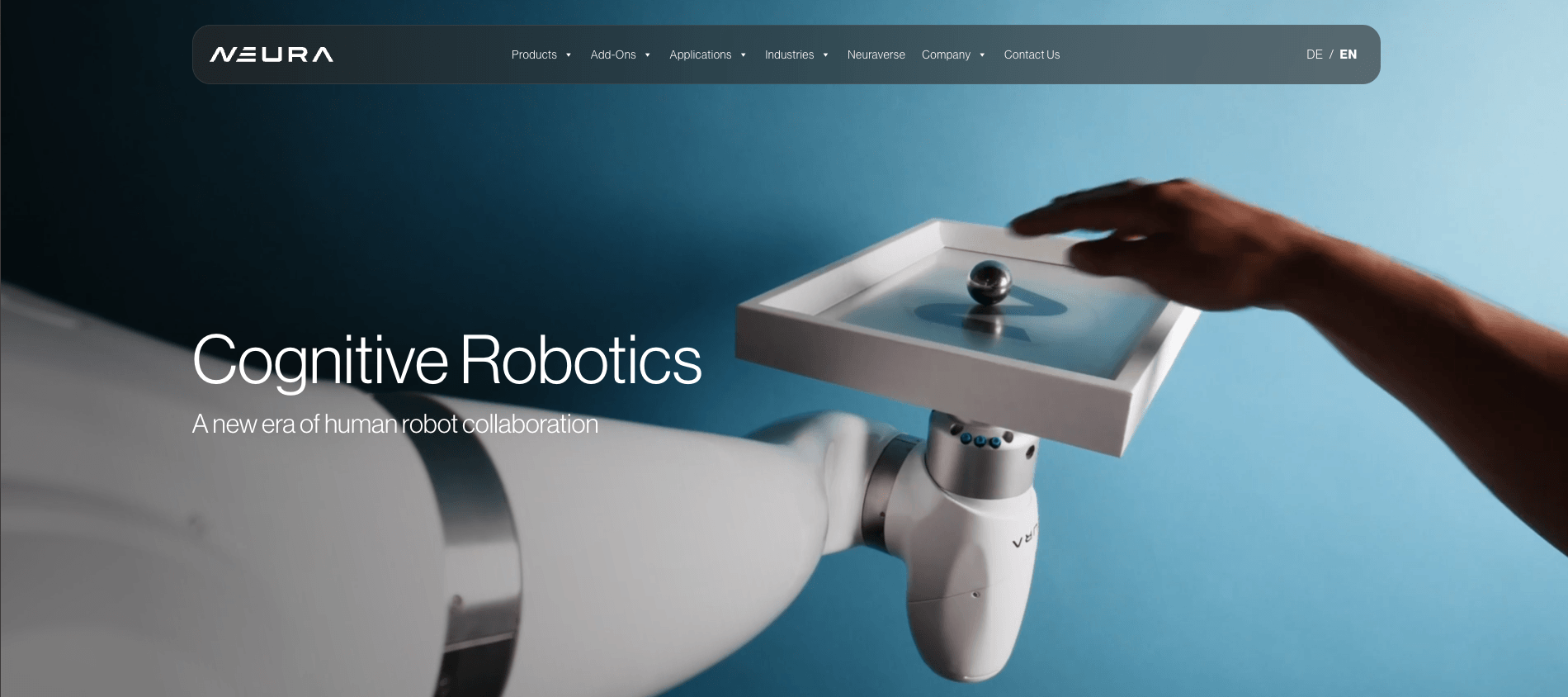

Neura Robotics (Germany)

Amount raised in H1 2025: €120M

Founded in 2019 in Germany, NEURA Robotics develops next-generation cognitive and humanoid robots that learn, adapt and collaborate with humans.

Its product range spans industrial, service and domestic robotics, including robot arms (MAiRA), mobile manipulators (MiPA) and humanoid platforms (4NE-1), all built on its proprietary AI platform and ecosystem (“Neuraverse”). The company’s mission is to make human-robot collaboration safe, intuitive and accessible across industry and everyday life.

In January, NEURA Robotics secured €120 million for its cognitive and humanoid robotics business, reinforcing its leadership in the field and positioning the company to lead Europe’s robotics industry and compete globally.

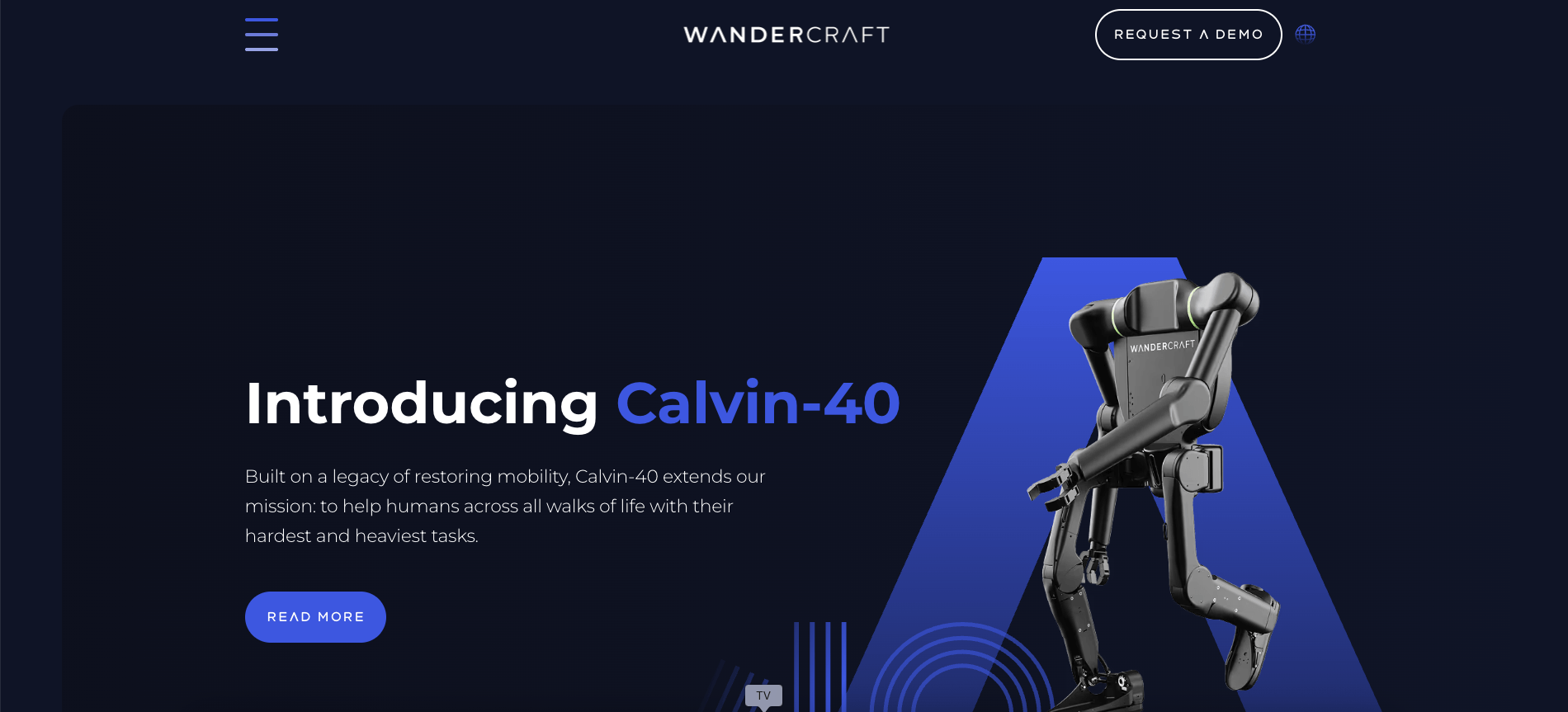

Wandercraft (France)

Amount raised in H1 2025: $75M

Wandercraft is a French robotics company on a mission to put movement, for people, industry and humanity, at the heart of engineering innovation.

Leveraging artificial intelligence and real-world experience, Wandercraft has developed the world’s first self-balancing personal exoskeleton, “Eve”, enabling individuals with severe motor impairments to walk both indoors and outdoors. The company also designs advanced robotics for rehabilitation and industrial applications, striving to restore autonomy, dignity and freedom of motion.

In June, Wandercraft secured $75 million for global acceleration of AI-powered robotics.

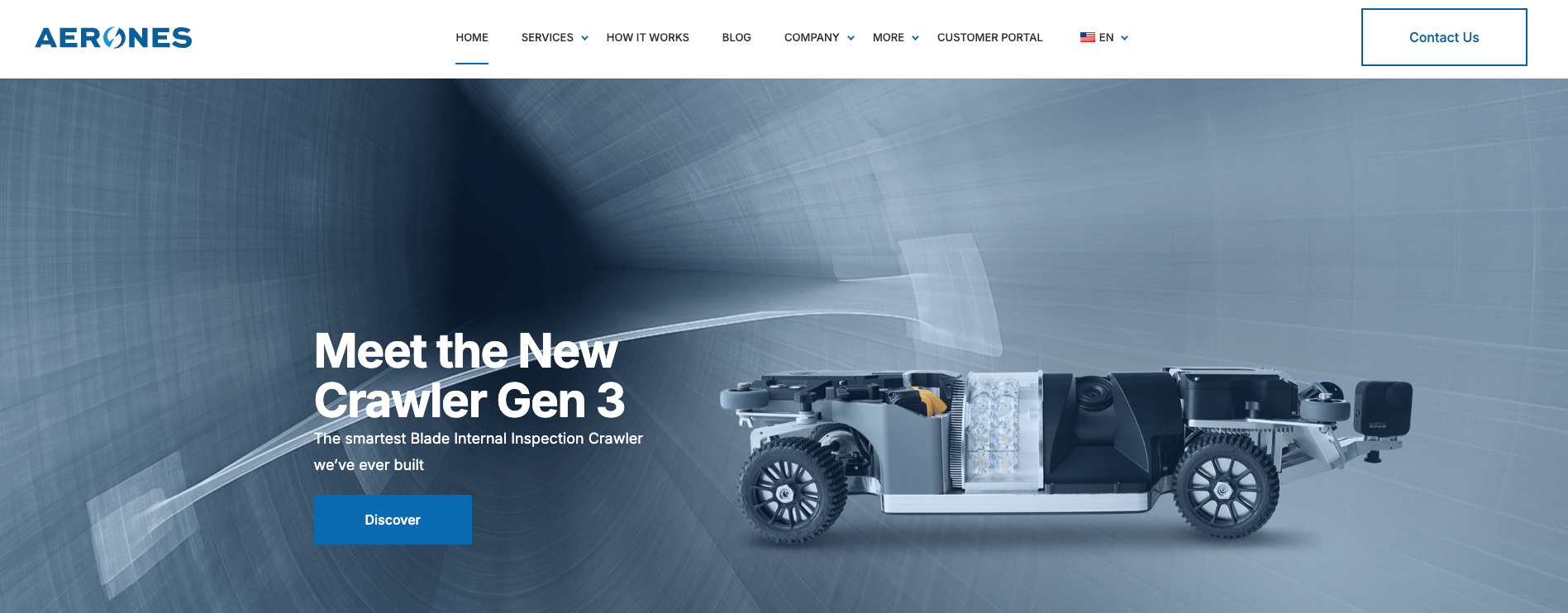

Aerones (Latvia)

Amount raised in H1 2025: $62M

Aerones is a pioneering robotics firm dedicated to transforming wind-energy maintenance.

By deploying patented robotic systems tailored for blade and tower inspections, cleaning, coating and repairs, the company enables wind-farm operators to boost efficiency, reduce downtime and enhance safety by replacing risky human processes. Aerones serves major global wind-power players, helping the industry move faster, cleaner and smarter.

In June, Aerones closed $62 million round to expand its global operations and develop artificial intelligence-assisted maintenance technologies.

Nomagic (Poland)

Amount raised in H1 2025: $44M

Nomagic delivers AI-powered “pick and place” robotics solutions designed to transform warehouse automation for leading retailers, manufacturers and logistics companies.

Their systems combine advanced vision, machine learning and robotics to boost accuracy in picking, packing and sorting operations. With 24/7 monitoring, remote operations support and a technology roadmap driven by teams from top tech backgrounds, they help clients scale into future-proof, lights-out warehouse fulfilment.

In February, Nomagic secured $44 million in funding to accelerate its European expansion and advance its investments in AI and robotics technologies.

ARX Robotics (Germany)

Amount raised in H1 2025: €31M

ARX Robotics develops Europe’s next-generation autonomous mobile robotics and digitalisation platform designed to modernise legacy fleets.

They offer modular robotic systems, called “autonomous all-rounders”, and their software suite Mithra OS for transforming existing vehicles into connected, AI-enabled assets. With a focus on modularity, open APIs, and rugged performance, ARX Robotics aims to enhance productivity and resilience across commercial and defence missions.

ARX Robotics raised €31 million in April to advance military automation.

Sereact (Germany)

Amount raised in H1 2025: €25M

Sereact offers an AI-powered automation solution designed for warehouses, delivering “day one” intelligence with over 98 per cent accuracy on any robot, without retraining or retooling.

Their technology integrates with existing systems and hardware (from cube storage to conveyors and autonomous mobile robots), enabling robots to pick, place, and adapt across workflows. With a production-ready vision-language-action model trained on millions of real-world picks, they provide a plug-and-play “brain” for robots, enabling fully autonomous operation in messy warehouse environments.

In January, Sereact raised €25 million to boost AI robotics zero-shot visual reasoning.

Capra Robotics (Denmark)

Amount raised in H1 2025: €11.3M

Capra Robotics is a Danish company that designs and builds versatile mobile robot platforms tailored for inspection, logistics and urban maintenance applications.

Based on its patented wheel-frame architecture, Capra delivers deployment-ready autonomous systems that work both indoors and outdoors to handle tasks like perimeter monitoring, facility logistics, de-icing and more. The company emphasises seamless integration, agility, and scalability to automate demanding environments.

Capra Robotics secured €11.3 million in January to create mobile robots to help people wherever they go.

Voliro (Switzerland)

Amount raised in H1 2025: $11M

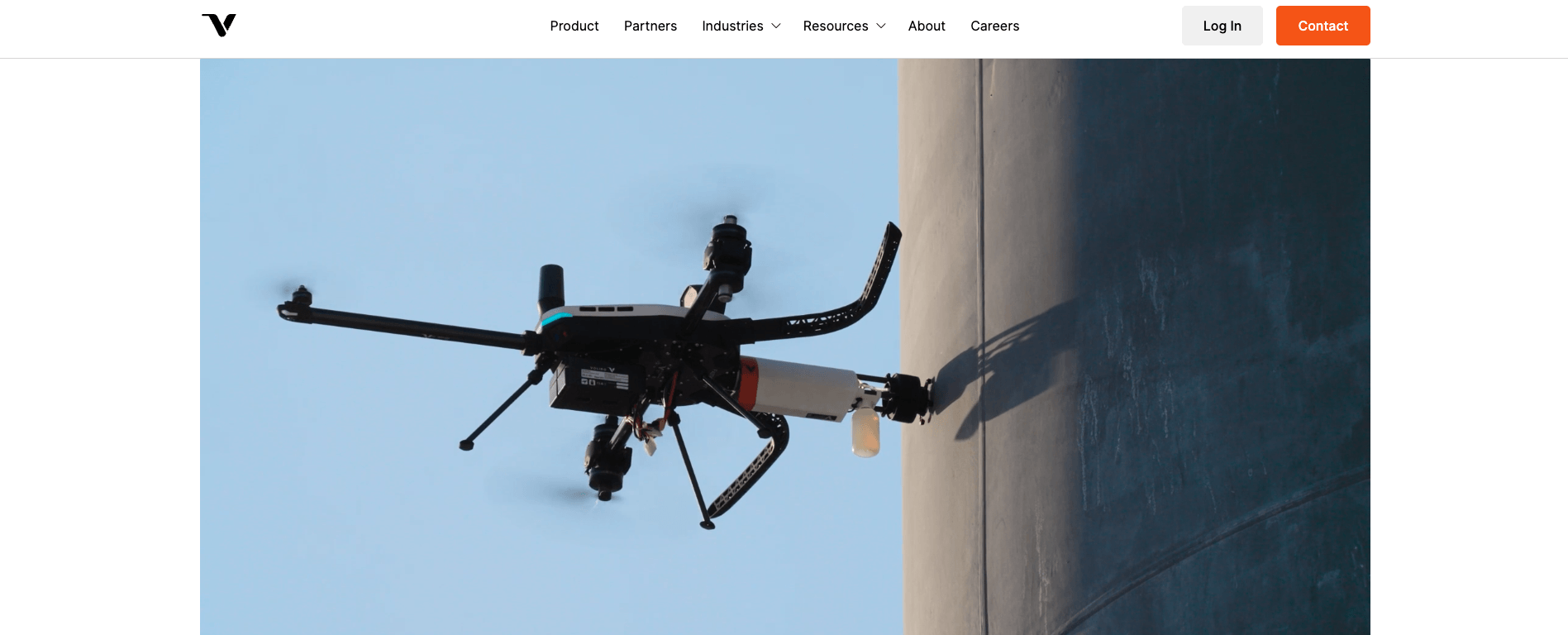

Voliro is a Swiss company specialising in drone-enabled non-destructive testing solutions.

Their flagship platform, the Voliro T, features tiltable rotors for omnidirectional mobility and can apply stable force and torque for contact inspections. Designed for industries like oil & gas, chemicals, wind energy, and infrastructure, it enables inspections in complex or high-risk environments, boosting safety, speed, and cost-effectiveness.

In June, Voliro secured $11 million to modernise infrastructure with aerial robotics.

Unchained Robotics (Germany)

Amount raised in H1 2025: €8.5M

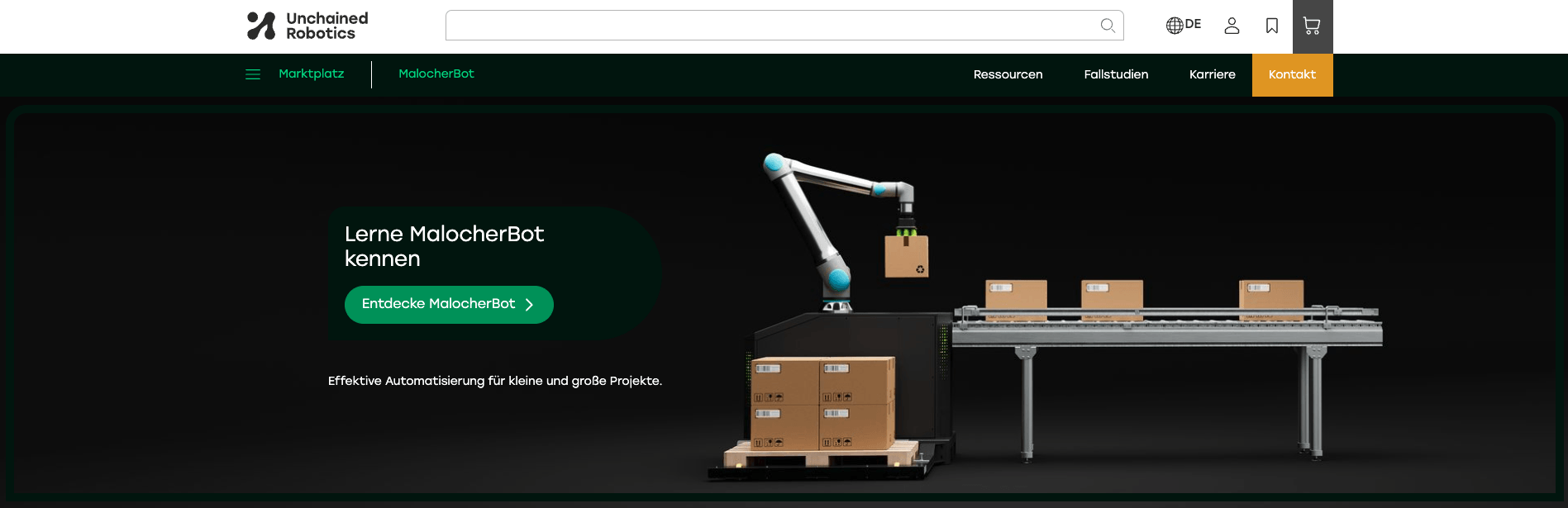

Unchained Robotics is an automation-platform company whose mission is to simplify access to robotics for manufacturers of all sizes.

They offer a brand-agnostic online marketplace and configurator that lets users compare robots, grippers, cameras and other components, with transparent pricing and specs.

For turnkey applications, they provide their modular cell system “MalocherBot” paired with their operating system “LUNA OS”, enabling pre-configured automation solutions that can be set up quickly and without deep programming expertise.

In June, Unchained Robotics raised €8.5 million to support the international expansion and further development of its intelligent software.

Would you like to write the first comment?

Login to post comments