Traveltech is one of the industries that quietly shapes how the European technology ecosystem operates. Behind every itinerary is software that simplifies trips, from policy-compliant bookings and automated approvals to organised expense tracking, allowing travellers to focus on the journey rather than administration.

In the background of every stay, digital hospitality platforms keep things running smoothly: property-management systems connect reservations, housekeeping, maintenance, and payments, while real-time revenue tools adjust prices to keep rooms full and margins healthy. Together, all of this forms a resilient ecosystem, gradually redefining how travel is planned, booked, and experienced.

The following are the ten largest funding rounds in the European traveltech industry during the first half of 2025.

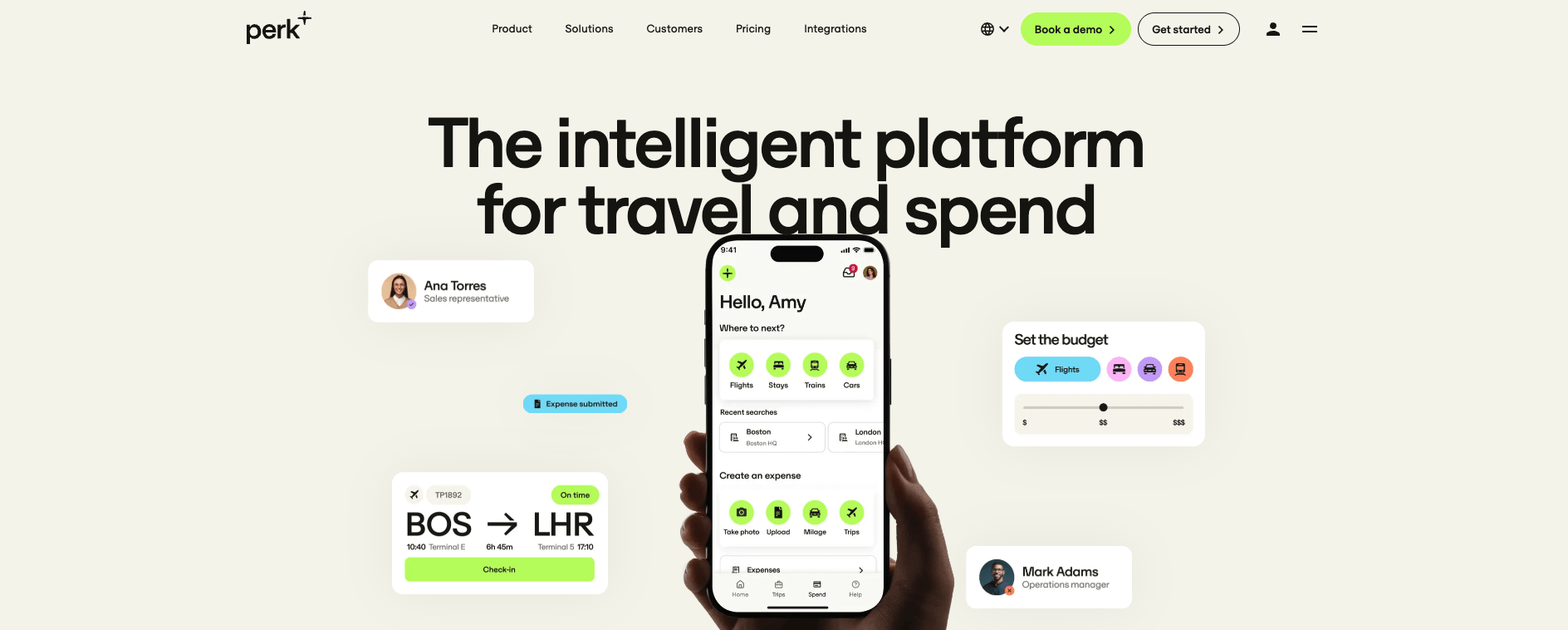

Perk (Spain)

Amount raised in H1 2025: $200M

Perk (formerly TravelPerk) is a cloud-based platform that brings together travel booking, expense management and invoice payment into a single intelligent suite.

It empowers teams to book and manage flights, trains, accommodation and cars, process expenses and invoices with AI automation, and gain real-time control and visibility over company spend and travel policy compliance.

In January, the company completed its Series E funding round, raising $200 million and nearly doubling its valuation to $2.7 billion.

Mews (Netherlands)

Amount raised in H1 2025: $75M

Mews Systems is a cloud-native hospitality management platform designed to streamline and elevate hotel operations. Its integrated suite includes property management (PMS), revenue management (RMS), point-of-sale (POS), guest tools like digital keys and virtual concierge, and full payment capabilities.

The system is trusted by over 12,500 properties worldwide, helping them automate manual tasks, personalise guest experiences, and grow revenue, all via a single intuitive platform.

In March, Mews raised $75 million to support its expansion in the US and DACH regions, accelerate platform innovation through AI-powered revenue management capabilities, and drive strategic acquisitions and R&D initiatives.

RoomPriceGenie (Switzerland)

Amount raised in H1 2025: $75M

RoomPriceGenie is a dynamic, automated revenue-management platform tailored for independent hotels, B&Bs and small chains.

It uses advanced algorithms and competitor/data-driven insights to set optimal room pricing every day, allowing hoteliers to boost revenue while maintaining full control and transparency.

In February, RoomPriceGenie raised $75 million to support its global expansion and develop a new generation of API integrations designed to streamline revenue management for independent hotels worldwide.

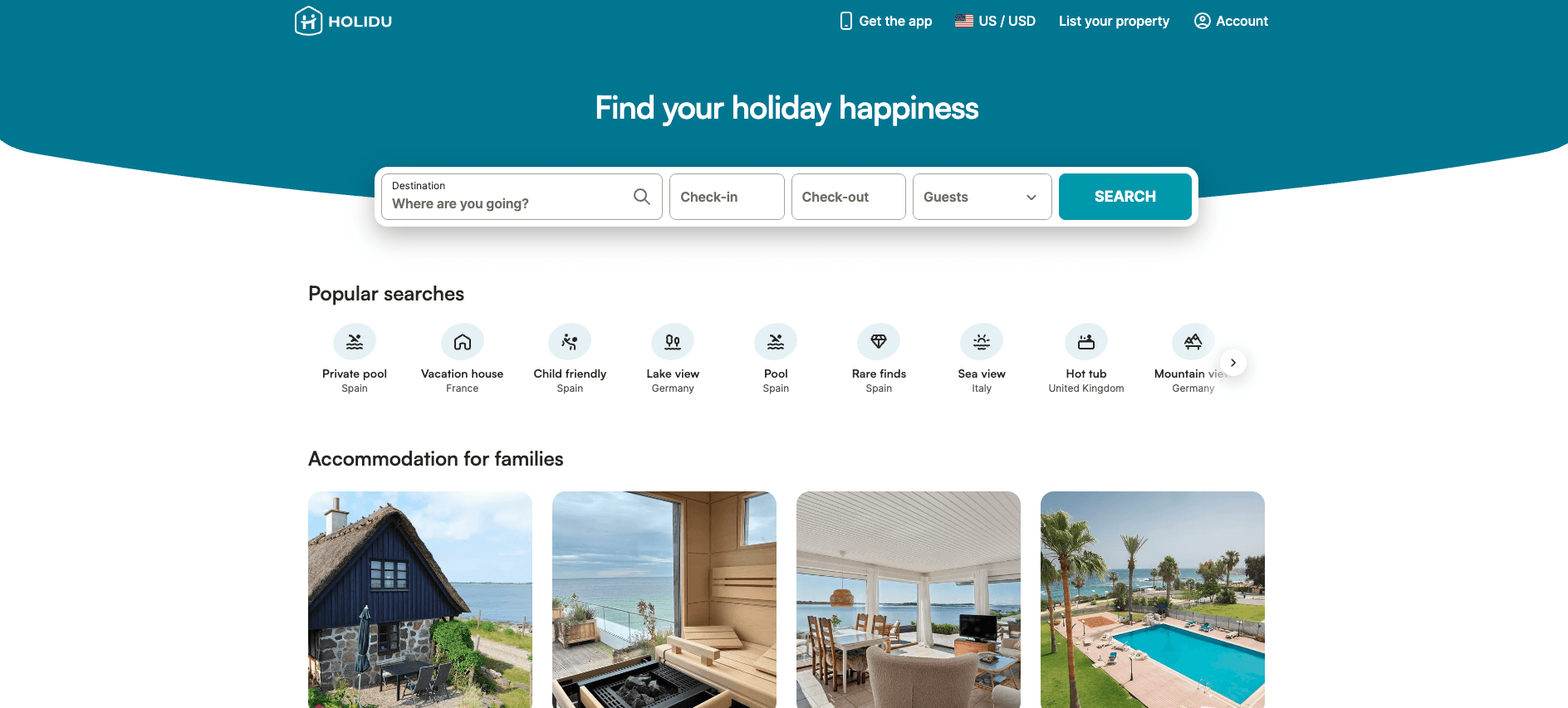

Holidu (Germany)

Amount raised in H1 2025: €46M

Holidu is a Munich-based tech company that operates a vacation-rental search and booking platform across Europe, offering travellers access to thousands of privately managed holiday homes with secure booking and comparison features.

At the same time, Holidu supports property owners and managers with tools to list, manage and optimise their rentals, enabling visibility across multiple booking portals and simplifying operations.

In June, Holidu raised €46 million in a growth financing round to accelerate its AI development roadmap, expand its Property Management Software (PMS) business, and drive further growth in key strategic markets.

Roadsurfer (UK)

Amount raised in H1 2025: €30M

Roadsurfer is a global camper-van and RV rental company offering fully-equipped vehicles for road-trip adventures across Europe and North America.

With flexible bookings, unlimited mileage in many locations, and a range of vehicle classes, from compact camper vans to larger motorhomes, the platform caters to both first-time campers and seasoned van-life enthusiasts.

In February, Roadsurfer secured €30 million through an asset-backed financing round to cover all planned fleet investments for 2025, enabling further expansion of its vehicle fleet across existing markets in Europe and North America.

Exoticca (Spain)

Amount raised in H1 2025: €25M

Exoticca is a Barcelona-based online tour operator, founded in 2013, that designs and sells all-inclusive vacation packages, including flights, hotels, transfers and guided or self-guided tours, to destinations around the world.

With a strong emphasis on value, technology and convenience, Exoticca offers carefully crafted itineraries at competitive prices by combining destination experts with its proprietary booking ecosystem.

In February, Exoticca secured a €25 million venture debt facility from BBVA Spark to strengthen its market position and support ongoing development initiatives.

HolaCamp (Spain)

Amount raised in H1 2025: €21M

HolaCamp is a Barcelona-based outdoor hospitality company operating a network of modern campsites and glamping destinations across the Iberian Peninsula.

They blend nature and comfort by offering thoughtfully designed accommodations under the banner “#CampStories,” coupled with digital booking and guest-experience tools.

In addition to running its own sites, HolaCamp provides centralised services to third-party campsite owners, such as revenue management, quality control and customer service, to elevate operations within the traditionally fragmented camping market.

In June, HolaCamp secured €21 million in debt financing from Banco Santander’s Smart Fund, which supports high-growth initiatives that are sustainable, innovative, digital, and foster job creation.

Naboo (France)

Amount raised in H1 2025: €20M

Naboo is an all-in-one platform for planning corporate retreats and events, letting teams book venues, catering, activities, and transport in just a few clicks.

It connects companies with curated locations and providers, streamlining off-sites, seminars, and team-building across Europe and North America.

In January, Naboo raised €20 million to meet growing demand in the UK market throughout 2025, and to further expand its European presence across Germany, the Netherlands, Spain, and Italy.

Gaiarooms (Spain)

Amount raised in H1 2025: €10M

Gaiarooms is a hospitality platform that operates a network of hotels, hostels and apartments across Spain, offering fully-digitalised accommodations with automated check-in/out, 24/7 online reception and smart-lock technology.

It also provides property owners with operational and revenue-management services to transform their assets into modern, efficient rental units.

Gaiarooms closed a €10 million round in March to revolutionise digital hotel management.

Hotiday (Italy)

Amount raised in H1 2025: €5.5M

Hotiday is a travel-tech startup offering a unique “Room Collection” concept, partnering with hotels to curate distinctive rooms tailored for modern travellers.

It not only addresses the challenge of unsold inventory but also equips hotels with powerful tools, including a proprietary revenue management system and advanced data analytics, to optimise pricing strategies and maximise profitability.

In May, Hotiday raised €5.5 million to launch new locations in major European resorts and cities, enhance its service offerings for partner hoteliers, and grow its team.

Would you like to write the first comment?

Login to post comments