In the first half of 2025, European deeptech is characterised by a strong emphasis on engineering, a focus on climate and industrial applications, and an increasing concentration on hardware-based solutions. The landscape is dominated by technologies that require long R&D cycles, specialised talent, and close ties to labs, pilot customers, and regulated markets, yet many ventures are clearly moving from prototype into industrialisation and early-scale deployment.

A lot of effort is going into making core systems cleaner and more efficient, like energy, materials, and infrastructure that sit underneath everything else. At the same time, there is a growing focus on technologies that improve how industrial systems are monitored and managed, enabling organisations to gain clearer visibility into complex operations, identify issues earlier, and improve performance in reliability-critical environments.

The following are the ten largest funding rounds in the European deeptech industry during the first half of 2025.

Marvel Fusion (Germany)

Amount raised in H1 2025: €50M

Marvel Fusion is a company focused on developing commercially viable fusion power systems.

Founded in 2019, the company is pioneering a laser-driven approach to nuclear fusion that aims to deliver safe, reliable, and low-carbon energy at scale. Its technology combines intense, short-pulse lasers with advanced fuel targets to initiate fusion reactions, seeking a pathway to compact and efficient fusion power plants.

Marvel Fusion collaborates with industrial and research partners as it works toward building the first generation of fusion energy facilities, positioning itself as a leader in the emerging private fusion energy sector.

In March, Marvel Fusion secured a €50 million extension to its Series B round, bringing total funding in the round to €113 million, as the company moves from research and development toward industrial deployment.

H2SITE (Spain)

Amount raised in H1 2025: €36M

H2SITE is developing advanced solutions to enable the sustainable production and transport of high-purity hydrogen.

The company’s proprietary membrane reactor and separator technology uses highly selective palladium-alloy membranes to extract and purify hydrogen from a range of feedstocks, including ammonia, methanol, syngas, and biogas, as well as from mixed gas streams.

Founded in Bilbao in 2020 as a deep-tech spin-off, H2SITE’s innovations are designed to address key challenges in the hydrogen value chain by making hydrogen more accessible and cost-effective for a range of uses.

In January, H2SITE raised €36 million to support the next phase of development of the company’s hydrogen technology, including plans to increase purification capacity to more than 20 tons per day by 2026.

Intelligent Energy (IE) (UK)

Amount raised in H1 2025: £17M

Intelligent Energy is a hydrogen fuel cell manufacturer that develops and produces proton-exchange membrane (PEM) fuel cell power systems.

The company offers zero-emission fuel cell products ranging from approximately 800W to over 300kW for various applications, including automotive, aerospace, stationary power, telecommunications, marine, rail, unmanned aerial vehicles, and materials handling.

Headquartered and manufacturing in the UK, Intelligent Energy works with partners and customers globally to support the deployment of hydrogen-powered solutions.

Intelligent Energy received £17 million in government-backed funding in June.

Keey Aerogel (UK)

Amount raised in H1 2025: €18M

KEEY Aerogel is a materials company founded in 2015 that develops and manufactures aerogel-based thermal insulation solutions.

The company produces sustainable silica aerogel using a patented process that upcycles construction waste, positioning its material as a local, competitive alternative to conventional insulation products.

KEEY Aerogel also provides R&D support and scale-up services to adapt and industrialise aerogel products for customer needs, with a stated goal of building a network of local production facilities in Europe.

In January, Keey Aerogel raised €18 million in Series A to scale Europe’s first green aerogel.

SemiQon (Finland)

Amount raised in H1 2025: €17.5M

SemiQon is a quantum hardware company developing silicon-based quantum processors designed to support the scale-up of quantum computers toward the “million-qubit era.”

The company builds quantum integrated circuits using standard semiconductor materials and manufacturing methods to improve scalability, cost efficiency, and sustainability.

In addition to quantum processors, SemiQon develops cryogenic CMOS (cryo-CMOS) chips for next-generation technologies that require reliable performance at very low temperatures.

SemiQon raised €17.5 million in funding in February to boost its cryogenic CMOS technology.

Chipiron (France)

Amount raised in H1 2025: $17M

Chipiron is a French medical imaging company developing an ultra-low-field, portable MRI system designed to make MRI more accessible and easier to deploy.

The company’s approach uses very low magnetic fields and aims to reduce the size, cost, and infrastructure requirements of conventional MRI, while targeting diagnostic-quality imaging for broader screening and clinical use.

In April, Chipiron raised $17 million in a Series A round to complete the development of its compact and lower-cost MRI system.

ATLANT 3D (Denamrk)

Amount raised in H1 2025: $15M

ATLANT 3D is a deeptech advanced manufacturing company developing atomic-scale fabrication technologies for microelectronics, optics, photonics, sensors, and other high-precision industries.

Its proprietary Direct Atomic Layer Processing (DALP) platform enables atomically precise material deposition and patterning, supporting rapid innovation across the full value chain from materials R&D and prototyping to scalable production of micro- and nano-devices.

ATLANT 3D’s tools and services aim to reduce design iteration time, lower costs, and expand manufacturing capabilities for complex applications, while maintaining compatibility with semiconductor industry standards.

In March, ATLANT 3D secured $15 million for space manufacturing, with support from NASA and ESA.

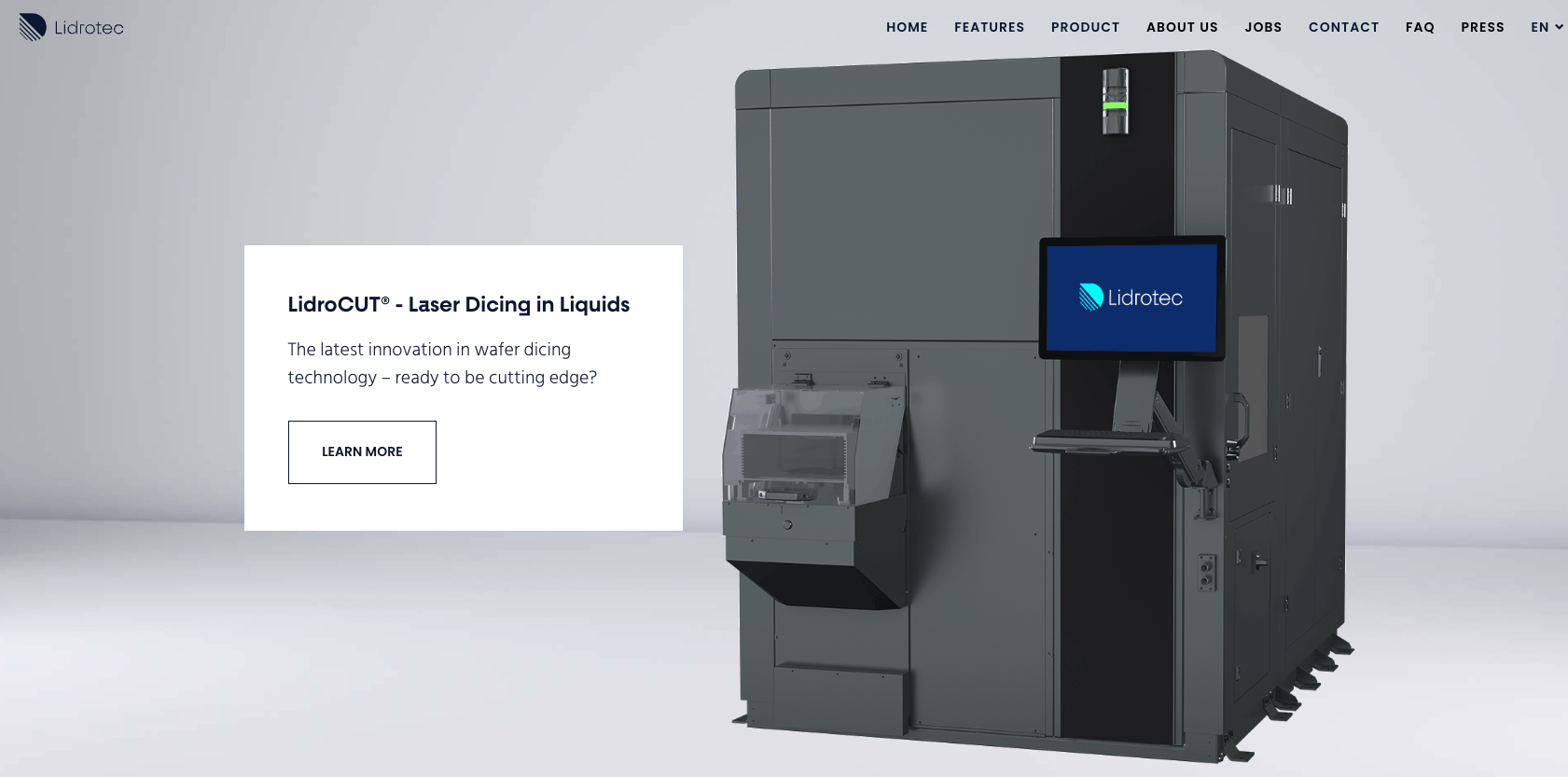

Lidrotec (Germany)

Amount raised in H1 2025: $13.5M

Lidrotec is a laser systems company focused on high-precision wafer dicing and micromaterial processing for the semiconductor industry.

Its technology combines ultrashort-pulse laser processing with controlled fluids to cool and clean the cutting zone, aiming to reduce heat damage, particle defects, and material waste while improving yield and cut quality.

The company develops equipment for cutting and structuring microchips and other high-tech components, with applications also extending to areas such as electronics, energy, and medical technology.

In June, Lidrotec raised $13.5 million to tackle semiconductor yield bottlenecks.

FononTech (Netherlands)

Amount raised in H1 2025: €8.5M

FononTech is an advanced manufacturing company developing Impulse Printing, an additive manufacturing technology designed for high-volume assembly of complex 2D and 3D microelectronic structures used in semiconductor and display manufacturing.

The company’s core products (including an impulse printhead and plate system) are built for integration into production environments and aim to enable smaller, higher-performance electronics while reducing material waste, energy use, and the overall manufacturing footprint.

In May, FononTech raised €8.5 million to finalise the development of its first product and accelerate customer acquisition efforts.

Axiles Bionics (Belgium)

Amount raised in H1 2025: €6M

Axiles Bionics is a company that designs and develops next-generation bionic prosthetics for lower-limb amputees.

The company focuses on intelligent ankle-foot prostheses that aim to better replicate natural movement by combining biomechanics with technologies such as robotics and artificial intelligence to support improved mobility and comfort in everyday use.

In June, Axiles Bionics closed the first €6 million of its €8 million Series A round to globalise its biomimetic prosthetic foot.

Would you like to write the first comment?

Login to post comments