Kroo, formerly known as B-Social has raised £17.7 million in a Series A round. The funding is slated to expand the team, secure a full banking license, and “mobilise” the bank in advance of an official launch early next year. To date, the firm has raised approximately £27.6 million.

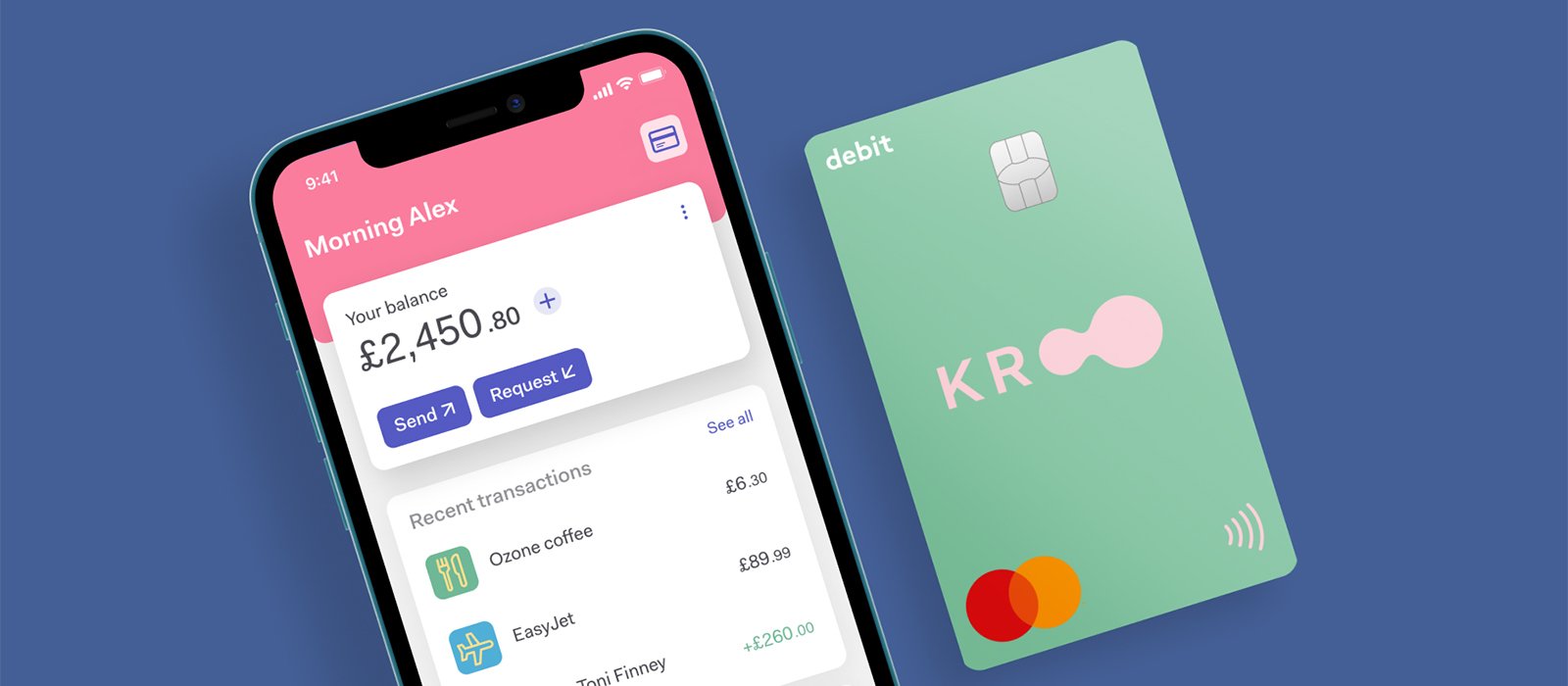

Founded in 2016, the main goal of Kroo is to remove the anxiety and awkwardness of financial interactions with friends and family. While not yet an official bank, the service achieves this goal through prepaid debit cards, and “innovative” ways for individuals to track their personal social finances. Some of these innovations include creating groups with friends and split and pay bills quickly.

Once obtaining a full banking license, Kroo intends on providing a platform that offers FSCS deposit protection and competitive loans. In early 2022.

Kroo’s Series A funding was led by Karlani Capital founder Rudy Karsan.

“The reason I’m excited about Kroo is that it has a concrete opportunity to dramatically change the way people feel about their bank, for good. Kroo has an exceptionally talented management team and a nimble tech stack that will enable the continuous delivery of banking features customers really care about. I’m confident Kroo is building a sustainable bank and am excited to support them on the next stage of their growth journey,” commented Karsan.

Call me a bit cynical here, but even looking at Kroo’s product roadmap, I’m hardpressed to see what the differentiator is here over any number of available fintech services. £27.6 million for a service that “expects to launch in early 2022”? And this is all dependent upon obtaining an official banking license?

Would you like to write the first comment?

Login to post comments