Swiss fintech startup Numbrs has just raised more than €36 million ($40 million) for its app that enables users to manage their existing bank accounts in one place, to buy financial products and make savings with the use of machine learning. According to the company, that allegedly counts 50 individuals and families among its investors, the recent round of funding brings the total capital invested to almost $200 million.

“Venture capital and private equity funds tend to have less patience. They get nervous when it takes longer for a startup to earn money,” said Martin Saidler, CEO of Numbrs.

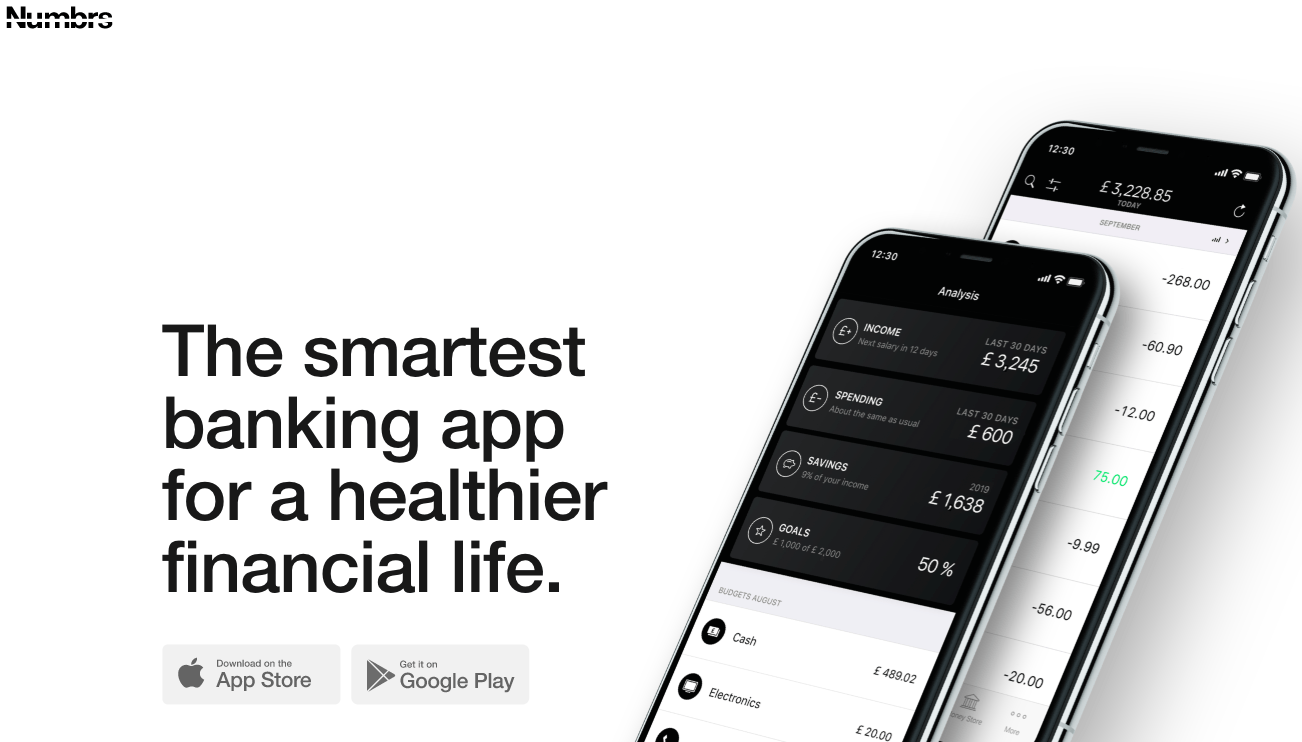

Launched in 2014 in Germany, Numbrs offers an account aggregation app and provides users with the opportunity to apply for bank accounts, credit cards, loans and insurances directly within the app from a panel of banks and insurers. With Barclaycard, Postbank, Santander, Bank of Scotland, Allianz, and AXA among its banking partners, Numbrs aims to establish UK as its second main market. “After that, we want to expand to other European countries,” added Saidler, noting that the company does not plan to expand to the US.

While Numbr is declining to name any of the investors that participated in this round of financing, the company previously identified former Deutsche Bank head Josef Ackermann and private banker Pierre Mirabaud as stakeholders.

Not profitable as of yet, the fintech startup that aims to break even in two years, has just become a so-called unicorn with a valuation at over $1 billion.

Would you like to write the first comment?

Login to post comments