There are more (aspiring) entrepreneurs looking to raise funding from investors than there are VCs, which makes for interesting dynamics.

One thing that has worked well for founders in the past has always been so-called 'warm introductions', as busy investors getting referrals from trusted sources tends to cut through the noise.

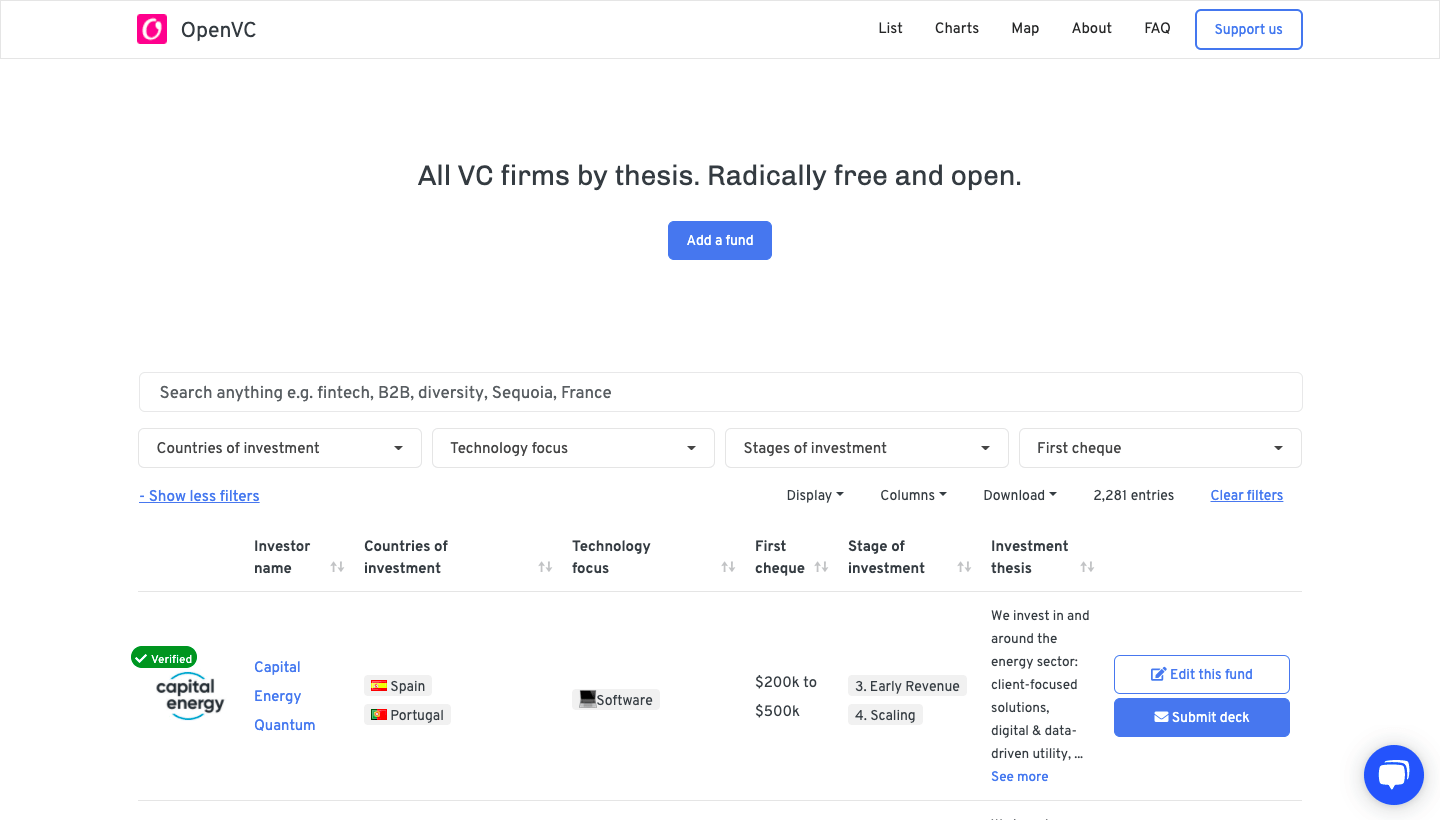

Things change, though, and a new open-source initiative called OpenVC wants to get out ahead of the curve by offering an online platform where VCs can display their investment criteria - things like preferred geography, technology stack, sector, stage, check size, etc.

By being "radically free and open", it wants to 'make venture capital a better place'.

"VCs today are more open than ever to cold outreach," Stephane Nasser, a co-founder of OpenVC, told tech.eu. "First, venture capital is getting more competitive and more international, so investors have to look beyond their usual connections. Second, tools and processes have improved, so investors today can handle larger volumes of opportunities than they used to. Third, the new generation of VCs tends to see warm intros as anti-inclusive. Some of them even champion cold outreach."

All those factors, according to Nasser, lay the groundwork for a shift in how deals are sourced. But how exactly does OpenVC hope to help?

"OpenVC allows VCs to publicly share their investment criteria, what they are looking for, and how they want to be contacted. So instead of being spammed by clueless founders, they receive valuable deal flow," Nasser explains.

"Maintaining data quality over time is the real challenge. We went open-source because it's the only way we can provide Verified data in a sustainable manner. As such, OpenVC is also free for both founders and investors. Think Wikipedia for VC." (Also check out Landscape, the 'Glassdoor for VCs'.)

One thing to note: all the above means those busy VCs will also need to make time to get their investment theses onto OpenVC, which Nasser acknowledges could be a hurdle. That said, nearly 150 VC firms have already signed up for OpenVC's private beta, as it also helps them rate their peers.

"FOMO is a strong motivator. Nobody wants to miss out on a qualified opportunity," Nasser posits.

Check it out for yourself.

Would you like to write the first comment?

Login to post comments