Pitchbook's annual VC valuation report shows CAGR for French and Benelux deal values outpaced corresponding data for the UK and Ireland over the past five years.

Last year, the median pre-money valuation for France and Benelux rose 23% year/year in angel and seed-stage rounds, rising by 44.9% in early stages and by 16.7% for venture growth deals.

These figures were in stark contrast to a 27.8% valuation dip year/year in the UK and Ireland median venture growth valuation, attributed by Pitchbook to British "political and economic turmoil."

Per the report, the headline valuation data suggest robustness across deal stages in 2022, despite "mounting uncertainty across the VC ecosystem and broader financial markets".

However exit valuations continued their retreat from record highs reported in 2021, and Pitchbook predicted corporate acquisitions might be the "favoured exit route" this year.

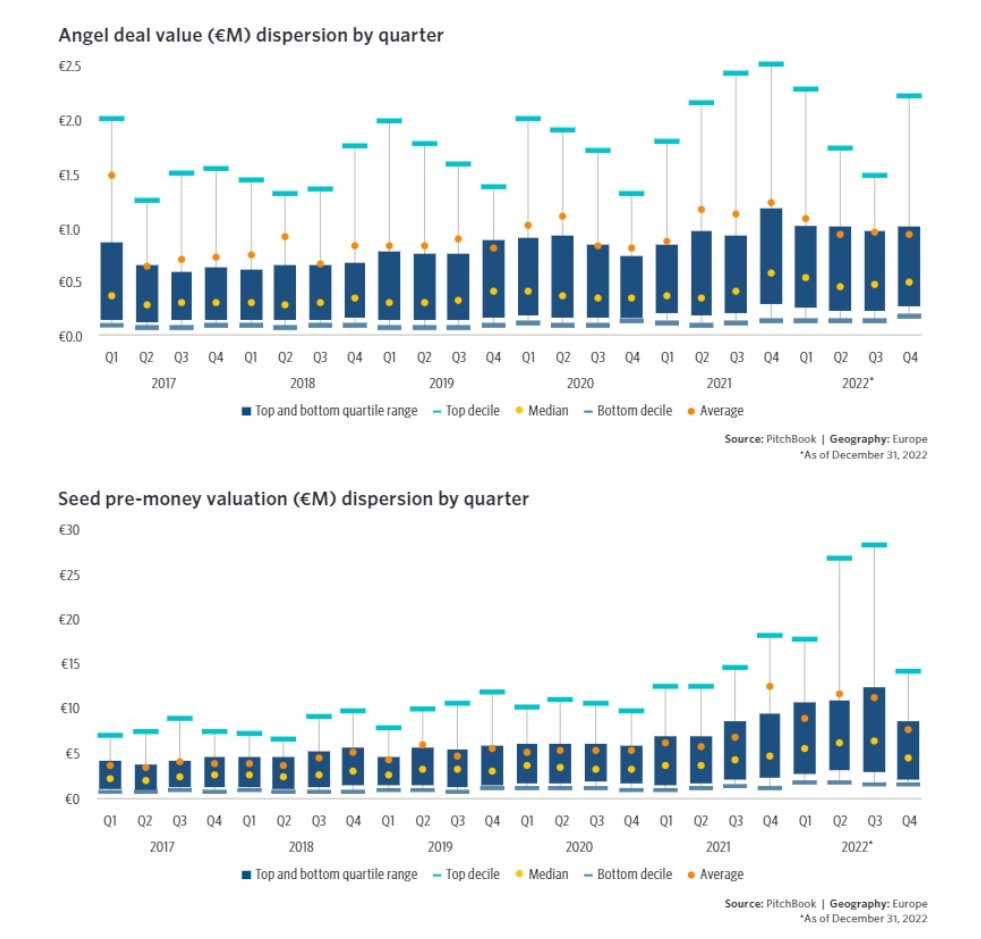

Angel round pre-money valuations amounted to €2.9 million in terms of the median, while seed round counterparts reached €5.8 million, rising by 29.2% and 42.7% respectively.

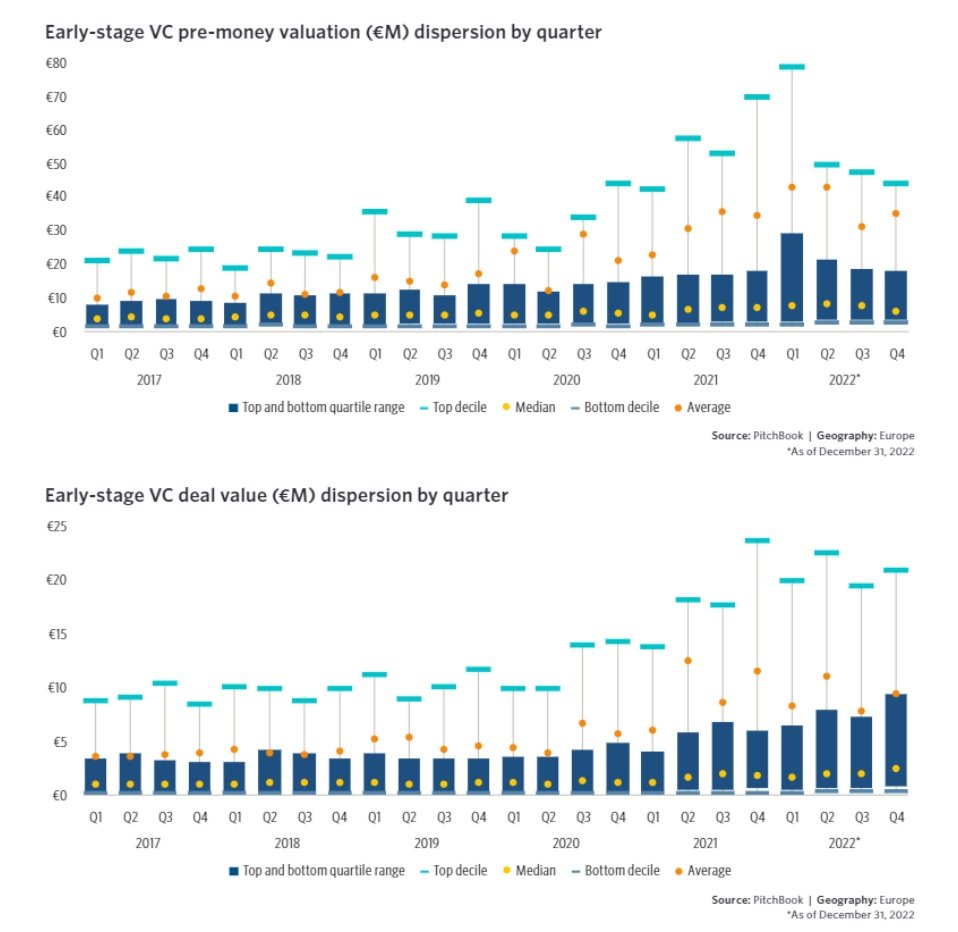

In early growth rounds, Pitchbook's data showed a 23.4% median valuation increase to €7.1 million, post-transaction, however it added quarter-by-quarter averages were tailing off suggesting "declines are on the horizon."

"Valuations have begun to be recalibrated for external financing rounds to ensure they are closer to realistic expectations of revenue multiples and achievable growth rates," Pitchbook argued.

Meanwhile, Pitchbook also captured the continued rise of non-traditional investors,, accounting for larger median valuations across every financing stage.

CVC units backed more deals than any other non-traditional investor type, however median deal values for CVC-backed rounds tended to be smaller than for instance PE firms, which backed fewer deals but typically at a greater valuation.

Would you like to write the first comment?

Login to post comments