This week, our research team tracked more than 80 tech funding deals worth over €660 million, and over 25 exits, M&A transactions, rumours, and related news stories across Europe.

As always, we are putting all weekly deals together for you in a list sent in our round-up newsletter (note: the full list is for paying customers only, and also comes in the form of a handy downloadable spreadsheet).

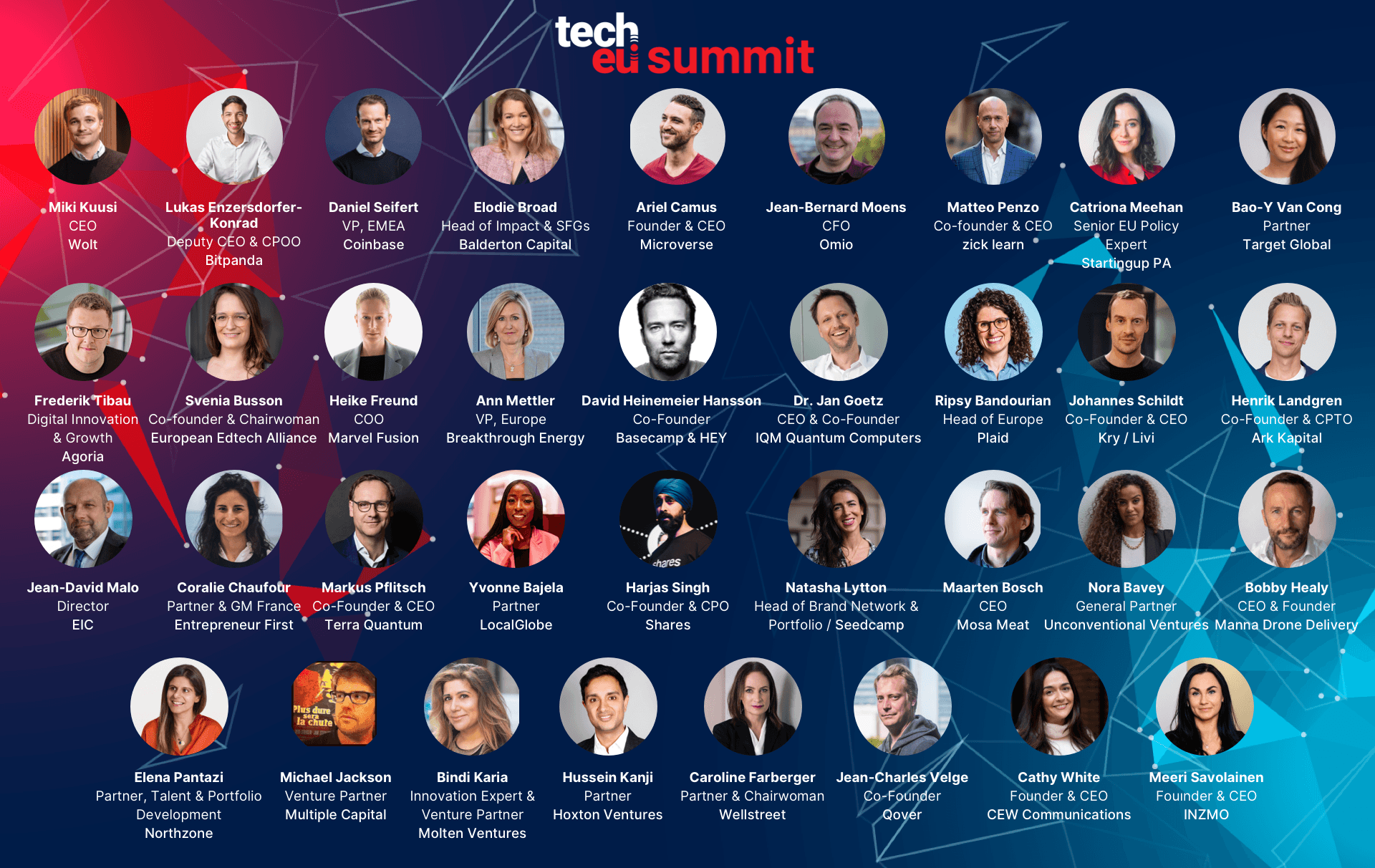

And don't forget: we're busy prepping for the next Tech.eu Summit, it's gonna be epic!

24 May in Brussels Expo

Still on the fence? Check out our first 25 confirmed speakers! and the 10 latest additions to the line-up!

With that said, let's get down to business with the biggest European tech news items for the past couple of days (subscribe to our free newsletter to get this round-up in your inbox).

What happened this week in European Tech?

-----

>> Notable and big funding rounds

Romania-based TOKHIT, a blockchain-powered gamified social app, says it has raised $100 million in a fresh funding round from an international investment fund.

Salzburg-based MYFLEXBOX, an open smart locker network provider, announced that it has raised €75 million in a fresh round of funding.

Credit Suisse has led a $65 million Series B round for Geneva-based digital asset custodian and services provider Taurus.

After raising $400 million in a series D funding round last summer, insurtech scale-up wefox is reported to have secured an additional $55 million from existing investors.

Zunder, a Spanish operator of "ultra-fast" EV charging infrastructure, recently inked a €40 million loan deal with the European Investment Bank to fund a charging network along Spain's section of the trans-European transport network.

Dronamics, a company making autonomous cargo drones, has landed $40 million in pre-Series A capital from investors including Founders Factory and Speedinvest.

Parisian hosptech startup Brigad has raised €33 million in a Series B funding round. The startup helps connect self-employed hospitality industry professionals with short-term assignments.

Berlin-based electric mobility subscription service provider Dance has raised €10 million in an equity and debt financing round led by existing investors HV Capital, Eurazeo, and BlueYard.

Helping energy-intensive businesses reduce greenhouse gas emissions and energy costs, QiO raises $10 million.

-----

>> Noteworthy acquisitions, mergers, IPOs and SPAC deals

Fresh from securing £220 million in a pre-IPO round in October, digital bank and loans provider Zopa has swooped up its UK counterpart DivideBuy, a BNPL finance provider that specialises in offering installment plans from physical retail stores.

UK-based employee savings and pensions platform Cushon is set to be acquired by banking firm NatWest in a £144 million deal.

Swedish e-commerce marketplace Fyndiq will become a subsidiary of the Nordics regional e-vendor Cdon, following agreement of a stock-and-cash deal worth SEK735 million (€65.6 million) that will see Fyndiq's investors own 40% of the newly-merged entity.

Barcelona-based Impress has acquired the UK’s invisible aligner brand, Diamond Whites in a deal reportedly valued at over €30 million.

Tallinn-based e-bike maker Ampler has announced in a joint press conference with Kõu Mobility Group that the two are joining forces to, “strengthen their position in the micromobility industry and to continue making emotive zero-emission commuting accessible for everyone.”

Greek startup Blueground has bought corporate housing specialist Travelers Haven to grow its footprint across the US.

Less than a month since opening a physical branch designed to provide face-to-face customer service, fintech Wahed has announced the acquisition of Birmingham-based iWill Solicitors and Milton Keynes-based True Wills.

Stockholm's PodX wants to be the leading international publisher of independent podcasts. After buying up a British purveyor of audio fiction, Goldhawk Productions, and the French podcasting studio Nouvelles Écoutes, this time PodX is keeping the magic local having acquired Stockholm peer Filt to drive its Nordic strategy.

Kpler's commodity intelligence platform will be expanded following its acquisition of the marine vessel tracker MarineTraffic and the latter's subsidiary FleetMon.

-----

>> Interesting moves from investors

Not content with its existing arsenal of funding instruments, five members of the European Investment Bank today launched a targeted €10 billion fund-of-funds to spawn more mega European VC funds with sufficient dry capital to supply late growth-stage EU innovators.

Summit Partners closed its fourth Europe growth equity fund, Summit Partners Europe Growth Equity Fund IV, at €1.4 billion in total commitments.

The private equity arm of IKEA's largest franchisee, Ingka Group, recently invested in London-based Ocean 14 Capital's ocean sustainability LP fund, bringing the total sum raised to €130 million towards Ocean 14's €150 million ceiling.

Barcelona-based health and life science-focused VC Asabys Partners announced a €100 million first close of its second fund.

Monaco-based VeUP, a consultancy firm that specifically helps Amazon Web Services (AWS) software partners scale revenue streams and optimise operations, announced on Monday that it has launched a new €100 million growth fund.

Austrian firm Speedinvest has announced the launch of a €3 million fund of funds to back emerging pre-seed and micro venture capitals.

Fresh from executing 120 early-stage deals last year, Startup Wise Guys is shifting the dial to address underserved geographies, from CEE to sub-Saharan Africa. It's recently pulled in €25 million toward a €45 million call for its accelerator fund and promises at least 200 startups will benefit.

Counteract, a climate tech investor, has closed its first £15 million for a fund to support the carbon removal industry.

Rob Kniaz, who co-founded Hoxton Ventures in 2013, is in talks with institutional investment firms about establishing a new venture capital fund focused on deep tech bets.

The European Investment Bank has leveraged its newly-launched development finance wing, EIB Global, to finalise a $27 million anchor investment in the Middle East and Pakistan LP vehicle Middle East Venture Fund IV.

A total of 18 space tech projects are to be funded by the UK government in a renewed growth funding initiative announced this week.

San Francisco-based WeFunder has launched in the EU, and you can thank new EU-wide regulations that underscore the potential of having harmonised rules across the bloc.

-----

>> In other (important) news

Google, Facebook parent Meta, Twitter and Apple face stricter EU online content rules, based on monthly user numbers published by the companies, which exceeded an EU threshold for big online platforms.

Turns out N26 was close to buying Bux.

Amazon.com warned distributors in Europe that it will cease ordering from them next year in favour of buying products directly from brands.

Revolut is facing a crackdown on cryptocurrency investing as ministers prepare to take action over on an unregulated trading strategy offered by the banking app.

The UK’s financial regulator is set to gain additional powers to regulate the buy now pay later (BNPL) sector under draft legislation unveiled by the government this week.

Atom Bank boss Mark Mullen has offered a clear indication that the fintech is sticking with London for its highly anticipated IPO, likely to take place this year.

The European Commission has agreed to probe Adobe’s $20 billion acquisition of web design platform Figma.

Amazon said on Wednesday it is in talks with regulators on its $1.7 billion bid for iRobot, maker of the robotic vacuum cleaner Roomba, with the takeover likely to draw tough scrutiny due to regulatory concerns about deals by Big Tech.

After seeing promising results in Eastern Europe, Google will initiate a new campaign in Germany that aims to make people more resilient to the corrosive effects of online misinformation.

Breakthrough Energy Ventures founder Bill Gates was in attendance to see UK cleantech players getting organised.

The European Commission is launching a regulatory sandbox to foster innovative blockchain use cases.

Ziglu’s founder and CEO Mark Hipperson has resigned from the crypto-focused neobank.

-----

>> Recommended reads and listens

It's a tough financial climate for most startups, especially in the mobility sector. Can Sono Motors' ambitious crowdfunding campaign get enough pre-orders in the next few weeks to begin production of the Sion solar EV in 2024?

How Spotify's podcast bet went wrong

Pitchbook has published its European valuation data, and there's good news for France and Benelux

Your guide to GetYourGuide: A candid conversation with co-founder and CEO Johannes Reck

In Change Ventures' new Baltic Startup Funding Report, the firm finds that Estonia is already far ahead of Europe and Israel in terms of startups per capita.

How can we help Europe's climate tech startups reach their full potential?

7 Generative AI Startups From CEE to Watch for in 2023

Tech.eu caught up with Dominic Jacquesson, VP of Insight and Talent at Index Ventures, and a longtime startup strategist and analyst. The author of three books for entrepreneurs about scaling startups, he's a driving force behind the Not Optional campaign in Europe.

Want a new job In tech? These tech sectors aren’t slowing down

Estonia, a European startup nation with the highest amount of VC investments per capita, keeps further developing its supportive business environment to hold its position.

Never mind the bollocks, here’s Podimo

While the phrase ‘Estonian mafia’ has gained credence over the years, if things keep going Lithuania’s way, they might just be laying the groundwork for their own mafia right now.

-----

>> European tech startups to watch

Unagi, the Paris-based blockchain gaming studio that in November lured attention from Binance Labs, recently collected €4.7 million in funding.The round was led by games early-stage VC Sisu Game Ventures.

Paris-based Agua Blanca has raised €3 million in a seed funding round that will see the just-over-a-year-since-lanch company press forward with a marketplace expansion.

Universal Quantum, a UK-based quantum computer developer, recently published new scientific data on its scalable trapped-ion quantum architecture for connecting quantum qubits across multiple computer microchips.

Parisian all-in-one recruiting CRM for teams solution Crew has raised $2.3 million in a seed round.

Nefta, a UK-based Web3 in gaming and entertainment startup, announced raising $5 million in a seed round led by venture firm Play Ventures' Future Fund.

Lyon's Previa Medical announced it had raised €2.1 million in seed funds for its certified early diagnostics device for sepsis, powered by artificial intelligence software.

Estonia's Raison, a private tech stock broking app and crypto asset manager, recently increased its valuation to $30 million.

Would you like to write the first comment?

Login to post comments