This week, our research team tracked more than 105 tech funding deals worth over €824 million, and over 10 exits, M&A transactions, rumours, and related news stories across Europe.

As always, we are putting all weekly deals together for you in a list sent in our round-up newsletter (note: the full list is for paying customers only, and also comes in the form of a handy downloadable spreadsheet).

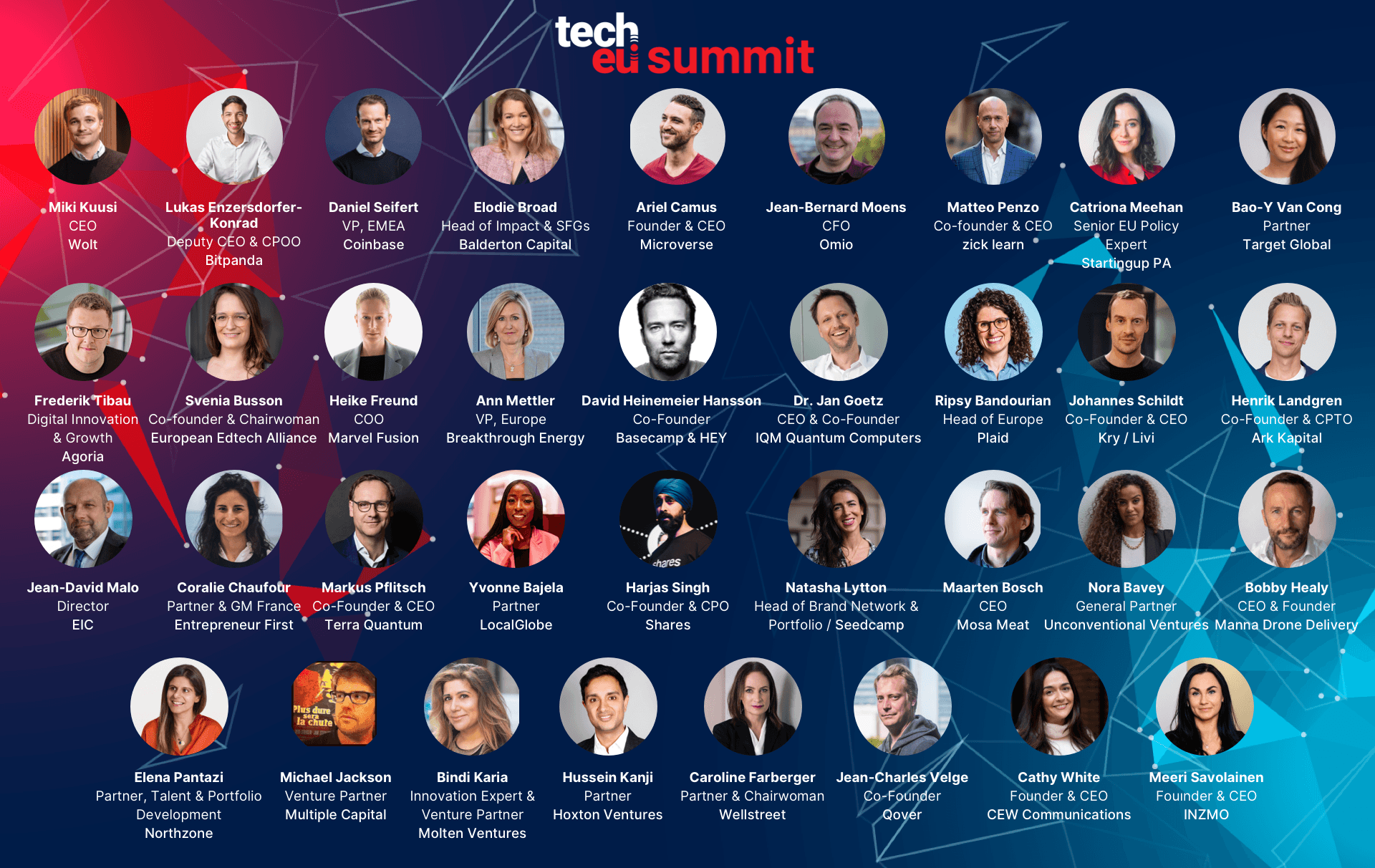

And don't forget: we're busy prepping for the next Tech.eu Summit, it's gonna be epic!

24 May in Brussels Expo

Still on the fence? Check out our first 25 confirmed speakers! and the 10 latest additions to the line-up!

With that said, let's get down to business with the biggest European tech news items for the past couple of days (subscribe to our free newsletter to get this round-up in your inbox).

What happened this week in European Tech?

-----

>> Slava Ukraini

As you may have noticed, Tech.eu has been highlighting remarkable Ukrainian startups on the one-year anniversary of the Russo-Ukrainian War:

Resilient and resourceful: 10 Ukrainian startups fundraising during wartime

10 Ukrainian startups to watch

The experience of PR during wartime

Here’s how Ukraine's macOS and iOS developer MacPaw is overcoming war challenges

Ukrainian CEO Alex Pasykov shared his thoughts on a difficult but rewarding year

C-Suite lessons to learn from Ukrainian IT in crises

One year later, Ukraine's Scalarr is fighting and standing strong

Despite the war, Ukrainian smart home startup i3 Engineering is growing in Europe

Health and wellness platform BetterMe supports the Ukrainian women's military with profits donations

With no plan for disaster, here's how Ukrainian greentech startup Releaf Paper has continued to thrive

Amid war challenges, Ukranian sales engagement platform Reply.io grows revenues by 55 percent

Ukraine's Deus Robotics clinches $1.5 million seed

-----

>> Notable and big funding rounds

Volocopter's Series E round got larger with a funding commitment from Japanese trading company Sumitomo, which is also coming on board as a strategic partner to bring Japanese VoloCity eVTOL aircraft into service by 2025.

EO Charging, a London, UK-based provider of electric vehicle charging solutions for fleets, raised $80 million in equity funding.

Greek car leasing platform Instacar is reported to have closed out €55 million in equity and debt funds as investors bought into its growth vision of melding flexible car rental with value-add services.

Electric vehicle maker Arrival has secured up to $50 million by issuing shares to Antara Capital. The firm has also issued $121.9 million in debt to Antara in return for 219.42 million shares in the company.

Eclipsing OQC’s £38 million Series A round announced in July of last year, London-based Quantum Motion Technologies has raised £42 million in a Series B round that will support the company’s continued development of silicon quantum processors.

BBVA and Wallbox, one of the world's leading providers of electric vehicle charging and energy management solutions, have signed a financing agreement of €25 million.

Amsterdam-based Source.ag said it has received $23 million in Series A funding, closing out the round to bring its lifetime total to $35 million. Source.ag develops AI to assist greenhouse farm owners.

Estonian-born, Johannesburg, South Africa-based car subscription startup Planet42 has raised $100 million in combined equity and debt funding.

London-based “neo car finance” startup Carmoola has raised £8.5 million in a Series A equity funding round that also sees the accompaniment of £95 million in debt facility.

Plant-based foods additive maker Paleo (not to be confused with the dietary method of avoiding whole and unprocessed foods) has raised €12 million in a Series A funding round.

-----

>> Noteworthy acquisitions, mergers, IPOs and SPAC deals

UK digital challenger Monzo has been approached by investment banks about a potential initial public offering.

Exchange operator Euronext has made an indicative offer to buy B2B wealthtech platform Allfunds for about €5.5 billion in cash and stock.

Cazoo has sold data platform Cazana, and agreed to sell its German subscription business, Cluno, both for undisclosed sums.

Virgin Media O2 and its shareholders are exploring a takeover bid for Trooli, one of the UK's army of 'altnet' fibre broadband companies.

Turkish largest micro and shared mobility provider BinBin announced the takeover of the Dutch GO Sharing.

Climate tech startup Doconomy has acquired Stockholm-based financial wellbeing fintech Dreams Technology for an undisclosed sum.

MikMak, a New York-based provider of an eCommerce acceleration platform for multichannel brands, has acquired Swaven, a Paris, France-based eCommerce enablement and analytics software company.

Amsterdam-based pr.co, an online newsroom company, has acquired PR learning platform Pioneer Academy.

US-based unicorn ZenBusiness, valued at $1.7 billion, has acquired the Ukrainian online logo maker Logaster.

Huddlestock Fintech continues to scale its wealth management and trading platform and has signed an agreement to acquire Dtech, a Norwegian software company with robust and easy to use solutions for portfolio management and fund order technology for the pension market and pension providers.

Slovenia-based mobile app and digital identity development company Kamino has been acquired by Netcetera, a Switzerland-based software company.

Global video solutions provider Accedo has acquired the assets of emmy-nominated provider of innovative extended reality (XR) solutions, eyecandylab.

-----

>> Interesting moves from investors

Spanish VC firm Clave Capital has just reached a first close of around €50 million for its Clave Innohealth fund, which seeks to invest in startups and innovative projects with high growth potential in the healthcare sector.

Bergen, Norway-based fund Sarsia is raising over €45 million for a new venture fund that focuses on climate and environmental investments.

Focusing predominantly on early-stage deeptech startups hailing from the DACH region, Amadeus Capital Partners and APEX Ventures have joined forces and have announced a first close at €28 million of a targeted €80 million.

Dutch pension fund ABP has reportedly stopped offering money to its investment arm, Inkef.

Barclays Eagle Labs: "We’re not the ‘bogeyman’ – we’re ready to support UK tech"

BGF’s early-stage team reported invested £69 million in a range of innovative businesses in the UK and Ireland.

FinTech Alliance has announced a partnership with Seedrs, a leading securities crowdfunding platform.

Jasper Masemann is the new investment partner over at Cherry Ventures.

Sameer Singh is joining Speedinvest as a Venture Partner with the Marketplaces & Consumer team.

-----

>> In other (important) news

The European Union's two biggest policy-making institutions have banned TikTok from staff phones for cybersecurity reasons, marking growing concerns about the Chinese short video-sharing app and its users’ data.

Sono Motors is ending its long-awaited electric car program and instead pivoting to a business that aims to sell its solar vehicle technology to other companies. The German-based company, which went public in November 2022, announced on Friday it is laying off 300 employees as a result of the change in business model.

German e-commerce giant Zalando was confirmed to be the latest affected by wide-scale redundancies. Hundreds of "overhead" roles will be shed in a company-wide restructuring.

Aleph Alpha, a European rival to OpenAI, is in talks amid AI boom to raise up to $100 million in new funding.

Solar mobility solutions provider Sono Motors has decided to pivot its business model to exclusively retrofitting and integrating its solar technology onto third party vehicles, and to terminate its Sion passenger car program.

Facebook on Monday temporarily fought off a collective lawsuit valued at up to 3 billion pounds ($3.7 billion) over allegations the social media giant abused its dominant position to monetise users' personal data. However, a London tribunal gave the proposed claimants' lawyers up to six months to "have another go" at establishing any alleged losses by users.

Barcelona is ready to unleash the taxman on delivery platforms like Amazon.

The US is now Swedish payment giant Klarna’s biggest market by revenue, surpassing Germany.

Telecoms gear maker Ericsson plans to cut about 1,400 jobs in Sweden as part of a broader plan to reduce costs globally.

Luxury carmaker Jaguar Land Rover said on Tuesday it is opening three new engineering hubs in Europe to develop autonomous vehicle technologies as part of its partnership with Silicon Valley artificial intelligence company Nvidia.

Russia's central bank is gearing up for a central bank digital currency pilot with real-world retail transactions.

Swedish cleantech company Stirling announced that the Board of Directors had resolved to let the shareholders consider a proposal of voluntary winding-up of the company at an extraordinary general meeting.

-----

>> Recommended reads and listens

International Data Corporation recently published new forecasts for the European AI market, with the industry predicted to notch up a 25.5% CAGR from 2022 - 2026. The upshot is that despite market anxieties and widespread lay-offs, the industry could be worth $191 billion in turnover by the end of the forecast period.

Is Europe Just Not Good at Innovating?

Japanese corporations want to do business with European startups – here's how to get in on it

How Macron wants Paris to steal London’s tech crown.

Climate fintech companies continued to lure early-stage funds in 2022 despite a deterioration in private markets more generally, according to a new data report from venture firm CommerzVentures.

A deep dive into the UK crypto regulatory consultation

How Helsinki became the mobile gaming capital of the world.

Brussels sets out to fix the GDPR.

These are the biggest French startups in 2023 according to the French government.

The UK represented only 0.3% of global patents in the semiconductor industry last year, despite a surge in new technologies in the sector, new research has found.

Bizay decided a four-day week was worth trialling; here's what it found

Entrepreneur First's Coralie Chaufour On Talent Investing In France

How Ukrainian startups survive “amid bombs, blackouts and evacuations” (podcast)

-----

>> European tech startups to watch

While a number of carbon footprint mapping tools focus on general industry, Carbon Maps is zeroing in on what we eat. Specifically, the Paris-based startup is using mathematical models coupled with a healthy dose of AI to offer what the company is calling high-precision assessments of consumer products, ingredients, and raw materials.

Founded in 2012 by serial entrepreneur Ali Nikam, bunq is racking up quite a list of trophies. It holds claim to being granted the first European banking permit in over 35 years, was bootstrapped for nearly a decade, and now claims to be the first EU-based neobank to report a quarterly profit.

Netherlands startup QuantWare is launching a 64-qubit processor that's based on superconducting circuits.

Barcelona Supercomputing Center spinout Qbeast has created an open-source solution to better align data lakes — server-side repositories of raw, unprocessed data — so they can be deployed later on for operational machine learning.

Forged on the back of research conducted in Germany's largest science and technology park, Berlin's Xolo is trying to make headway on something of a holy grail for the 3D printing industry.

Gothenburg, Sweden-based climate SaaS company CarbonCloud has received €7.5 million in a series A round co-led by Cusp Capital and Peak, joined by its existing investors TS Ventures and Maki VC.

Would you like to write the first comment?

Login to post comments