Cross-border business payments firm MODIFI has secured $100 million in a debt facility via HSBC Innovation Banking UK. Helping businesses around the globe manage the complexities of global trade, MODIFI allows sellers to get paid instantly, while their Buyers have the option to pay later.

The new working capital from HSBC arrives on the heels of a previously undisclosed debt facility of $75 million provided by an unnamed ‘global financial institution’.

Founded in 2018, MODIFI has established a presence in Amsterdam, Berlin, New York, Mexico City, Delhi, Mumbai, Shenzhen, Hong Kong, Singapore, Dubai, and Dhaka, and counts over 1,500 buyers and sellers operating in some 50 countries.

Traditionally, most small and medium-sized businesses see a 50% rejection rate when seeking trade finance. This equates to an annual funding gap of $1.5 trillion. Now toss a global pandemic, i.e. a dramatically reduced risk appetite, and it’s SME’s that end up suffering, and ultimately local businesses.

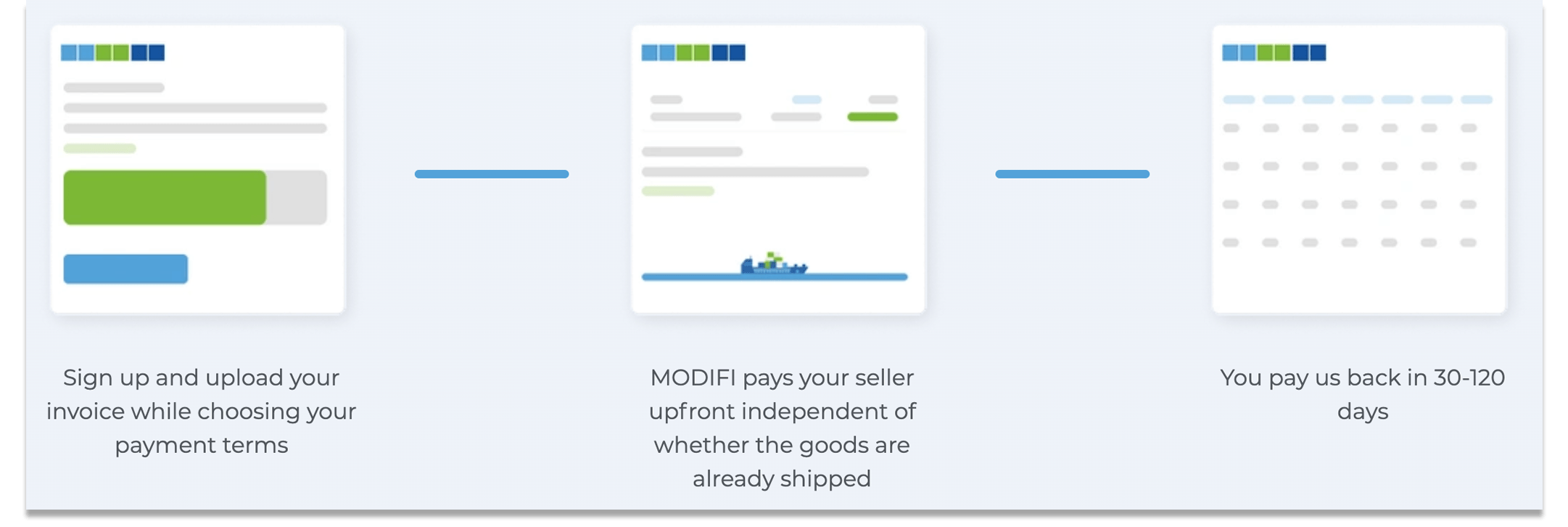

It’s exactly this conundrum that MODIFI is aiming to solve, by fronting the money for SMEs, buyers, or sellers, to pay or receive payments for their invoices with an option to defer payments for up to 180 days.

HSBC now joins a list of existing MODIFI backers that include Silicon Valley Bank, Solaris, Heliad Equity Partners, Global Founders Capital, Picus Capital, and Maersk Growth.

Would you like to write the first comment?

Login to post comments