Only 15 days after the announcement of a successful raise of €20 million, today Paris-based Hexa launches a new initiative to fall under its purview, Hexa Scale.

In line with Hexa’s ethos, that which sees its roots in startup studio eFounders, fintech-focused studio Logic Founders, and web3-focused outfit 3founders, Hexa scale positions itself as a late-stage co-founder and seeks to offer a third alternative to traditional VC and PE models.

Dead end trajectory

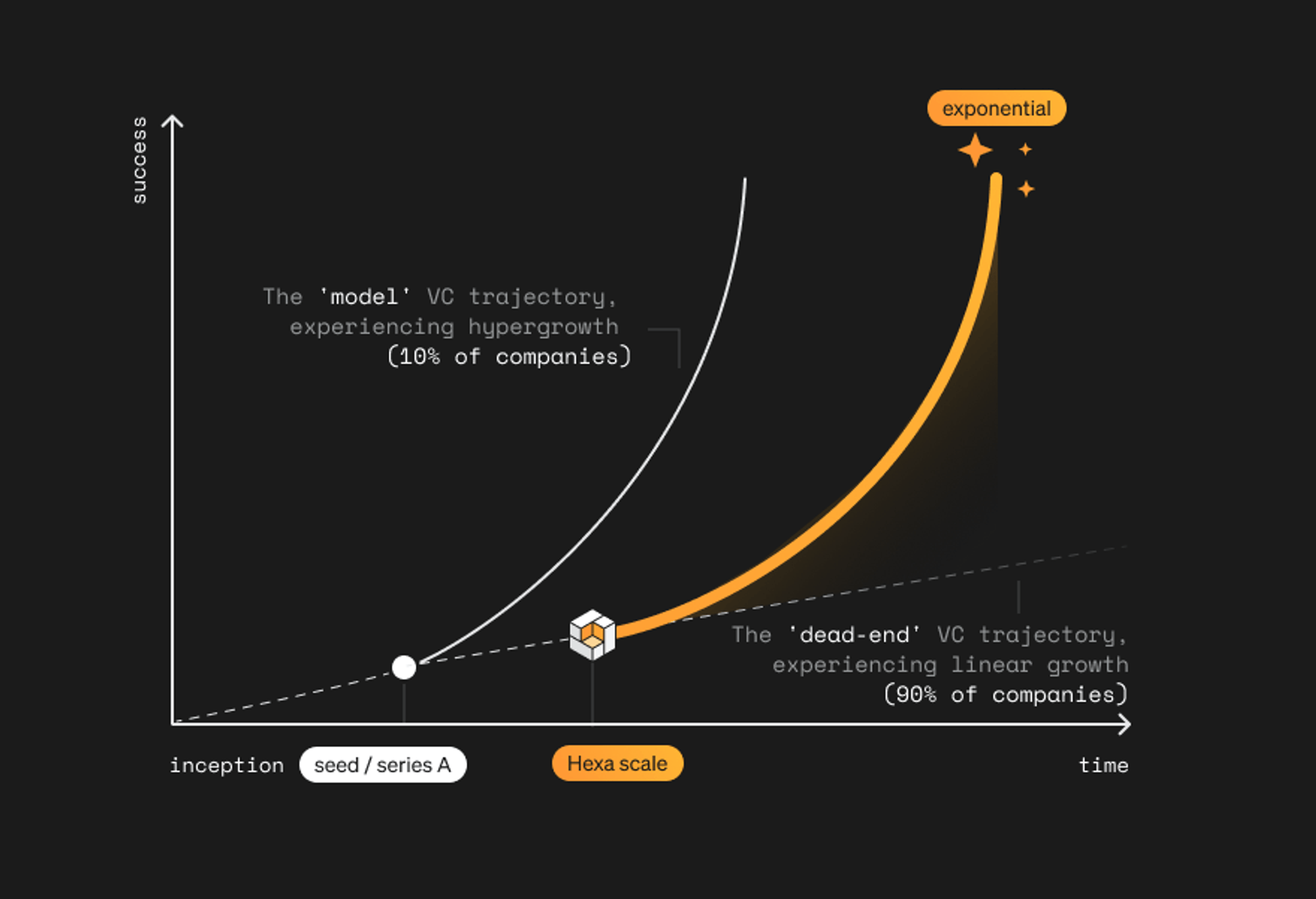

Hexa Scale’s logic takes aim at what it refers to as “the dead-end VC trajectory”, a path experienced by 90 percent of companies.

In contrast, Scale says that through its hands-on approach that offers companies new takes on strategies, marketing, product, talent, operations, and naturally, financing, a linear path can be transformed into an exponential one.

While the marketing and jargon of hype might be applied a bit thick here, Hexa Scale does have the credentials to back up the chatter, namely via that of Yousign.

18 months later

An eFounders project established in 2013, as of January 2018, Yousign had raised only €3.5 million, be that a good thing or bad, depending upon your point of view, but evidence supporting a pattern of linear growth.

Fast forward to June 2021, and Yousign welcomed a €30 million Series A investment round and set its sights on market incumbent DocuSign. Just over half a year later, Yousign acquired Canyon, a move that saw the company broaden its scope to include document automation services.

It's precisely this pattern of growth that Hexa Scale aims to replicate on a larger scale.

Yousign founder Luc Pallavidino shared:

“Joining Hexa truly felt like a fresh start. The entire team shared this mindset of diving into something completely new. Hexa equipped us with the necessary tools and methodologies to propel Yousign forward and establish it as a major European contender.”

Experience at the helm

Tapped to lead this new initiative at Hexa is serial entrepreneur Augustin Celier, who’s navigated the waters of both acquisitions and overly advantageous VC term sheets.

“I’ve been building companies for the last 15 years. For my last venture, we ended up in a financing no-man’s land, which led us to a fire sale. Like many, we were confronted with very narrow support options: to stay on the VC track, you need continuous hypergrowth, while you need to settle for slow, linear growth to go down the self-financing or private equity route,” explained Celier. “By acting as a late co-founder, Hexa Scale offers a third path.”

Hexa Scale is now actively seeking B2B software companies that are aiming to scale to the likes of Yousign and greater and can demonstrate an ARR between €1 million and €10 million.

Lead image: Augustin Celier. Photo: Uncredited.

Would you like to write the first comment?

Login to post comments