One of Europe’s biggest challenger banks bunq has reported its first-ever full-year profit, as it gears up for its UK relaunch after submitting an Electronic Money Institution (EMI) licence application.

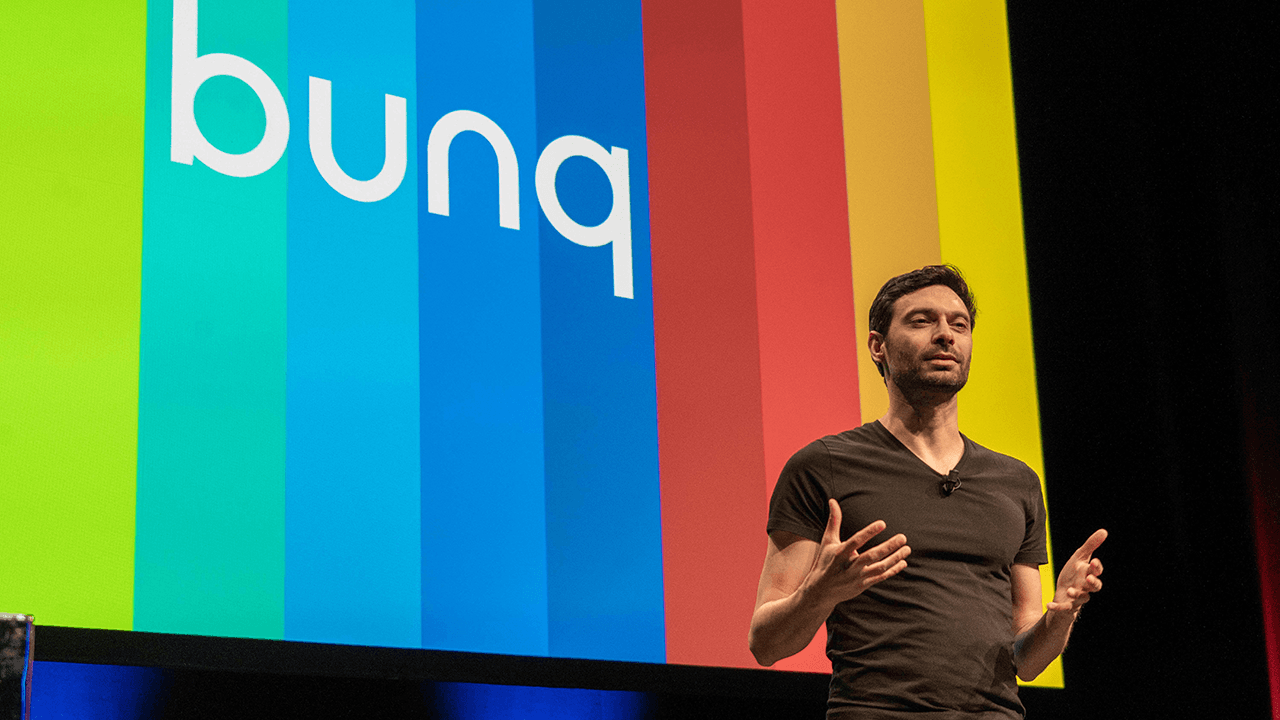

Ali Niknam, the CEO of the Dutch neobank, told Tech.eu that he is excited about its second crack at the UK market:

“A lot of our users are digital nomads, and we can clearly see how we can make their international banking experience seamless across Europe. When we were active in the UK pre-Brexit, we had a lot of positive feedback from British users.

“We’re convinced that once we’re back, many more Brits will be excited to sign up for bunq.”

Bunq, which has over 11 million users in Europe and more than €7bn in deposits, retreated from the UK market in 2020, when it stopped UK signups after Brexit scuppered its plans. It is currently in over 30 markets across Europe.

Bunq has now submitted its application to the UK regulator, the FCA, for an EMI licence in the UK.

The challenger bank says the UK market includes around 2.8 million digital nomads, and its target demographic, such as remote workers.

“The UK is home to the second-highest number of digital nomads globally, so naturally, we want to be there”, says Niknam.

“We want to truly make their life easy, that’s why we’re excited to reintroduce bunq to the Brits and enable them to bank like a local all across Europe.”

It has opted to apply for a UK EMI licence, not a UK banking licence, as it is a “natural step” to bring its products and services to the UK.

It will be based in London and the fintech is currently on the hunt for an executive to head up its UK offering.

It is likely to offer UK users services such as UK and EU accounts.

Meanwhile, bunq is the latest fintech to report a full-year profit, reporting €53.1 million in net profit in 2023, a big jump from the €16.5 million loss it reported the year previous.

Bunq says it has achieved the dramatic reversal by growing user deposits year on year fourfold in the last quarter of 2023 from €1.8 billion to almost €7 billion and fee income growing by 20 per cent.

Gross interest income in the last quarter of 2023 grew by 488 per cent, compared to the same period in 2022, it added.

Bunq has also recently launched a Generative AI-powered chatbot called Finn.

Lead image via bunq.

Would you like to write the first comment?

Login to post comments