Attempting to shake up a massive market of cliched credit cards, London-based fintech Yonder has emerged from stealth with a £20 million funding. The platform is now rolling out its lifestyle credit card in the U.K.

The round was led by Northzone and LocalGlobe with Seedcamp participating alongside a host of angels, including Sharmadean Reid, Marshmallow founders Oliver and Alex Kent-Braham, and the retired footballer who has already backed Sorare and Sokin, Rio Ferdinand.

Following a pre-seed round of £850,000 in February 2021 led by Seedcamp and LocalGlobe, the platform’s total funding to date stands at £20.85 million.

The market size for ‘credit invisible’ customers who are underserved by current credit providers stands at 5 million people across the U.K. Founded in 2021 by Clearscore alumni Tim Chong, Theso Jivajirajah and Harry Jell, Yonder aims to rebuild customers’ relationship with credit, eliminating stress and complexity from the customer experience.

According to Tim Chong, CEO and co-founder, Yonder, for too long, credit cards have taken advantage of consumers. “These cards are ridden with hidden fees, discriminatory credit scoring, and rewards that belong in the 1990s, all in the interest of the bank’s quarterly earnings. We’re challenging the status quo with a card that helps our members to discover the best of their city, and a promise to put the customer first.”

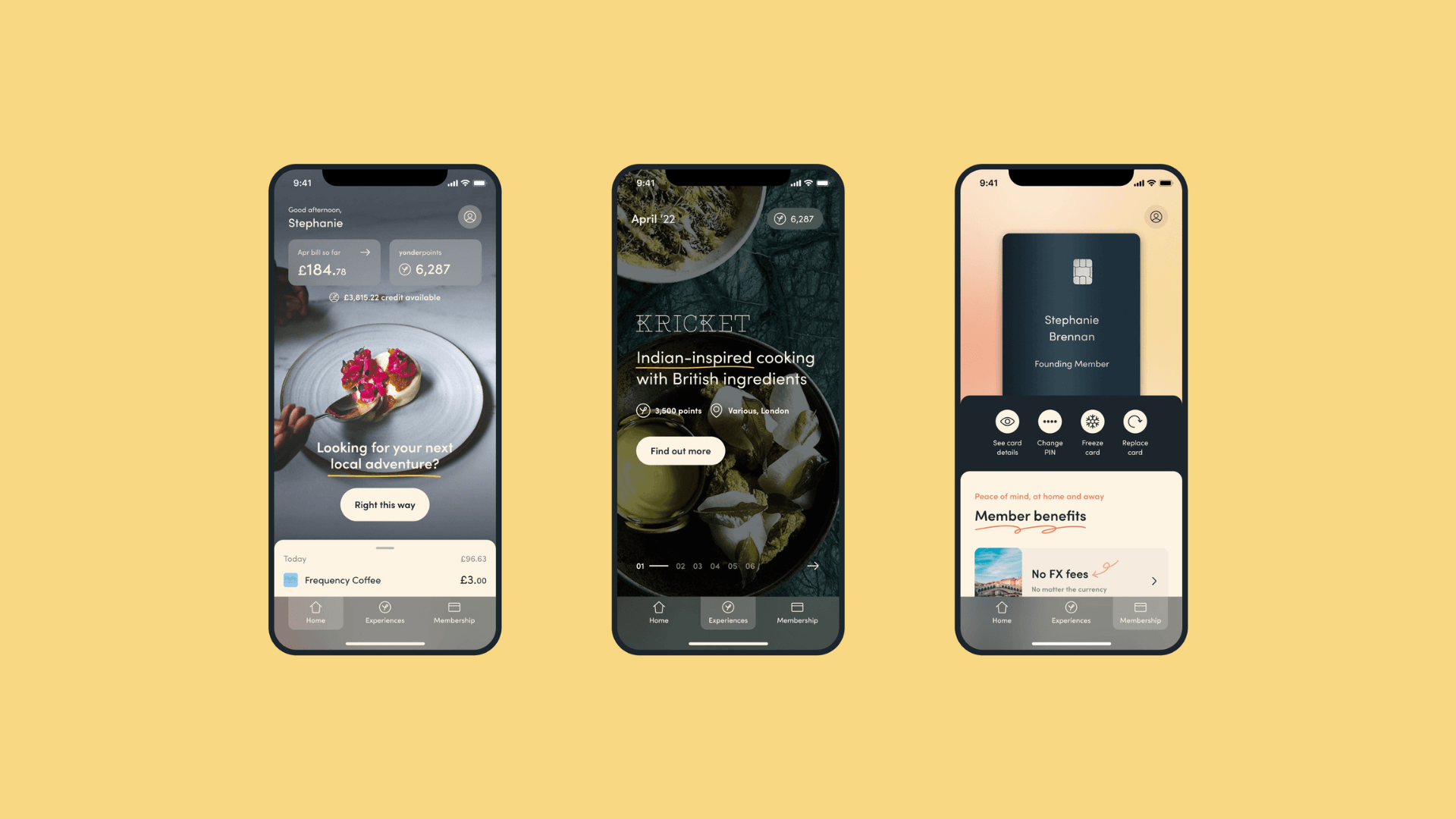

While offering an array of rewards is nothing new, the startup claims its rewards programme is designed around real people’s lifestyles, inspired by hundreds of user research sessions with Londoners from around the globe to learn how they really spend their time and money. Its credit card will provide members with access to exclusive drinking, dining and leisure experiences with partners, including The Gladwin Brothers and Kricket restaurants, plus the ability to spend abroad with zero FX fees. With an FCA authorisation in just nine months, the platform is evaluating credit suitability based on transaction data, using open banking to build a more personalised picture of its customers’ spending habits than relying on traditional credit checks alone.

Jeppe Zink, general partner, Northzone added: “We have seen the rise of a $300 billion fintech industry, predominantly driven by customers demanding better seamless financial services, and yet a key service has not changed for decades: credit cards. Yonder is creating a modern, digital credit card experience for young professionals that replaces outdated loyalty programmes with a highly curated experience-based membership service. There is an urgent need to redesign the payments industry with the customer at the heart.”

Remus Brett, general partner, LocalGlobe added: “Credit has earned a bad rap, with companies benefiting from a huge profit pool while sidelining their customers’ best interests. We’ve been actively looking to invest in credit challengers, and Yonder has all the qualities we look for at LocalGlobe.”

Would you like to write the first comment?

Login to post comments