It's that time of the year when venture capital firm Atomico, in partnership with Orrick, Lazard, SVB and Slush and a host of data providers, releases its annual mammoth report on the State of European Tech.

With 2022 almost behind us, we dove into the report ahead of its release date to give you the 16 key findings (in our humble opinion). We also took a closer look at some of the report's most significant sections.

1) Still no progress (in fact, a setback) when it comes to diversity

We'll get to the shiny headline numbers in a second, but first things first: the data shows it still sucks to be a woman founder or investor in the European tech industry - and things seem to be getting worse still.

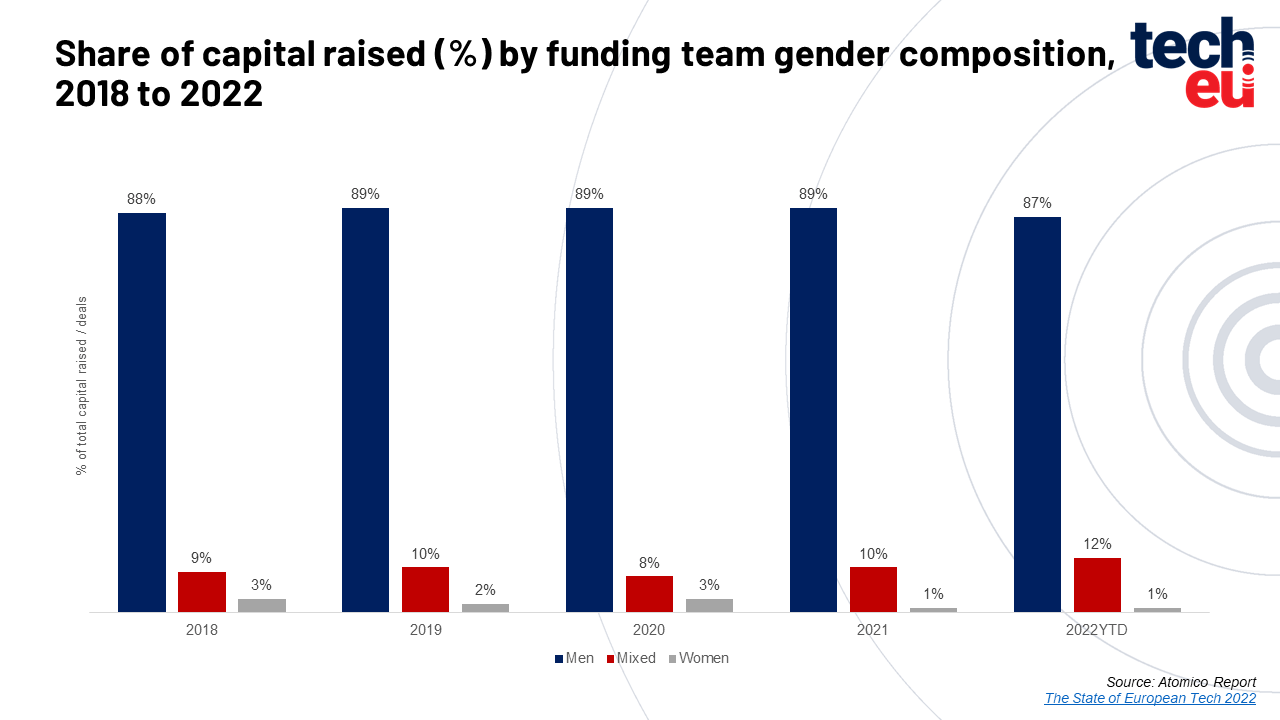

Through both the ups and downs of the past several years, female founders' share of investment has remained relatively stagnant, and shamefully so.

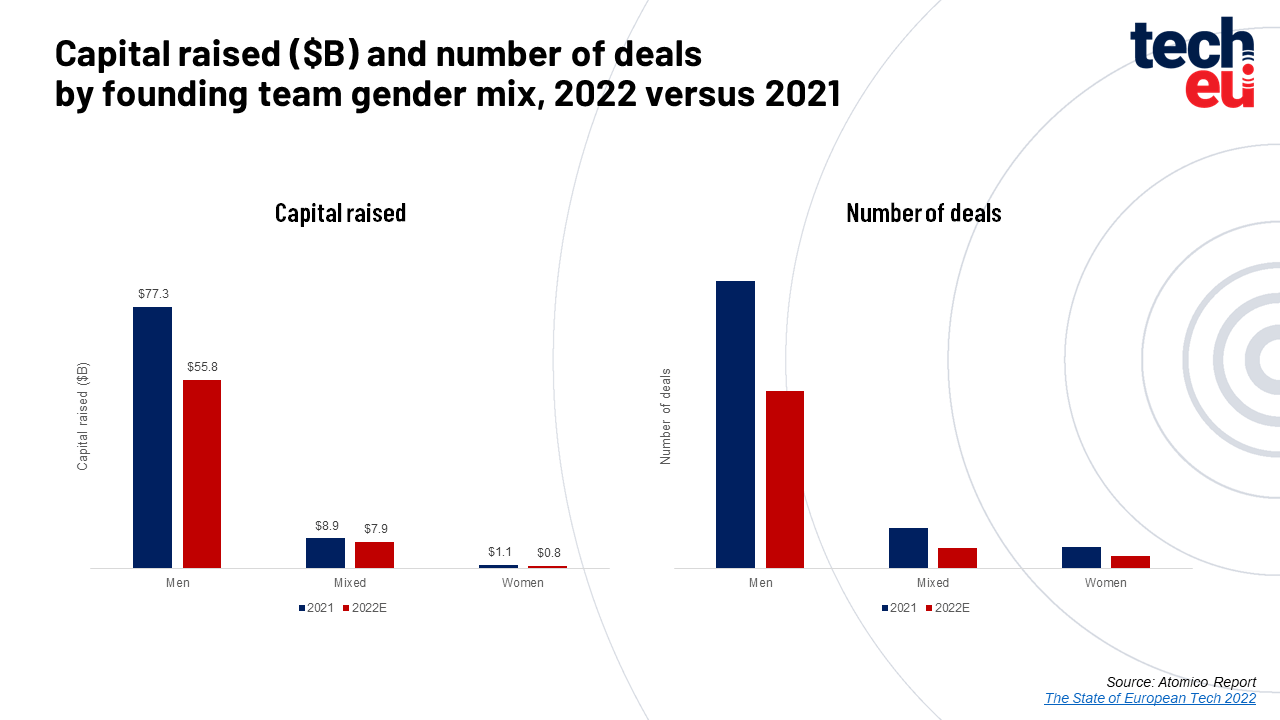

A staggering 87% of all VC funding in Europe continues to be raised by male-only founding teams, while the proportion of funding raised by women-only teams has not even managed to remain at the same level, as it has upsettingly dropped even further - from 3% to a mere 1% since 2018.

And even when women-only teams successfully close a financing round, they are likely to receive less funding than men-only teams.

Looking at mixed teams, their share of total funding has slightly increased to 12%, up from 10% last year.

Up to you whether you want to go ahead and deem this a silver lining.

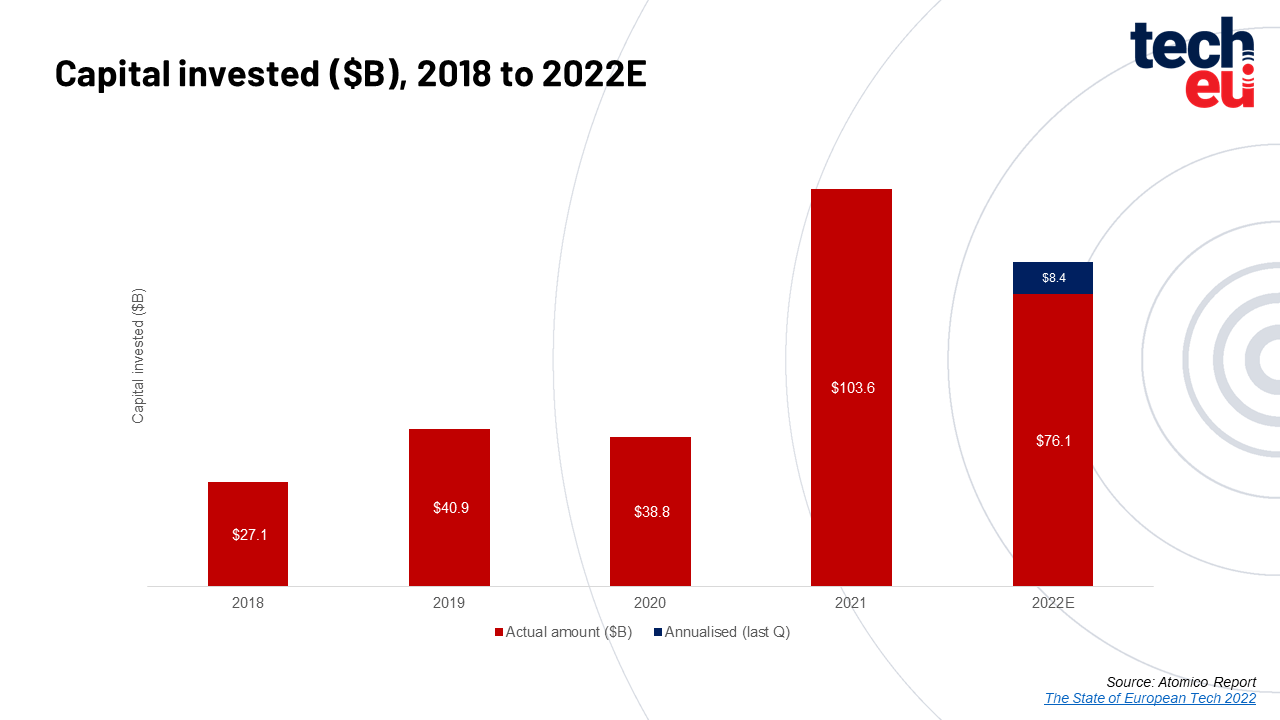

2) $85 billion invested, compared to $103 billion last year

No two ways about it: the European tech industry is hurting after a relatively strong start of the year, and a record-breaking 2021. Whereas more than $100 billion was raised by European tech companies last year, that number will drop to around $85 billion.

That's a 17.5% decrease, and the only reason it's not worse is because a lot of deals that were made before the economic downturn was set into motion in Q1 were announced in the first half of 2022.

On a positive note: the 2022 total is still more than the totals of 2019 and 2020 put together (= around $81 billion).

The next chart shows the cool-down started around the summer, and it will continue for the foreseeable future (don't expect strong numbers or broken records in 2023 either, in other words).

3) It all started with late-stage, but early-stage is starting to feel the burn

Unsurprisingly, it's especially tough out there for late-stage companies.

While total capital invested in rounds sized at $20 million or higher was up 62% in Q1 2022 compared to the same period 2021, the shift in the market that took effect in Q2 saw total investment that quarter decline by 26% versus the comparative quarter in 2021.

In the third quarter of 2022, the comparison is even more bleek, with total investment down 48% compared to Q3 2021.

Early-stage contraction came later, but it did arrive.

During the first half of 2022, the total capital invested in rounds of $20 million or less was up 4% on the same period last year, but a dwindling in early-stage investment activity has led to a third-quarter total that is down 5% versus the equivalent period of 2021.

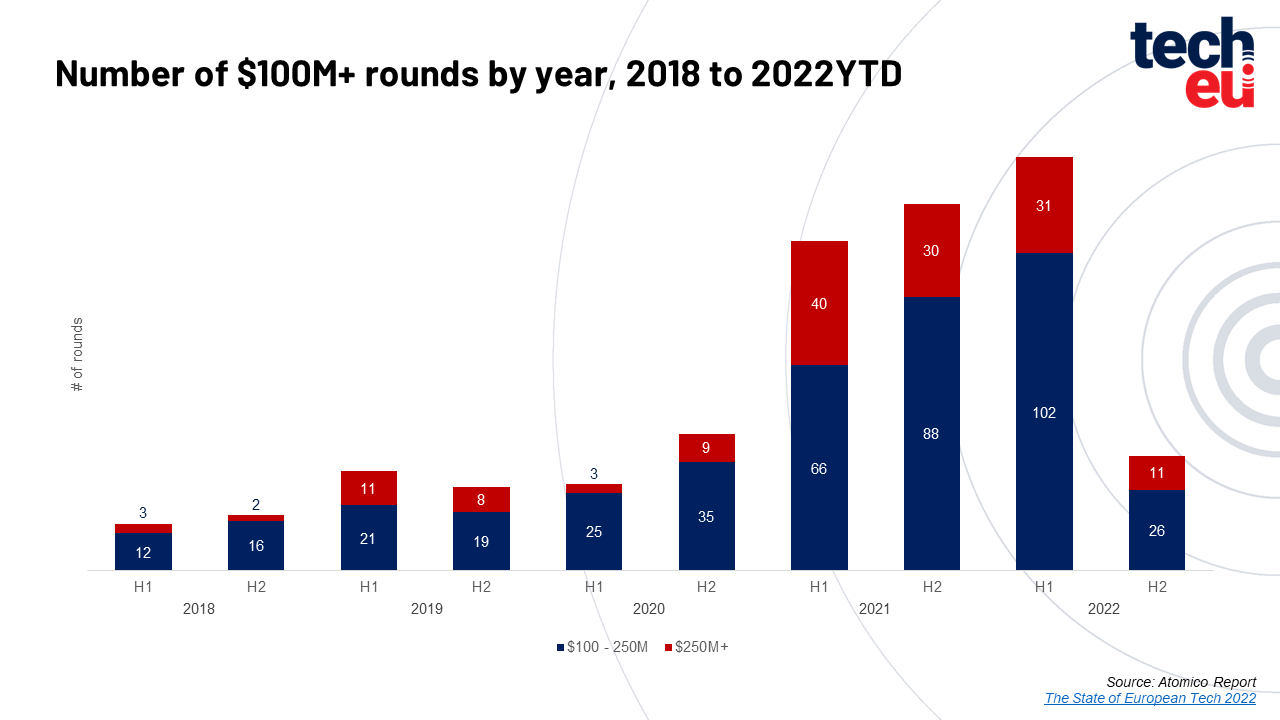

4) The sudden death of the mega-round in European Tech

In the first half of 2022, there were a total of 133 funding rounds equal to or exceeding $100 million. That's a massive number any way you slice it but, again, this is a lagging indicator as most have those rounds were most likely already started back in 2021 when times were still good.

As a result, the report says H2 2022 is on track to fall far short of these numbers if Q4 continues in line with Q3's investment levels - with only 37 rounds of this magnitude so far. It will be a while for monster financing rounds to return.

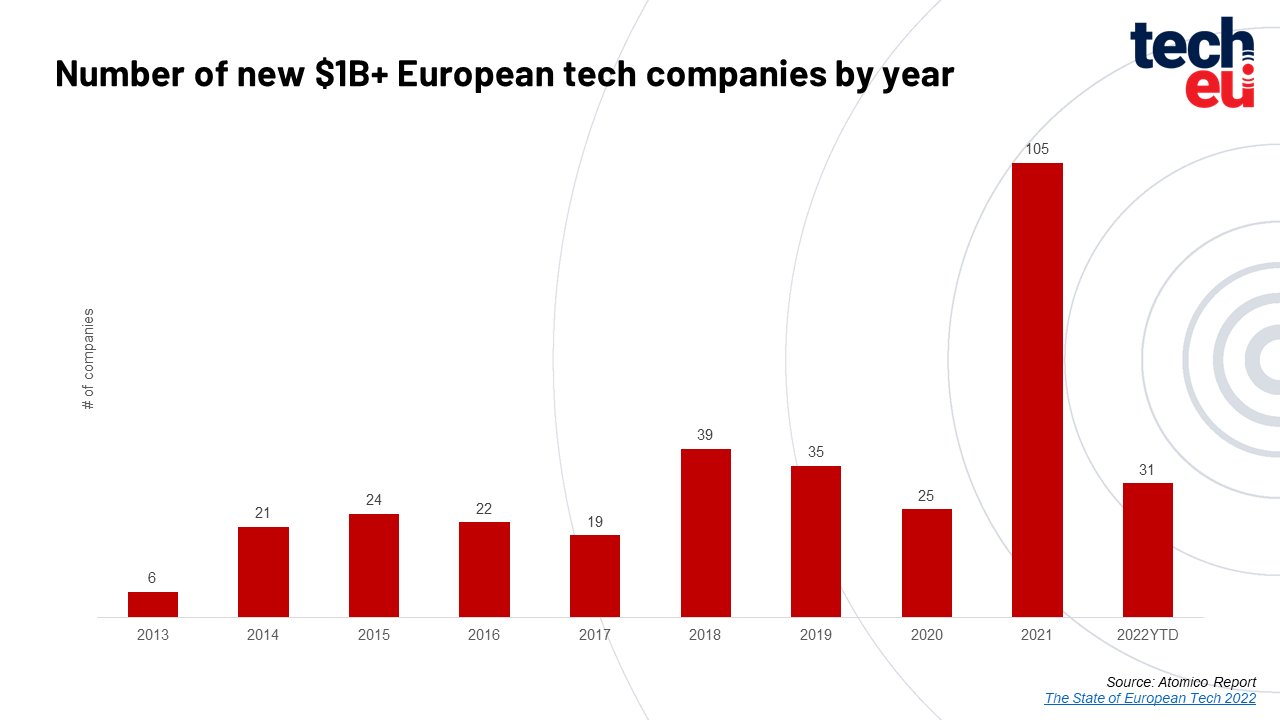

5) The European unicorn factory stalls

Not sure it still makes sense to use the creation of unicorns as a solid benchmark, but the stats don't lie: European tech has produced fewer new $1 billion+ companies this year than it did in 2018 and 2019.

It birthed more than 100 unicorns last year, but 2022 looks downright brutal in comparison, with only just north of 30 accounted for.

That's a steep 70% drop right there.

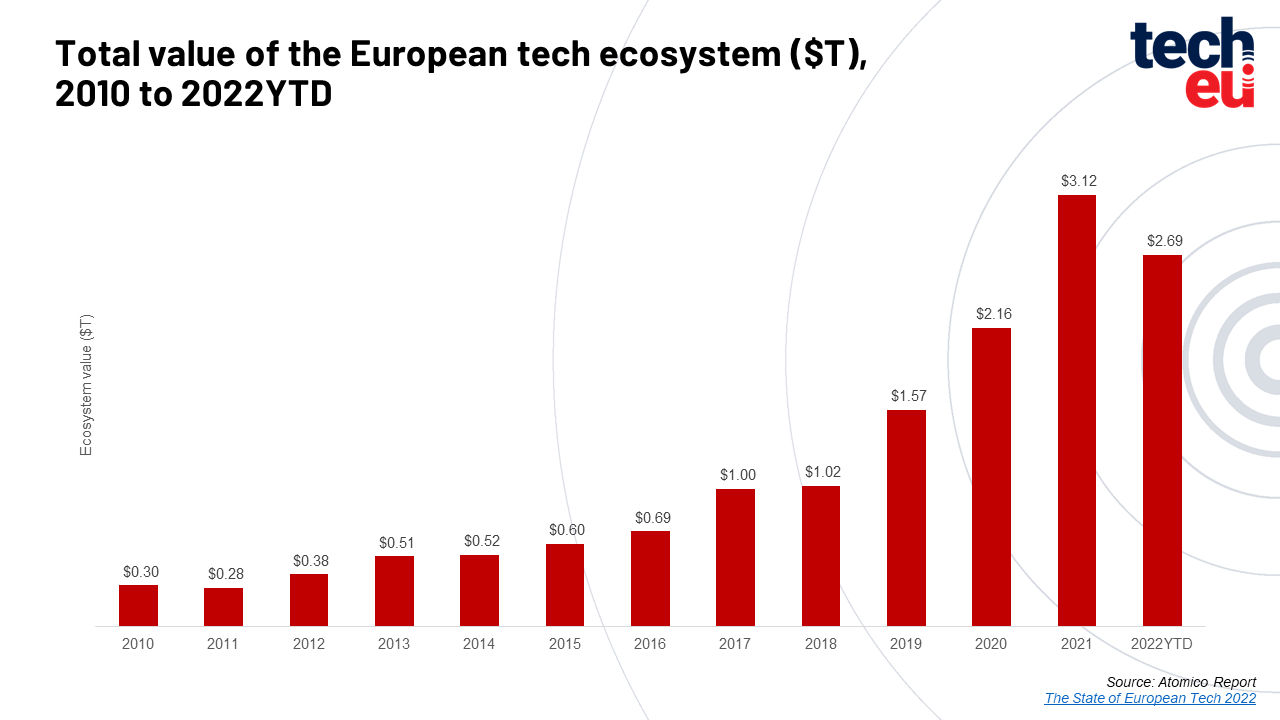

6) Around $400 billion in value went 'poof'

Not that it happened overnight, but the report authors calculated that European tech companies across both the public and private markets saw roughly $400 billion of value erased in just 12 odd months.

As a result, the total ecosystem value has fallen to $2.7 trillion today, from its $3.1 trillion peak in late 2021.

Atomico points out that's still 5x greater than the total 'value of European tech' in 2015, but at this point we shouldn't be looking that far back in time.

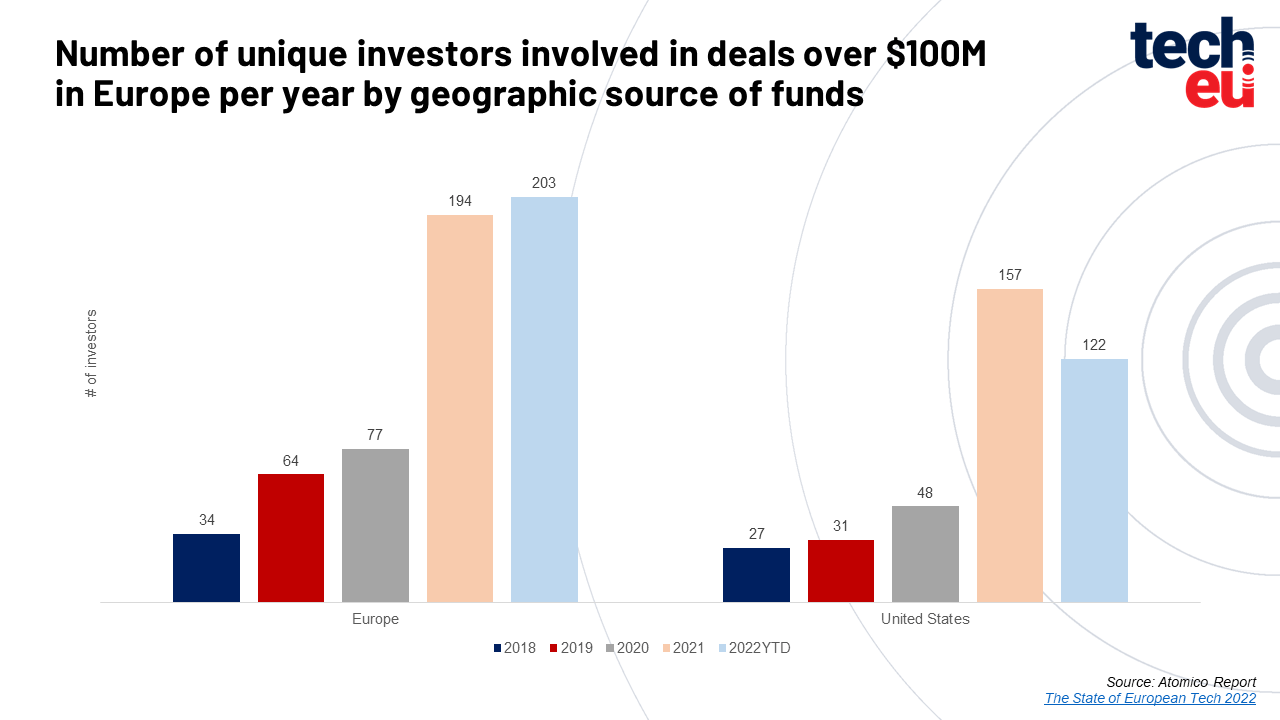

7) US investors' appetite in European Tech decreases

When late-stage funding cools, so does the interest of US-based investment firms in European startups and scale-ups.

While 2022 has seen the number of European investors in rounds of $100 million or more grow ever so slightly, there is a notable decline (-22%) in the number of active US investors in these rounds since 2021.

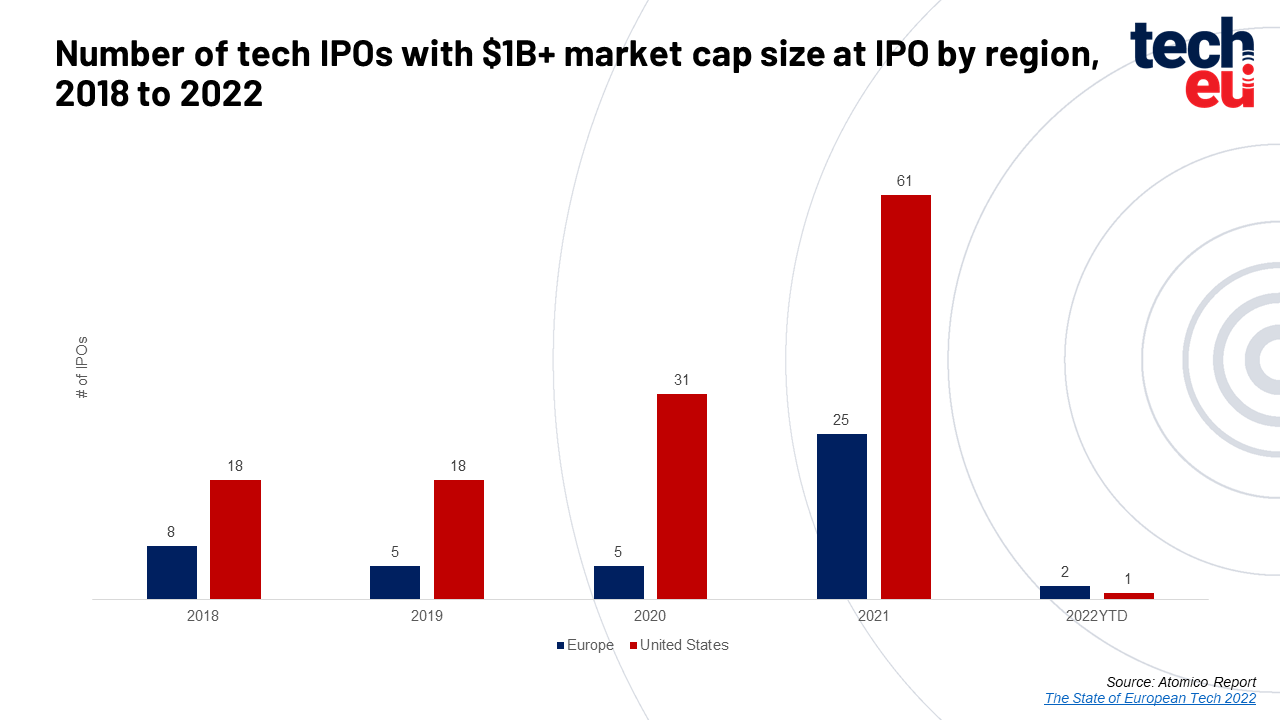

8) Forget closed - the IPO window is bolted shut

There have only been three tech IPOs with a market cap in excess of $1 billion in Europe and the US this year.

That's right, less than one per quarter.

That compares to 86 decent-sized IPOs during the bumper year that was 2021, representing a 30x reduction in volume.

Atomico puts it well:

"This, of course, has significant knock-on effects for the overall ecosystem in terms of capital liquidity, both from the perspective of the ability to tap the public markets for capital, as well as in terms of the ability for existing shareholders to crystallise value by exiting holdings and distributing or reinvesting any capital gains elsewhere."

9) A bleak environment for M&A exits, but there are signs of life

Following a record year of VC-backed M&A exits in Europe in 2021, it is down 72% so far this year. However, while VC-backed exit activity slowed down in 2022, it consistently represents over 30% of all European M&A activity, according to the report.

The total announced deal value between Q1 and Q3 2022 was $35 billion, down 49% from $69 billion in the same three quarters last year.

On a cumulative basis since 2018, VC-backed European tech companies have generated around $160 billion of exit value via M&A.

The total value of closed deals in 2022 (to date) amounts to approximately $75 billion, the report posits.

10) And yet, the big talent flywheel keeps on turning

Atomico and co have attempted to measure the number of new founders that have 'graduated' from prior cohorts of successful companies.

The report claims that Europe has seen the emergence of nearly 1,500 founders that went on to start their own companies after working for a European unicorn founded during the 2000s.

If we compare 'alumni' from unicorns founded in the 2000s to those founded in the 2010s, the latter has led to almost 700 identifiable founders – almost 25x the amount from the 2000s cohort at the equivalent point in time.

This was also echoed in a recent report from Accel and offers more than a glimmer of hope in dark times.

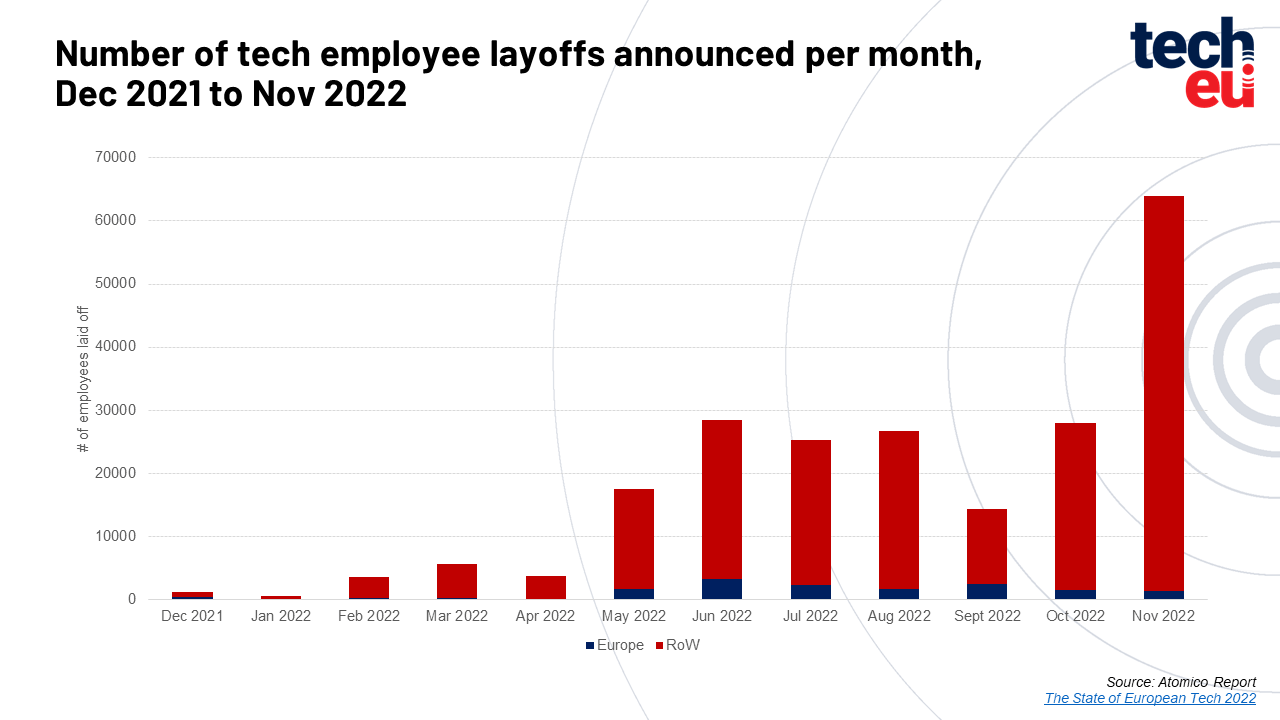

11) A downturns means workforce reductions, as in: tens of thousands of lay-offs

Around the world, the tech sector has been hit by a wave of layoffs that shows no signs of slowing down, evidently as a result of the ongoing crisis and market downturn.

Globally, more than 200,000 tech workers lost their jobs at more than 1,000 companies in the past year, according to Layoffs Tracker.

That includes more than 14,000 tech employees of Europe-headquartered tech companies losing their jobs, representing 7% of all tech employee layoffs globally, but it does not include those that haven't been 'announced' with a number of staff reductions.

As the data seems to indicate, we may have not seen the worst just yet.

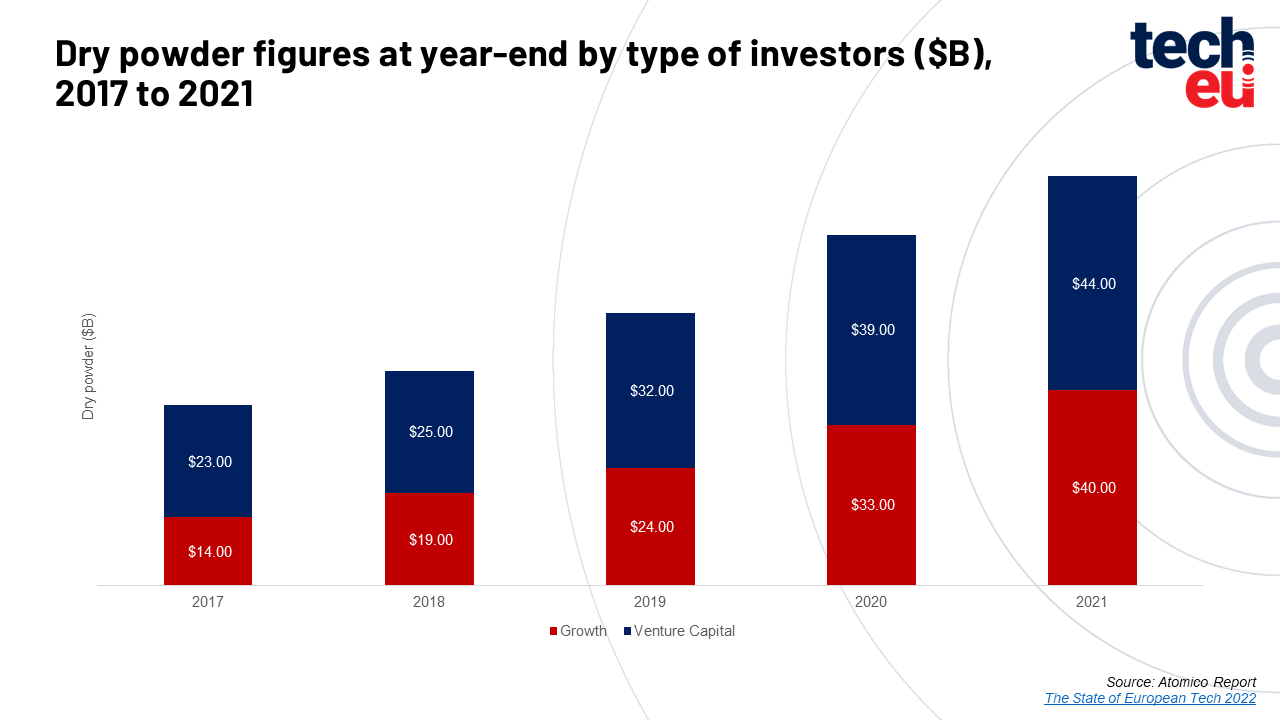

12) Dry powder aplenty

The overall market moves at a different speed than the capital markets, and the data suggests that investment firms will have enough capital to deploy for many years (difficult ones or '2021 style') to come.

13) Europe's top tech cities and countries: no major surprises

The usual European tech hubs that we all know and love - London, Paris, and Berlin - are at the top of the list when it comes to cities with the most capital invested this year.

The UK ecosystem continues to be Europe's most funded, capturing 35% of the total capital invested in Europe in the last five years.

Furthermore, according to the report, the UK, France, and Germany together are home to the lion's share of Europe's (160,000) startups - nearly half.

Going back at funding flowing into specific cities, Paris is on track to grow capital invested by 21% in 2022 after a record year in 2021. According to the report, while most cities lost some capital investing momentum from last year's boom, all are at least 1.5x higher than investment levels in 2020.

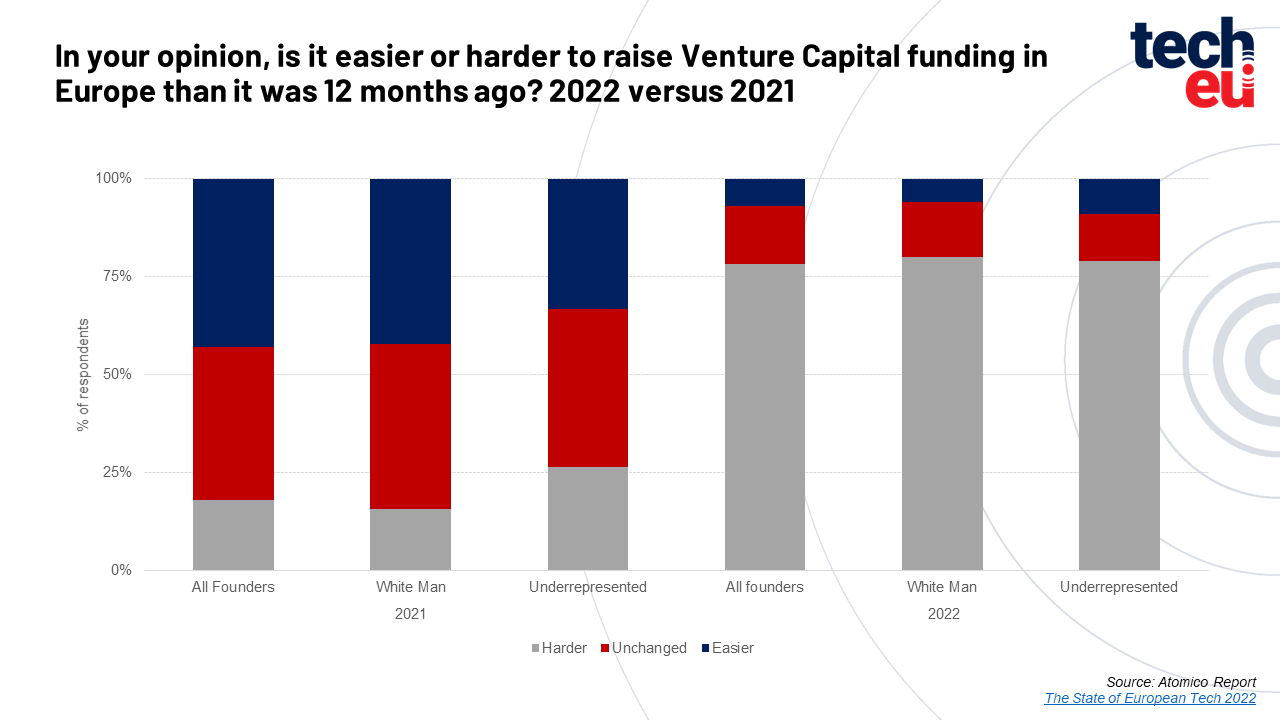

14) Founders are having a hard time fundraising, especially at favourable terms

Surprising absolutely no one, startup founders say it's tough out there to secure financing.

According to the report, last year more than a third of founders said fundraising had become easier compared to the year before. RIP good times: nearly 80% of founders now say it's become harder to land that funding round.

In this brave new world, common adjustments founders and C-level execs have made to their fundraising efforts include their valuation expectations, the length of the fundraising process, and round sizes.

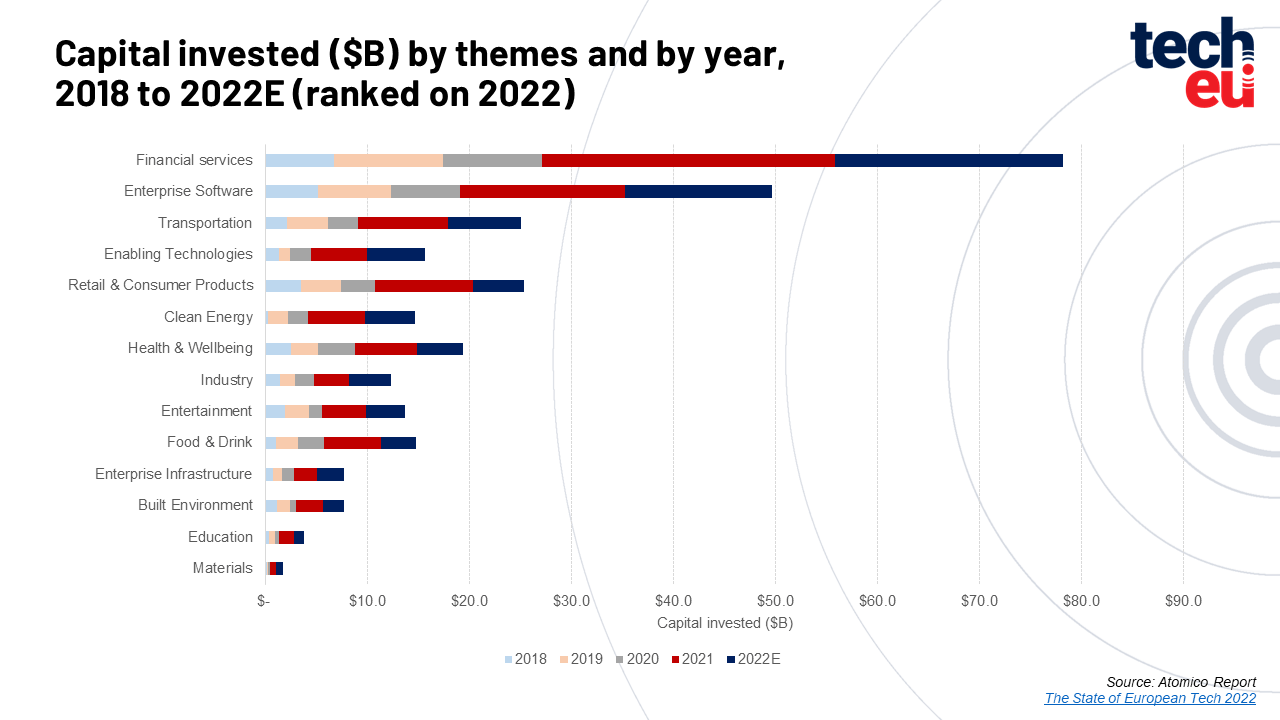

15) The usual sector suspects

The European tech ecosystem has produced breakout companies in 'fintech' and 'enterprise software', and capital keeps flowing to those sectors: nearly half (46%) of all capital invested into Europe this year has gone to companies Atomico mapped to those categories.

Fintech has captured $80 billion of cumulative capital invested in Europe over the past five years, while enterprise software has hit more than $50 billion in the same timeframe.

That said, the report also shows that fintech is where the slowdown is felt acutely: investment in the sector this year is on track to be down considerably compared to 2021 as a result.

16) Debt funding is on the rise

If you've been reading Tech.eu lately, this should be obvious: founders are increasingly turning to debt funding in the current market environment.

After a dip in 2019 and 2020, the number of (disclosed) debt financing rounds have seen a jump in interest over the past two years across Europe. , as founders started turning more towards debt. Given the enduring challenges in the equity capital markets, debt instruments are expected to become a more frequent source of funding for companies over the next 12 months as demand will inevitable increase.

In 2022, the number of disclosed debt rounds will come in around double that of 2020 (when 52 such rounds were accounted for).

According to VC respondents to Atomico's survey, just under 30% shared they have advised companies to use debt financing as a way for founders to increase cash balances and runway.

---

Evidently, there is a lot more to unpack in the full report, so check it out. According to the report, 77% of Atomico's survey respondents are either more optimistic or retain the same level of optimism as they did 12 months ago.

Are you optimistic even after reading the report front to back? Let us know in the comments!

----

In addition to the above, we’ve also had a look at:

Would you like to write the first comment?

Login to post comments