Despite recession worries and lower valuations for cloud contenders globally, a new report from Notion Capital indicates European SaaS is holding up well.

Some 80% of SaaS founders surveyed by Notion reported little impact from the macroeconomic recession and many said the shrinking economy was creating a renewed focus on SaaS quality over quantity.

The data findings were compiled as part of Notion Capital's Cloud Challenger 100 report, a list of Europe's top 100 B2B SaaS and cloud companies.

Among the top five, Tech.eu reported on Danish SaaS revenue startup Growblocks on Wednesday. Openline, Orus, Medusa and Sona also ranked at the head of the league table.

Around 64% of companies in the list operate in one of three cloud/SaaS sectors: big data, API or automation.

Further data insights reveal all-women founding teams feature in just three of the Challenger 100 startups. Around 13% of the founders are female. Despite the slide back in valuations, venture funding to European clouds and SaaS remains viable with nearly 50% securing follow-on funding in the last 12 months.

Notion's data comes in the context of a substantial drop in valuations for public clouds, in yet another signal of the downward gravity piling up around private tech markets.

A cited analytical piece from Cloud Judgement showed revenue multiples of public clouds drifted back by more than 60% in median terms, and the median run rate reduced sharply from a 22x multiplier to 5x.

Notion Capital highlighted that Cloud's data findings largely mirrored an analysis of late-stage tech median valuations globally by CB Insights.

Series D median values recorded a marked decrease from $1.6 billion in the first quarter last year to $1.1 billion in Q3 2022. However, this trend did not translate to a degradation in early-stage valuations for global cloud companies.

In fact series A median values of $64.9 million, for the third quarter, remained significantly above first-quarter equivalents ($54.3 million.) On the contrary, CBI Insights reported a dramatic fall in both series A and seed stage deal count.

Notion Capital's Jos White

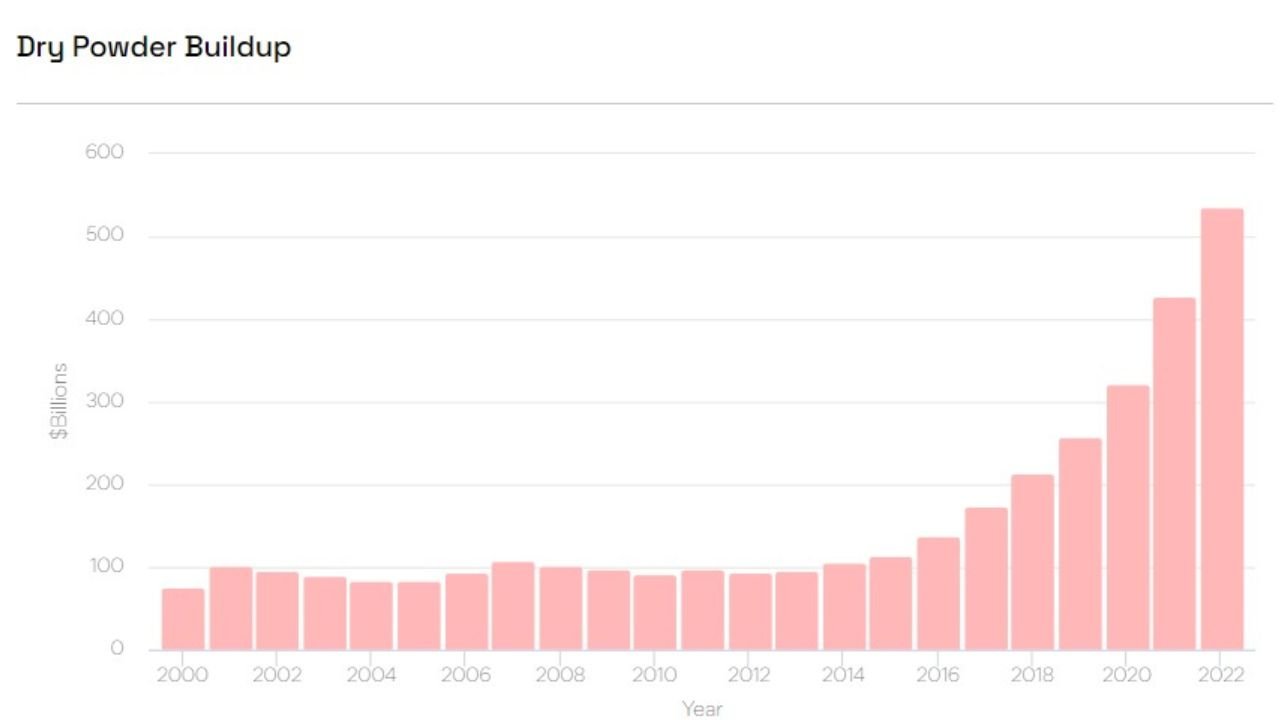

Notion Capital general partner Jos White said the data highlighted that recession worries were beginning to bite despite the fact that dry powder held by VC investors escalated last year, reaching $536 billion from $428 billion in 2021, citing data from Preqin and Wall Street Journal

He also recommended a renewed focus on quality screening, addressing the market's desire for category leaders with potential to drive value. In effect, this may equate to just a handful of startups in any tech category.

White wrote: "A startup needs to have the potential to be a category leader. In times of easier money, too many more derivative startups were able to raise funding; and they will find themselves more exposed in these more challenging conditions.

"We know that there is a ‘power law’ in tech whereby the majority of value goes to the top 2-3 winners in any one category."

Would you like to write the first comment?

Login to post comments