Micapass, a Vilnius-based startup offering an on-chain AML compliance solution, has raised €240,000 in order to continue development of its KYC product for DeFi protocols and web3 users.

The company received the investment via the Lithuanian innovation lab Super How? as well as Baltics accelerator and VC fund Firstpick.

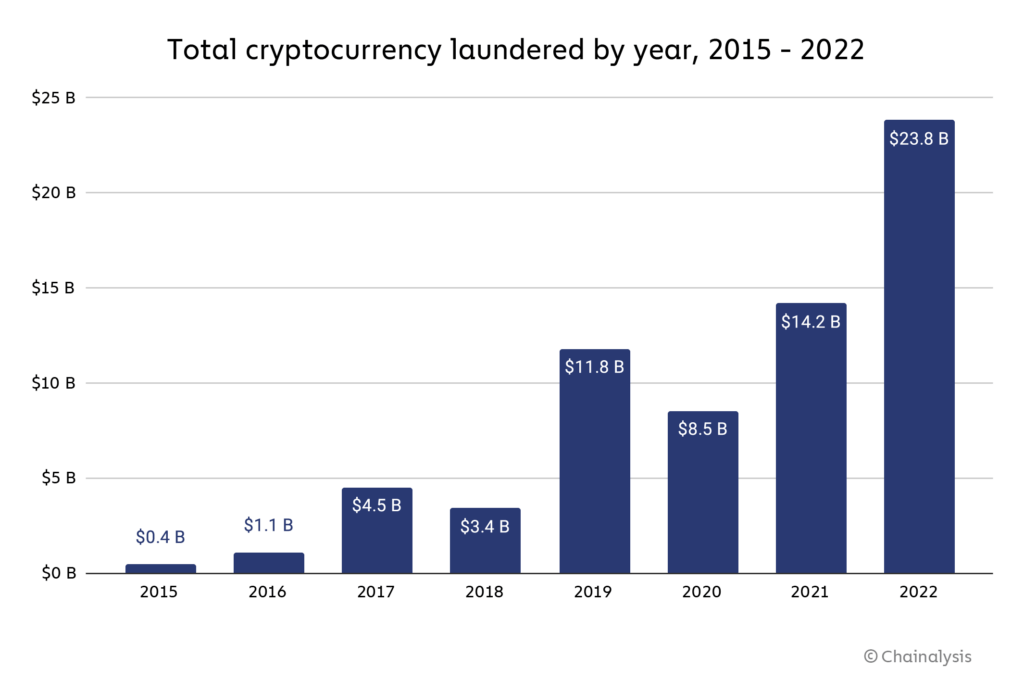

According to Chainalysis, “... illicit addresses sent nearly $23.8 billion worth of cryptocurrency in 2022, a 68.0 percent increase over 2021.”

This same report indicates, “over 40 percent of illicit funds move first to intermediary services — primarily mixers and illicit services or DeFi protocols”

With DeFi usage growing day by day, now involving over 6 million unique addresses, current AML practices aren’t keeping up with the tracking of illegal crypto movements.

“While transaction data on the blockchain is publicly accessible, bad actors complicate AML tracking by routing their transactions through intermediary services, enhancing funds movement complexity and making wallet attribution with real sanctioned individuals complex,” says Micapass CEO and co-founder Gintarė Košubienė.

With privacy a fundamental component of blockchain, and decentralisation meaning that there’s no third-party AML operator storying users’ data, the conundrum of keeping crypto on the up and up begins to become monumentally difficult.

Unless of course, you look at the problem from the other side, and pre-screen the entire process.

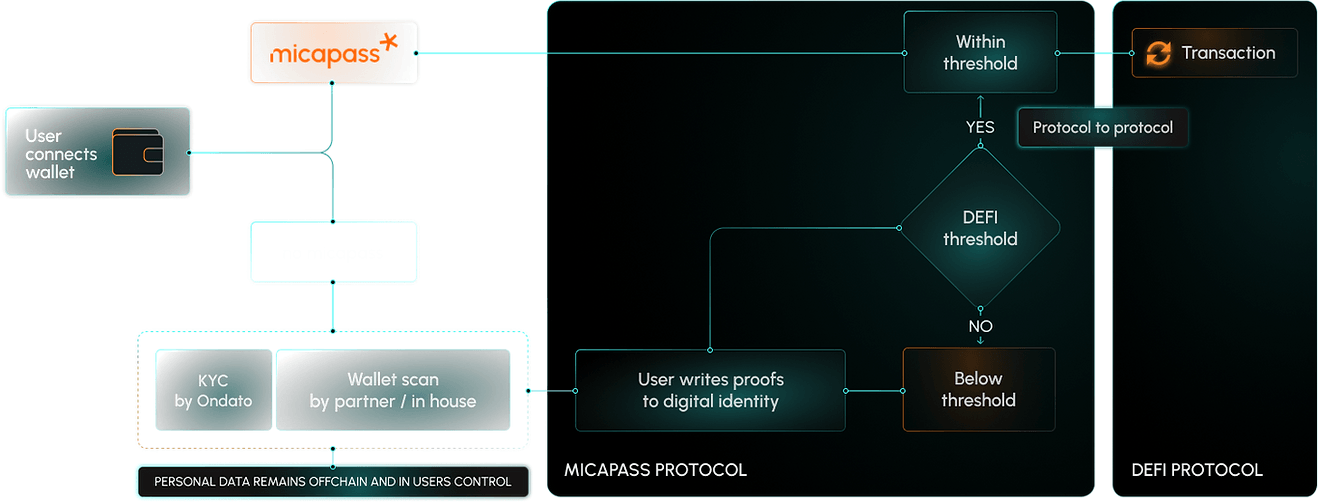

“If we shift this process to the client side, one can undergo the KYC process once and be accepted by different DeFi protocols,” explained Košubienė. “To make the whole AML compliance in cryptocurrencies easier, the outcome of the KYC process can be shared using a digital verification of legitimacy. In this case, the private user’s data stays off the chain and there’s no need to repeat KYC screenings on different protocols.”

Lead image via Micapass

Would you like to write the first comment?

Login to post comments